OPEN-SOURCE SCRIPT

Z SMMA | QuantEdgeB

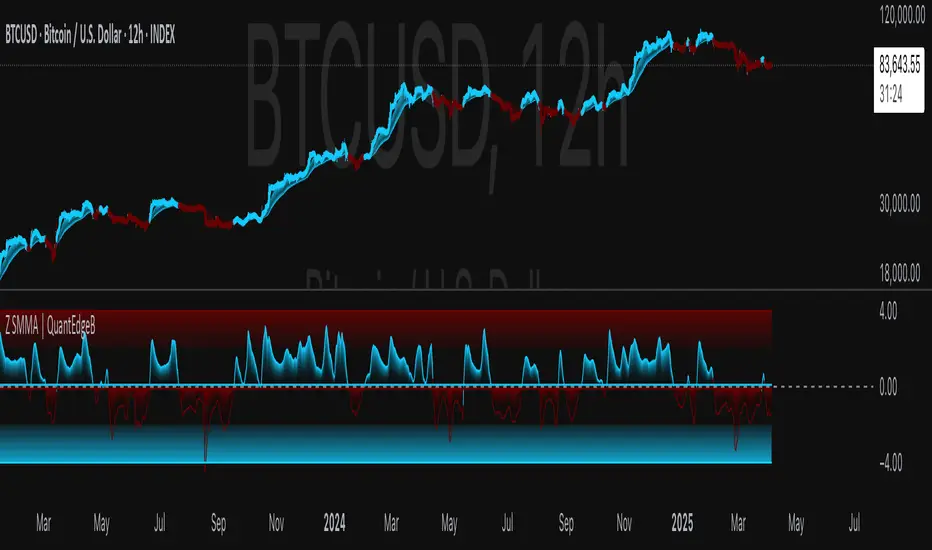

📈 Introducing Z-Score SMMA (Z SMMA) by QuantEdgeB

🛠️ Overview

Z SMMA is a momentum-driven oscillator designed to track the standardized deviation of a Smoothed Moving Average (SMMA). By applying Z-score normalization, this tool dynamically adapts to price volatility, enabling traders to detect meaningful directional shifts and trend changes with enhanced clarity.

It serves both as a trend-following and mean-reversion system, identifying opportunities through standardized thresholds while remaining robust across volatile and calm market conditions.

✨ Key Features

🔹 Z-Score Normalization Engine

Applies Z-score to a custom SMMA baseline, allowing traders to compare price action relative to its recent volatility-adjusted mean.

🔹 Dynamic Trend Detection

Generates actionable long/short signals based on customizable Z-thresholds, making it adaptable across different asset classes and timeframes.

🔹 Overbought/Oversold Zones

Highlight reversion and profit-taking zones (default OB: +2 to +4, OS: -2 to -4), great for counter-trend or mean-reversion strategies.

🔹 Visual Reinforcement Tools

Includes candle coloring, gradient fills, and optional ALMA/EMA band overlays to visualize trend regime transitions.

🔍 How It Works

1️⃣ Z-Score SMMA Calculation

The core is a custom Smoothed Moving Average (SMMA) that is normalized by its standard deviation over a lookback period.

Final Formula:

Z = (SMMA - Mean) / StdDev

2️⃣ Signal Generation

• ✅ Long Bias: Z-Score > Long Threshold (default: 0)

• ❌ Short Bias: Z-Score < Short Threshold (default: 0)

3️⃣ Visual Aids

• Candle Color → Shows trend bias

• Band Fills → Highlight trend strength

• Overlays → Optional ALMA/EMA bands for structure analysis

⚙️ Custom Settings

• SMMA Length → Default: 12

• Z-Score Lookback → Default: 30

• Long Threshold → Default: 0

• Short Threshold → Default: 0

• Color Themes → Choose from 6 visual modes

• Extra Plots → Toggle advanced overlays (ALMA, EMA, bands)

• Label Display → Show/hide “𝓛𝓸𝓷𝓰” & “𝓢𝓱𝓸𝓻𝓽” markers

👥 Who Should Use It?

✅ Trend Traders → For early entries with confirmation from Z-score expansion

✅ Quantitative Analysts → Standardized deviation enables comparison across assets

✅ Mean-Reversion Traders → Use OB/OS zones to fade parabolic spikes

✅ Swing & Systematic Traders → Identify momentum shifts with optional ALMA/EMA overlays

📌 Conclusion

Z SMMA offers a smart, adaptive framework for tracking deviation from equilibrium in a quant-friendly format. Whether you're looking to follow trends or catch exhaustion points, Z SMMA provides a clear, standardized view of momentum and price extremes.

