OPEN-SOURCE SCRIPT

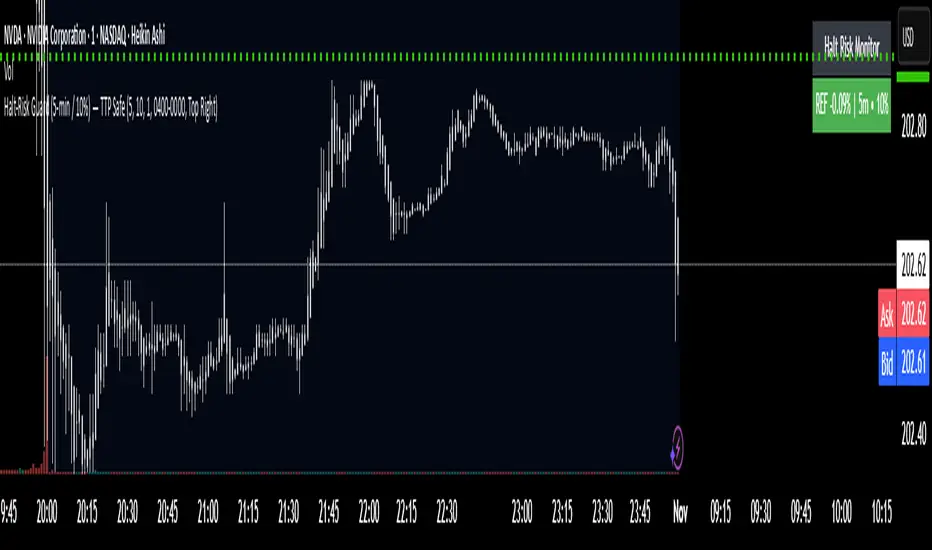

Halt-Risk Guard (5-min / 10%) — TTP Safe

🛑 Halt-Risk Guard (5-min / 10%) — TTP Safe

Stay clear of halts, invalidations, and over-extended moves.

🔍 Overview

The Halt-Risk Guard helps traders avoid sudden invalidations by monitoring price velocity over the past X minutes (default: 5 min) and flagging when moves exceed a configurable threshold (default: 10%).

Originally built to meet Trade The Pool (TTP) risk-management rules — where even non-halted 10% moves can void trades — this tool provides a clear, visual warning system and optional entry blocker.

⚙️ Key Features

✅ Halt-Risk Detection – Calculates both reference-based and swing-based (high↔low) percentage change over the chosen lookback period.

✅ TTP Safe Mode – “Swing mode” captures extreme volatility spikes that may invalidate trades even when the market stays open.

✅ Entry Blocker (optional) – Automatically greys candles and dims the background during risky conditions to prevent impulsive entries.

✅ Customisable Positioning – Move the on-chart info box to any corner of your chart (Top Left / Top Right / Bottom Left / Bottom Right).

✅ Clean Alerts –

⚠️ At/Above Threshold

✅ Back to Safe

⛔ Entry Blocker Active

✅ Visual Table Display – Compact dashboard shows current % move, lookback window, and threshold with intuitive green/red status.

✅ Strategy-Ready Output – A hidden 0/1 plot lets you block or filter trades in automated systems.

⚡ How It Works

Monitors the selected symbol using your chosen computation timeframe (recommended 1-minute).

Evaluates either:

REF mode: Close-to-close change over the lookback window.

SWING mode: High-to-low range within the same window.

If the move ≥ Threshold %, the script highlights a halt-risk condition and optionally activates the entry blocker.

🎨 Recommended Settings

Lookback: 5 minutes

Threshold: 10 %

Swing mode: ON (TTP-safe)

Computation timeframe: 1 minute

Entry blocker: ON

Dim background: ON

🧠 Use Cases

TTP and other prop-firm evaluations enforcing price-movement limits.

Volatility-based scalping systems to avoid chasing extended candles.

Strategy filters for algorithmic entries (e.g. pause trading during halt-risk windows).

⚠️ Disclaimer

This tool provides visual and alert-based guidance only. It does not guarantee compliance with any specific firm’s rules or eliminate trading risk. Always verify thresholds and rules with your broker or evaluation provider.

Stay clear of halts, invalidations, and over-extended moves.

🔍 Overview

The Halt-Risk Guard helps traders avoid sudden invalidations by monitoring price velocity over the past X minutes (default: 5 min) and flagging when moves exceed a configurable threshold (default: 10%).

Originally built to meet Trade The Pool (TTP) risk-management rules — where even non-halted 10% moves can void trades — this tool provides a clear, visual warning system and optional entry blocker.

⚙️ Key Features

✅ Halt-Risk Detection – Calculates both reference-based and swing-based (high↔low) percentage change over the chosen lookback period.

✅ TTP Safe Mode – “Swing mode” captures extreme volatility spikes that may invalidate trades even when the market stays open.

✅ Entry Blocker (optional) – Automatically greys candles and dims the background during risky conditions to prevent impulsive entries.

✅ Customisable Positioning – Move the on-chart info box to any corner of your chart (Top Left / Top Right / Bottom Left / Bottom Right).

✅ Clean Alerts –

⚠️ At/Above Threshold

✅ Back to Safe

⛔ Entry Blocker Active

✅ Visual Table Display – Compact dashboard shows current % move, lookback window, and threshold with intuitive green/red status.

✅ Strategy-Ready Output – A hidden 0/1 plot lets you block or filter trades in automated systems.

⚡ How It Works

Monitors the selected symbol using your chosen computation timeframe (recommended 1-minute).

Evaluates either:

REF mode: Close-to-close change over the lookback window.

SWING mode: High-to-low range within the same window.

If the move ≥ Threshold %, the script highlights a halt-risk condition and optionally activates the entry blocker.

🎨 Recommended Settings

Lookback: 5 minutes

Threshold: 10 %

Swing mode: ON (TTP-safe)

Computation timeframe: 1 minute

Entry blocker: ON

Dim background: ON

🧠 Use Cases

TTP and other prop-firm evaluations enforcing price-movement limits.

Volatility-based scalping systems to avoid chasing extended candles.

Strategy filters for algorithmic entries (e.g. pause trading during halt-risk windows).

⚠️ Disclaimer

This tool provides visual and alert-based guidance only. It does not guarantee compliance with any specific firm’s rules or eliminate trading risk. Always verify thresholds and rules with your broker or evaluation provider.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.