OPEN-SOURCE SCRIPT

Adaptive Pivot (HLC3)

SUMMARY:

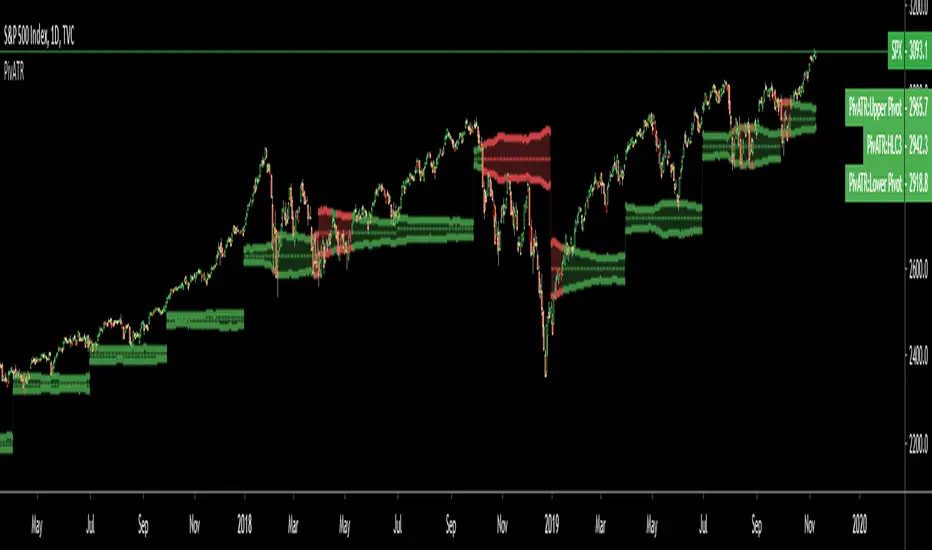

Standard Pivot (HLC3) with ATR leeway added to make it adaptive to market volatility.

DESCRIPTION:

Adaptive Pivot is an indicator utilizing the simplicity of HLC3 Pivots as a turning point (and sometimes a trend indicator) while addressing it's fixed and inflexible nature.

Because the indicator is just a single line in the chart, the price may go near it but never touch it. Or it can go pass through it and never retest it again. In an attempt to lessen these from occurring, we can combine pivots with average true range (ATR). This is the specific formula I applied in this indicator:

>Upper Pivot = HLC3 + ATR

>Lower Pivot = HLC3 - ATR

This creates a kind of a range or cloud around the Pivot, making it possibly a more accurate indicator for market turning points.

ADJUSTABLE PARAMETERS:

The usual ATR parameters are included in this indicator:

>ATR_Length = input(14, title="ATR Length", minval=1)

>ATR_Smoothing = input(title="ATR Smoothing", defval="RMA", options="RMA", "SMA", "EMA", "WMA")

Added to the usual ones is this:

>ATR_Multiplier = input(1, title="ATR Multiplier", minval=0.1)

which modifies the extent of the ATR (similar to Chandelier Exit) as it is added/subtracted from the pivot values.

Pivot’s timeframe is also adjustable:

>Pivot_Timeframe = input("3M", title='Pivot Resolution')

Note: I did not lock the type to input.resolution to allow for more possible timeframes.

OTHER PARAMETERS

Indicator color will change to green when the open is above the HLC3 Pivot and change to red when the reverse is true.

Standard Pivot (HLC3) with ATR leeway added to make it adaptive to market volatility.

DESCRIPTION:

Adaptive Pivot is an indicator utilizing the simplicity of HLC3 Pivots as a turning point (and sometimes a trend indicator) while addressing it's fixed and inflexible nature.

Because the indicator is just a single line in the chart, the price may go near it but never touch it. Or it can go pass through it and never retest it again. In an attempt to lessen these from occurring, we can combine pivots with average true range (ATR). This is the specific formula I applied in this indicator:

>Upper Pivot = HLC3 + ATR

>Lower Pivot = HLC3 - ATR

This creates a kind of a range or cloud around the Pivot, making it possibly a more accurate indicator for market turning points.

ADJUSTABLE PARAMETERS:

The usual ATR parameters are included in this indicator:

>ATR_Length = input(14, title="ATR Length", minval=1)

>ATR_Smoothing = input(title="ATR Smoothing", defval="RMA", options="RMA", "SMA", "EMA", "WMA")

Added to the usual ones is this:

>ATR_Multiplier = input(1, title="ATR Multiplier", minval=0.1)

which modifies the extent of the ATR (similar to Chandelier Exit) as it is added/subtracted from the pivot values.

Pivot’s timeframe is also adjustable:

>Pivot_Timeframe = input("3M", title='Pivot Resolution')

Note: I did not lock the type to input.resolution to allow for more possible timeframes.

OTHER PARAMETERS

Indicator color will change to green when the open is above the HLC3 Pivot and change to red when the reverse is true.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.