OPEN-SOURCE SCRIPT

업데이트됨 Gains and Drawdowns with Standard Deviations

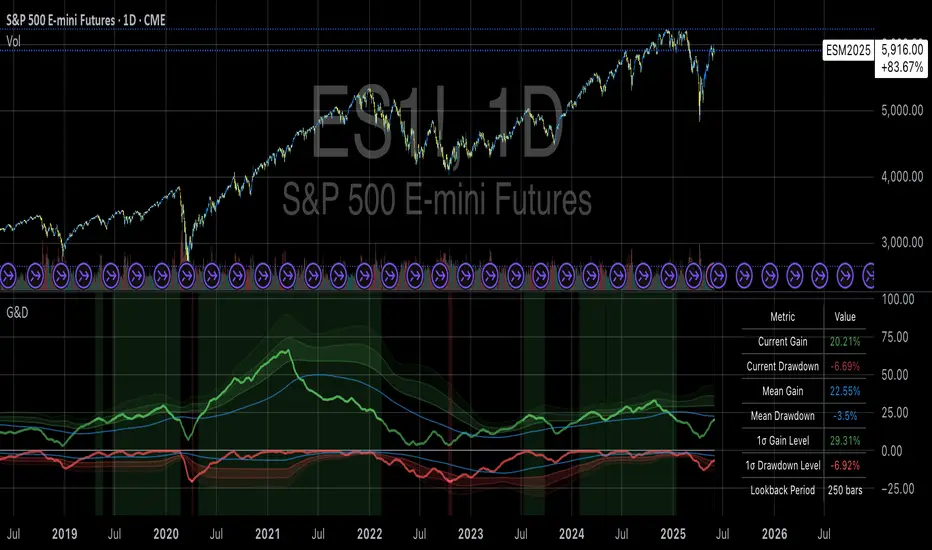

This “Gains and Drawdowns with Standard Deviations” indicator helps in analyzing and visualizing the percentage gains and drawdown phases of a market or asset relative to its historical range. By calculating gains from the lowest low and drawdowns from the highest high over a specified lookback period, this indicator provides deeper insights into price movements and risk.

Key Features and Applications:

1. Gain and Drawdown Calculation:

• Gains: The indicator calculates the percentage gain from the lowest price point within a specific lookback period (e.g., 250 days).

• Drawdowns: Drawdowns are calculated as the percentage change from the highest point in the same period. This helps in identifying the maximum loss phases.

2. Standard Deviation:

• The indicator computes the standard deviation of both gains and drawdowns over a specified period (e.g., 250 days), allowing you to quantify volatility.

• Three bands (1st, 2nd, and 3rd standard deviations) are plotted for both gains and drawdowns, representing the frequency and magnitude of price movements within the normal volatility range.

3. Extreme Movements Highlighting:

• The indicator highlights extreme gains and drawdowns when they exceed user-defined thresholds. This helps in identifying significant market events or turning points.

4. Customizable Thresholds:

• Users can adjust the thresholds for extreme gains and drawdowns, as well as the lookback period for calculating gains, drawdowns, and standard deviations, making the indicator highly adaptable to specific needs.

Application in Portfolio Management:

The use of standard deviation in portfolio management is essential for assessing the risk and volatility of a portfolio. According to Modern Portfolio Theory (MPT) by Harry Markowitz, diversification of assets in a portfolio helps to minimize overall risk (especially the standard deviation), while maximizing returns. The standard deviation of a portfolio measures the volatility of its returns, with higher standard deviation indicating higher risk.

Scientific Source: Markowitz, H. M. (1952). Portfolio Selection. The Journal of Finance, 7(1), 77-91.

Markowitz’s theory suggests that an optimized portfolio, by minimizing the standard deviation of returns and combining a diversified asset allocation, can achieve better risk-adjusted returns.

Conclusion:

This indicator is particularly useful for traders and portfolio managers who want to understand and visualize market risk and extreme events. By using gains, drawdowns, and volatility metrics, it allows for systematic monitoring and evaluation of price movements, leading to more informed decisions in trading or portfolio management. A comprehensive understanding of price behavior and volatility helps in optimizing risk management and making strategic market entries.

