OPEN-SOURCE SCRIPT

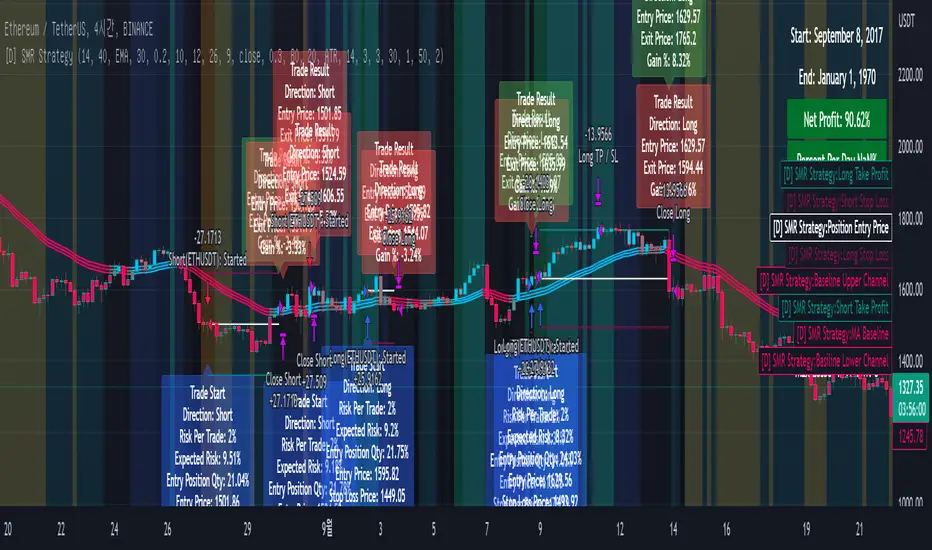

[DuDu95] SSL 4C MACD Laugerre RSI Strategy

Hello Guys! Nice to meet you all!

Before I start, my nickname has changed to 'DuDu95'!!

This is the Strategy introduced by youtube channel.

I made this based on the open source indicator by kevinmck100, vkno422, KivancOzbilgic. Thank you All!

### Entry Logic

1. Long Entry Logic

- close > SSL Hybrid baseline upper k (keltner channel)

- macd signal > 0 and current MACD value > previous MACD value

- Laguerre RSI < overbought Line.

2. short Entry Logic

- close < SSL Hybrid baseline lower k (keltner channel)

- macd signal < 0 and current MACD value < previous MACD value

- Laguerre RSI > overbought Line.

### Exit Logic

1. Long Exit Logic

- close < SSL Hybrid baseline lower k (keltner channel)

- macd signal < 0

2. short Entry Logic

- close > SSL Hybrid baseline upper k (keltner channel)

- macd signal > 0

### StopLoss

1. Can Choose Stop Loss Type: Percent, ATR, Previous Low / High.

2. Can Chosse inputs of each Stop Loss Type.

### Take Profit

1. Can set Risk Reward Ratio for Take Profit.

- To simplify backtest, I erased all other options except RR Ratio.

- You can add Take Profit Logic by adding options in the code.

2. Can set Take Profit Quantity.

### Risk Manangement

1. Can choose whether to use Risk Manangement Logic.

- This controls the Quantity of the Entry.

- e.g. If you want to take 3% risk per trade and stop loss price is 6% below the long entry price,

then 50% of your equity will be used for trade.

2. Can choose How much risk you would take per trade.

### Plot

1. Added Labels to check the data of entry / exit positions.

2. Changed and Added color different from the original one. (green: #02732A, red: #D92332, yellow: #F2E313)

Before I start, my nickname has changed to 'DuDu95'!!

This is the Strategy introduced by youtube channel.

I made this based on the open source indicator by kevinmck100, vkno422, KivancOzbilgic. Thank you All!

### Entry Logic

1. Long Entry Logic

- close > SSL Hybrid baseline upper k (keltner channel)

- macd signal > 0 and current MACD value > previous MACD value

- Laguerre RSI < overbought Line.

2. short Entry Logic

- close < SSL Hybrid baseline lower k (keltner channel)

- macd signal < 0 and current MACD value < previous MACD value

- Laguerre RSI > overbought Line.

### Exit Logic

1. Long Exit Logic

- close < SSL Hybrid baseline lower k (keltner channel)

- macd signal < 0

2. short Entry Logic

- close > SSL Hybrid baseline upper k (keltner channel)

- macd signal > 0

### StopLoss

1. Can Choose Stop Loss Type: Percent, ATR, Previous Low / High.

2. Can Chosse inputs of each Stop Loss Type.

### Take Profit

1. Can set Risk Reward Ratio for Take Profit.

- To simplify backtest, I erased all other options except RR Ratio.

- You can add Take Profit Logic by adding options in the code.

2. Can set Take Profit Quantity.

### Risk Manangement

1. Can choose whether to use Risk Manangement Logic.

- This controls the Quantity of the Entry.

- e.g. If you want to take 3% risk per trade and stop loss price is 6% below the long entry price,

then 50% of your equity will be used for trade.

2. Can choose How much risk you would take per trade.

### Plot

1. Added Labels to check the data of entry / exit positions.

2. Changed and Added color different from the original one. (green: #02732A, red: #D92332, yellow: #F2E313)

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.