OPEN-SOURCE SCRIPT

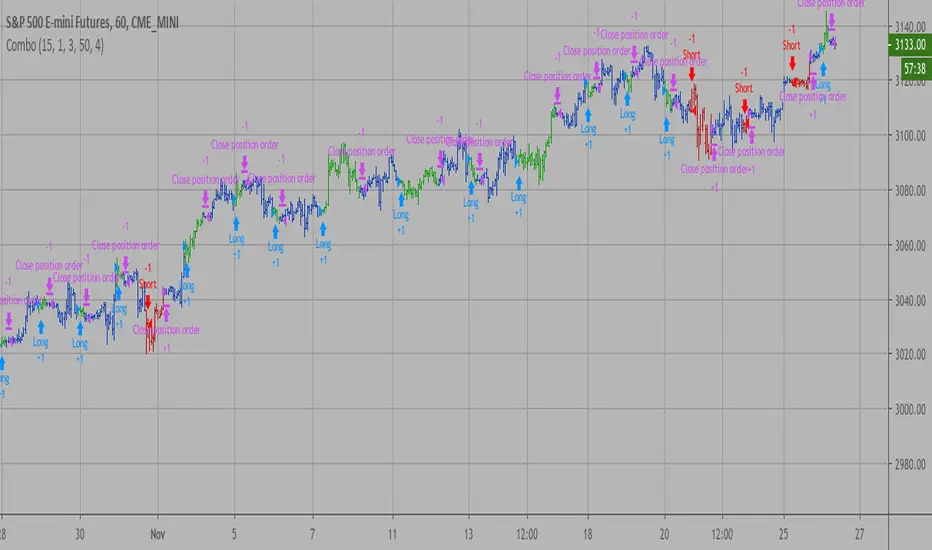

Combo Backtest 123 Reversal & D_ELI (Ehlers Leading Indicator)

This is combo strategies for get a cumulative signal.

First strategy

This System was created from the Book "How I Tripled My Money In The

Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

The strategy buys at market, if close price is higher than the previous close

during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

The strategy sells at market, if close price is lower than the previous close price

during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

Second strategy

This Indicator plots a single

Daily DSP (Detrended Synthetic Price) and a Daily ELI (Ehlers Leading

Indicator) using intraday data.

Detrended Synthetic Price is a function that is in phase with the dominant

cycle of real price data. This one is computed by subtracting a 3 pole Butterworth

filter from a 2 Pole Butterworth filter. Ehlers Leading Indicator gives an advanced

indication of a cyclic turning point. It is computed by subtracting the simple

moving average of the detrended synthetic price from the detrended synthetic price.

Buy and Sell signals arise when the ELI indicator crosses over or under the detrended

synthetic price.

See "MESA and Trading Market Cycles" by John Ehlers pages 64 - 70.

WARNING:

- For purpose educate only

- This script to change bars colors.

First strategy

This System was created from the Book "How I Tripled My Money In The

Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

The strategy buys at market, if close price is higher than the previous close

during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

The strategy sells at market, if close price is lower than the previous close price

during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

Second strategy

This Indicator plots a single

Daily DSP (Detrended Synthetic Price) and a Daily ELI (Ehlers Leading

Indicator) using intraday data.

Detrended Synthetic Price is a function that is in phase with the dominant

cycle of real price data. This one is computed by subtracting a 3 pole Butterworth

filter from a 2 Pole Butterworth filter. Ehlers Leading Indicator gives an advanced

indication of a cyclic turning point. It is computed by subtracting the simple

moving average of the detrended synthetic price from the detrended synthetic price.

Buy and Sell signals arise when the ELI indicator crosses over or under the detrended

synthetic price.

See "MESA and Trading Market Cycles" by John Ehlers pages 64 - 70.

WARNING:

- For purpose educate only

- This script to change bars colors.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.