Key Features:

• Visualization of Gains and Drawdowns with color-coded highlights for extreme movements.

• Standard Deviation Calculations for detailed volatility analysis.

• Customizable Thresholds for identifying extreme market events.

This indicator is a valuable tool for analyzing market data from a scientific standpoint, improving risk management, and making data-driven decisions based on historical performance.

Key Features and Applications:

1. Gain and Drawdown Calculation:

• Gains: The indicator calculates the percentage gain from the lowest price point within a specific lookback period (e.g., 250 days).

• Drawdowns: Drawdowns are calculated as the percentage change from the highest point in the same period. This helps in identifying the maximum loss phases.

2. Standard Deviation:

• The indicator computes the standard deviation of both gains and drawdowns over a specified period (e.g., 250 days), allowing you to quantify volatility.

• Three bands (1st, 2nd, and 3rd standard deviations) are plotted for both gains and drawdowns, representing the frequency and magnitude of price movements within the normal volatility range.

3. Extreme Movements Highlighting:

• The indicator highlights extreme gains and drawdowns when they exceed user-defined thresholds. This helps in identifying significant market events or turning points.

4. Customizable Thresholds:

• Users can adjust the thresholds for extreme gains and drawdowns, as well as the lookback period for calculating gains, drawdowns, and standard deviations, making the indicator highly adaptable to specific needs.

Application in Portfolio Management:

The use of standard deviation in portfolio management is essential for assessing the risk and volatility of a portfolio. According to Modern Portfolio Theory (MPT) by Harry Markowitz, diversification of assets in a portfolio helps to minimize overall risk (especially the standard deviation), while maximizing returns. The standard deviation of a portfolio measures the volatility of its returns, with higher standard deviation indicating higher risk.

Scientific Source: Markowitz, H. M. (1952). Portfolio Selection. The Journal of Finance, 7(1), 77-91.

Markowitz’s theory suggests that an optimized portfolio, by minimizing the standard deviation of returns and combining a diversified asset allocation, can achieve better risk-adjusted returns.

Conclusion:

This indicator is particularly useful for traders and portfolio managers who want to understand and visualize market risk and extreme events. By using gains, drawdowns, and volatility metrics, it allows for systematic monitoring and evaluation of price movements, leading to more informed decisions in trading or portfolio management. A comprehensive understanding of price behavior and volatility helps in optimizing risk management and making strategic market entries.

Key Features:

• Visualization of Gains and Drawdowns with color-coded highlights for extreme movements.

• Standard Deviation Calculations for detailed volatility analysis.

• Customizable Thresholds for identifying extreme market events.

This indicator is a valuable tool for analyzing market data from a scientific standpoint, improving risk management, and making data-driven decisions based on historical performance.

릴리즈 노트

Key Improvements:Advanced Visualization Features

- Added a comprehensive statistics table with real-time metrics

- Implemented dynamic color schemes with dark/light mode support

- Introduced band fills for better visual representation of standard deviation zones

- Added configurable table positioning and styling options

Enhanced Technical Analysis

- Implemented EMA smoothing for gains and drawdowns calculations

- Added validation for data availability before statistical calculations

- Improved handling of division by zero cases

- Enhanced peak and trough detection with validation

Improved User Interface

- Organized inputs into logical groups for better usability

- Added configurable line widths for different elements

- Implemented toggle options for various display elements

- Added professional tooltips for all parameters

Advanced Alert System

- Added comprehensive alert conditions for extreme movements

- Implemented threshold-based alerts for both gains and drawdowns

- Added alert messages for better user notification

Performance Optimizations

- Implemented proper data validation checks

- Added efficient handling of statistical calculations

- Optimized transparency and color calculations

- Improved memory usage with better variable management

Professional Styling

- Implemented a consistent color scheme with proper contrast ratios

- Added professional table formatting with adaptive colors

- Improved visual hierarchy of information

- Enhanced readability with proper spacing and organization

Code Structure

- Better organized code sections with clear separation of concerns

- Improved variable naming and documentation

- Added proper error handling and validation

- Implemented more efficient calculation methods

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

Where others speculate, we systematize.

edgetools.org

edgetools.org

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

Where others speculate, we systematize.

edgetools.org

edgetools.org

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.