🔹 Key Takeaways:

1️⃣ Z-Score standardization ensures dynamic range awareness

2️⃣ SMMA base filters out noise, offering smoother signals

3️⃣ Color-coded visuals support faster reaction and cleaner charts

📌 Disclaimer: Past performance is not indicative of future results. No trading strategy can guarantee success in financial markets.

📌 Strategic Advice: Always backtest, optimize, and align parameters with your trading objectives and risk tolerance before

🛠️ Overview

Z SMMA is a momentum-driven oscillator designed to track the standardized deviation of a Smoothed Moving Average (SMMA). By applying Z-score normalization, this tool dynamically adapts to price volatility, enabling traders to detect meaningful directional shifts and trend changes with enhanced clarity.

It serves both as a trend-following and mean-reversion system, identifying opportunities through standardized thresholds while remaining robust across volatile and calm market conditions.

✨ Key Features

🔹 Z-Score Normalization Engine

Applies Z-score to a custom SMMA baseline, allowing traders to compare price action relative to its recent volatility-adjusted mean.

🔹 Dynamic Trend Detection

Generates actionable long/short signals based on customizable Z-thresholds, making it adaptable across different asset classes and timeframes.

🔹 Overbought/Oversold Zones

Highlight reversion and profit-taking zones (default OB: +2 to +4, OS: -2 to -4), great for counter-trend or mean-reversion strategies.

🔹 Visual Reinforcement Tools

Includes candle coloring, gradient fills, and optional ALMA/EMA band overlays to visualize trend regime transitions.

🔍 How It Works

1️⃣ Z-Score SMMA Calculation

The core is a custom Smoothed Moving Average (SMMA) that is normalized by its standard deviation over a lookback period.

Final Formula:

Z = (SMMA - Mean) / StdDev

2️⃣ Signal Generation

• ✅ Long Bias: Z-Score > Long Threshold (default: 0)

• ❌ Short Bias: Z-Score < Short Threshold (default: 0)

3️⃣ Visual Aids

• Candle Color → Shows trend bias

• Band Fills → Highlight trend strength

• Overlays → Optional ALMA/EMA bands for structure analysis

⚙️ Custom Settings

• SMMA Length → Default: 12

• Z-Score Lookback → Default: 30

• Long Threshold → Default: 0

• Short Threshold → Default: 0

• Color Themes → Choose from 6 visual modes

• Extra Plots → Toggle advanced overlays (ALMA, EMA, bands)

• Label Display → Show/hide “𝓛𝓸𝓷𝓰” & “𝓢𝓱𝓸𝓻𝓽” markers

👥 Who Should Use It?

✅ Trend Traders → For early entries with confirmation from Z-score expansion

✅ Quantitative Analysts → Standardized deviation enables comparison across assets

✅ Mean-Reversion Traders → Use OB/OS zones to fade parabolic spikes

✅ Swing & Systematic Traders → Identify momentum shifts with optional ALMA/EMA overlays

📌 Conclusion

Z SMMA offers a smart, adaptive framework for tracking deviation from equilibrium in a quant-friendly format. Whether you're looking to follow trends or catch exhaustion points, Z SMMA provides a clear, standardized view of momentum and price extremes.

🔹 Key Takeaways:

1️⃣ Z-Score standardization ensures dynamic range awareness

2️⃣ SMMA base filters out noise, offering smoother signals

3️⃣ Color-coded visuals support faster reaction and cleaner charts

📌 Disclaimer: Past performance is not indicative of future results. No trading strategy can guarantee success in financial markets.

📌 Strategic Advice: Always backtest, optimize, and align parameters with your trading objectives and risk tolerance before

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

🔹 Get access to our premium tools:

whop.com/quantedgeb/ 💎

🔹 Unlock our free toolbox:

tradinglibrary.carrd.co/ 🛠️

Disclaimer: All resources and indicators provided are for educational purposes only

whop.com/quantedgeb/ 💎

🔹 Unlock our free toolbox:

tradinglibrary.carrd.co/ 🛠️

Disclaimer: All resources and indicators provided are for educational purposes only

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

🔹 Get access to our premium tools:

whop.com/quantedgeb/ 💎

🔹 Unlock our free toolbox:

tradinglibrary.carrd.co/ 🛠️

Disclaimer: All resources and indicators provided are for educational purposes only

whop.com/quantedgeb/ 💎

🔹 Unlock our free toolbox:

tradinglibrary.carrd.co/ 🛠️

Disclaimer: All resources and indicators provided are for educational purposes only

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.