PROTECTED SOURCE SCRIPT

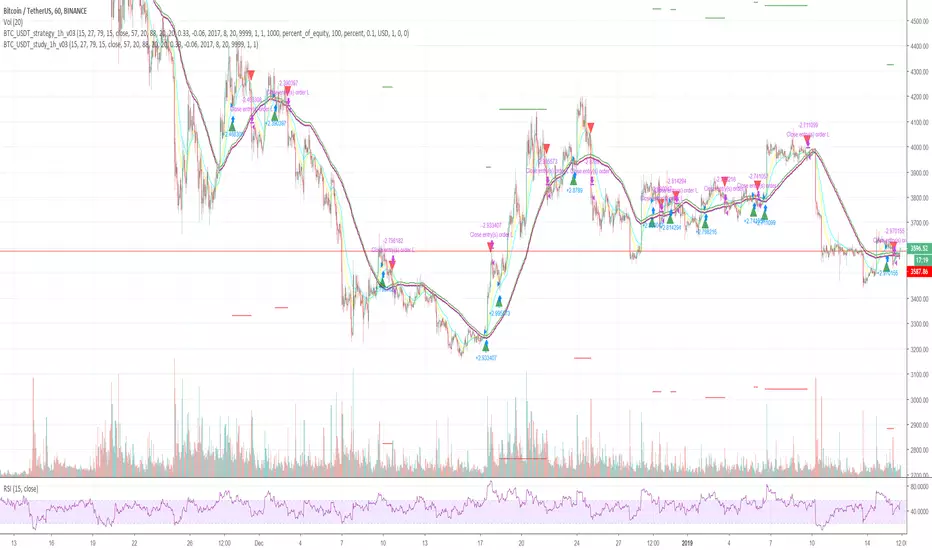

Cryptocurrency trend following LONG only strategy

This strategy uses multiple indicators to find optimal time to enter/exit the trade. The default setting is mainly for trading bitcoin/stable coin pair such as USDT etc on 1h timeframe but it can be applied to any pair/any timeframe with some settings adjustments.

Strategy settings description:

ID Name Descrption

1 FastMA - Value for fast exponencial moving average

2 SlowEMA - Value for slow exponencial moving average

3 SMA - Value for simple moving average

4 RSI Length - Length of RSI identificator

5 RSI Source candle - What price of candle is used for RSI calculation (open, close, high, low)

6 RSI Long condition - When buy, RSI indicator must be below this value to prevent of buying already overbought coin

7 RSI Short condition - When sell, RSI indicator must be above this value to prevent of selling already oversold coin

8 RSI close trade condition - Sell once RSI indicator acquires defined value

9 Take Profit (%) - Take profit value in percent

10 Stop Loss (%) - Stop loss value in percent

11 Long price toleration (%) - Price deviation for filtering bounces of simple moving average - price must close defined percents above SMA to open long trade

12 Short price toleration (%) - Price deviation for filtering bounces of simple moving average - price must close defined percents bellow SMA to close long trade

13 From Year - To run strategy in interval

14 From Month - To run strategy in interval

15 From Day - To run strategy in interval

16 To Year - To run strategy in interval

17 To Month - To run strategy in interval

18 To Day - To run strategy in interval

19 Show every signal? - (Study only) Unchecked shows only first signal based on strategy. But if you use take profit/stoploss settings within your bot, you might want to rebuy on next signal. Checked shows signal on each candle.

Notice that there are also false signals, especially when the coin is not trending or is strongly manipulated. Overall strategy is profitable though. You just take some minor loses and wont miss the big move.

You may also consider to compare buy&hold return vs profit from trading this strategy. In downtrend as we have seen recently, profit may not be as high as you expect but it is still much better than just hold and hope.

You can use the strategy script for fine tunning settings and find best settings for yourself

Study script helps you to automate trading with use of alerts perharps with 3commas bot or even trade manually based on email/sms notification setted by tradingview

Make sure that you keep same settings for strategy and study scripts.

If you need any help with settings do not hesitate to ask. I would also appriciate any feedback and ideas how to improve this script.

Here is backtest result from 23.08.2017:

Strategy settings description:

ID Name Descrption

1 FastMA - Value for fast exponencial moving average

2 SlowEMA - Value for slow exponencial moving average

3 SMA - Value for simple moving average

4 RSI Length - Length of RSI identificator

5 RSI Source candle - What price of candle is used for RSI calculation (open, close, high, low)

6 RSI Long condition - When buy, RSI indicator must be below this value to prevent of buying already overbought coin

7 RSI Short condition - When sell, RSI indicator must be above this value to prevent of selling already oversold coin

8 RSI close trade condition - Sell once RSI indicator acquires defined value

9 Take Profit (%) - Take profit value in percent

10 Stop Loss (%) - Stop loss value in percent

11 Long price toleration (%) - Price deviation for filtering bounces of simple moving average - price must close defined percents above SMA to open long trade

12 Short price toleration (%) - Price deviation for filtering bounces of simple moving average - price must close defined percents bellow SMA to close long trade

13 From Year - To run strategy in interval

14 From Month - To run strategy in interval

15 From Day - To run strategy in interval

16 To Year - To run strategy in interval

17 To Month - To run strategy in interval

18 To Day - To run strategy in interval

19 Show every signal? - (Study only) Unchecked shows only first signal based on strategy. But if you use take profit/stoploss settings within your bot, you might want to rebuy on next signal. Checked shows signal on each candle.

Notice that there are also false signals, especially when the coin is not trending or is strongly manipulated. Overall strategy is profitable though. You just take some minor loses and wont miss the big move.

You may also consider to compare buy&hold return vs profit from trading this strategy. In downtrend as we have seen recently, profit may not be as high as you expect but it is still much better than just hold and hope.

You can use the strategy script for fine tunning settings and find best settings for yourself

Study script helps you to automate trading with use of alerts perharps with 3commas bot or even trade manually based on email/sms notification setted by tradingview

Make sure that you keep same settings for strategy and study scripts.

If you need any help with settings do not hesitate to ask. I would also appriciate any feedback and ideas how to improve this script.

Here is backtest result from 23.08.2017:

보호된 스크립트입니다

이 스크립트는 비공개 소스로 게시됩니다. 하지만 이를 자유롭게 제한 없이 사용할 수 있습니다 – 자세한 내용은 여기에서 확인하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

보호된 스크립트입니다

이 스크립트는 비공개 소스로 게시됩니다. 하지만 이를 자유롭게 제한 없이 사용할 수 있습니다 – 자세한 내용은 여기에서 확인하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.