Hello!

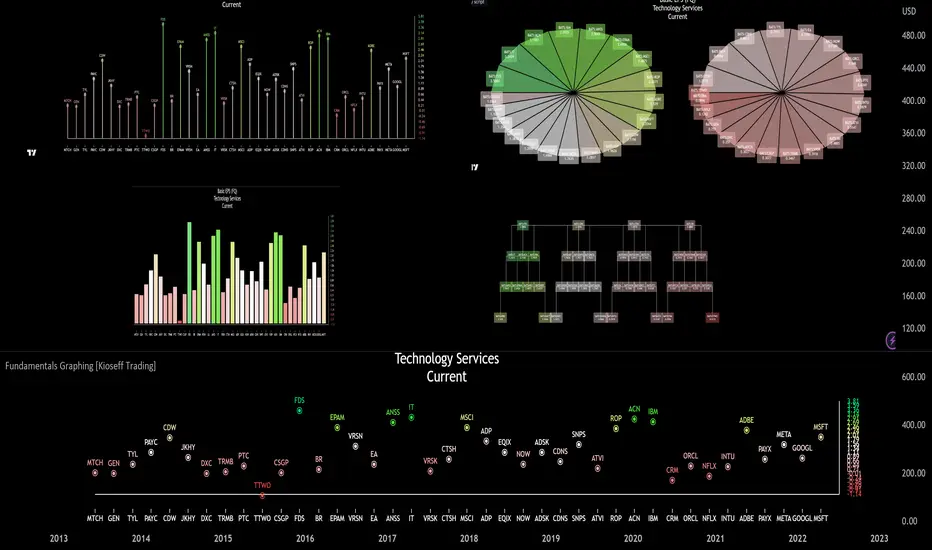

This script "Fundamental Comparison" allows you to compare almost any fundamental metric across 40 assets; various charting methods are employable!

Thank you to TradingView / PineCoders for providing the framework in the "Financials on Chart" indicator - thereby expediting a generous portion of work (:

Features

Self-Adjusting Graph

The graph adjusts to the orientation/size of your chart!

The image above shows the graph on a price chart with a 229 bar difference.

The image above shows the same price chart; however, there's now a 1941 bar difference to which the fundamentals graph automatically adjusts!

The images above show the same expansion/reduction for the pie chart; all graph types shrink and expand with the price chart.

Fundamental Metrics

The image above shows most of the settings for the indicator!

Most of the metrics from the "Financials on Chart" indicator are included!

Quarterly or annual data are retrievable, in addition to industry presets.

Additionally, you can retrieve the financial data any number of intervals back (so long as the data exists and is provided by TradingView)

The image above shows an example of retrieving a fundamental metric from a previous FQ. The same can be done with FY!

Sortable Data

All data retrieved by the indicator is sortable - allowing for, hopefully, easier evaluations (:

The image above exemplifies the capability!

Data from any quarter/year can be sorted similarly.

Reversible Scale / Reversible Color Scheme

A seemingly trivial feature: a reversible scale and color scheme should assist in instances where "a higher number is bad" and a "lower number is good" - in addition to other scenarios.

For instance,

The image above shows a graph for taxes. The scale and color scheme have not been reversed and, presently, larger columns are correlating to a smaller amount of money out/in than smaller columns.

This can be fixed by reversing the scale.

The image above shows the "Reverse Scale" feature selected. Consequently, larger columns correlate to a larger amount of money out/in.

Similarly, a "Reverse Colors" feature is available. A useful option when a more positive number is "bad" and a less positive number is "good".

For instance,

The image above shows graphing for the Beneish M-Score.

A more positive number is generally interpreted as "bad"; a less positive number is generally interpreted as "good".

However, our color scheme doesn't seem to correspond (unless one considers red = good and green = bad)

Let's enable the reverse color feature.

The image above shows the completion of the process!

Finally, there's a built-in search feature that's a bit difficult to use; however, should you grow comfortable with it you may save some time sorting through fundamental data.

Big thanks to rumpypumpydumpy for providing an easy-to-work-with framework for the pie chart!

That's all for now; thank you for checking this out.

This script "Fundamental Comparison" allows you to compare almost any fundamental metric across 40 assets; various charting methods are employable!

Thank you to TradingView / PineCoders for providing the framework in the "Financials on Chart" indicator - thereby expediting a generous portion of work (:

Features

- Most metrics included in the "Financials on Chart" indicator are graphable

- Scatter chat

- Histogram

- Bar chart

- Pie chart

- Reversible scaling

- Adjusts to the size of your chart

- 10 industry presets

- Custom symbol dataset

- Retrieve, graph, and compare fundamental data by quarter/year. The indicator can "look back" to grab fundamental data from previous quarters/years.

- Sortable data - ascending/descending

- Built-in search function [a bit difficult to use (:]

Self-Adjusting Graph

The graph adjusts to the orientation/size of your chart!

The image above shows the graph on a price chart with a 229 bar difference.

The image above shows the same price chart; however, there's now a 1941 bar difference to which the fundamentals graph automatically adjusts!

The images above show the same expansion/reduction for the pie chart; all graph types shrink and expand with the price chart.

Fundamental Metrics

The image above shows most of the settings for the indicator!

Most of the metrics from the "Financials on Chart" indicator are included!

Quarterly or annual data are retrievable, in addition to industry presets.

Additionally, you can retrieve the financial data any number of intervals back (so long as the data exists and is provided by TradingView)

The image above shows an example of retrieving a fundamental metric from a previous FQ. The same can be done with FY!

Sortable Data

All data retrieved by the indicator is sortable - allowing for, hopefully, easier evaluations (:

The image above exemplifies the capability!

Data from any quarter/year can be sorted similarly.

Reversible Scale / Reversible Color Scheme

A seemingly trivial feature: a reversible scale and color scheme should assist in instances where "a higher number is bad" and a "lower number is good" - in addition to other scenarios.

For instance,

The image above shows a graph for taxes. The scale and color scheme have not been reversed and, presently, larger columns are correlating to a smaller amount of money out/in than smaller columns.

This can be fixed by reversing the scale.

The image above shows the "Reverse Scale" feature selected. Consequently, larger columns correlate to a larger amount of money out/in.

Similarly, a "Reverse Colors" feature is available. A useful option when a more positive number is "bad" and a less positive number is "good".

For instance,

The image above shows graphing for the Beneish M-Score.

A more positive number is generally interpreted as "bad"; a less positive number is generally interpreted as "good".

However, our color scheme doesn't seem to correspond (unless one considers red = good and green = bad)

Let's enable the reverse color feature.

The image above shows the completion of the process!

Finally, there's a built-in search feature that's a bit difficult to use; however, should you grow comfortable with it you may save some time sorting through fundamental data.

Big thanks to rumpypumpydumpy for providing an easy-to-work-with framework for the pie chart!

That's all for now; thank you for checking this out.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

•Access to Next-Gen Optimization Tools: tradingiq.io

•Discord Server: discord.gg/aKWPuM4HPy

•Discord Server: discord.gg/aKWPuM4HPy

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

•Access to Next-Gen Optimization Tools: tradingiq.io

•Discord Server: discord.gg/aKWPuM4HPy

•Discord Server: discord.gg/aKWPuM4HPy

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.