PROTECTED SOURCE SCRIPT

False highs and lows

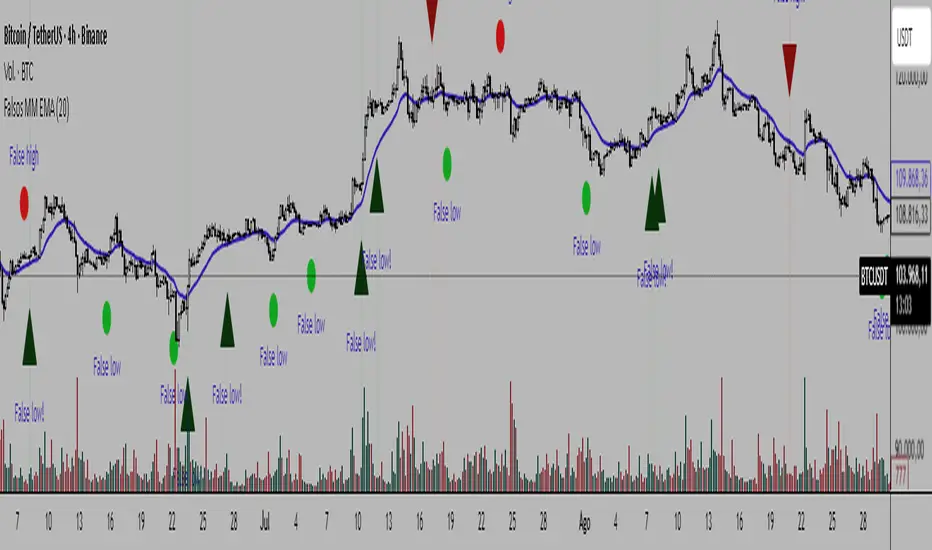

This technical indicator shows points of probable reversal. Specifically, it exploits the phenomenon of false highs and lows: supply or demand entries with strong momentum.

The signals with green and red arrows are in favor of the trend and above the EMA 20, so you should pay close attention to them. The signals marked with green and red circles also show great opportunities, but they should be studied with greater caution.

Warnings:

-Avoid entries on false highs when there is strong buying pressure (evident in bullish candles with high momentum).

-Avoid entries on false lows when there is strong selling pressure (evident in bearish candles with high momentum).

-Avoid entries on false lows when there is clear resistance and the price is overbought.

-Avoid entries on false highs when there is nearby support and the price is oversold.

-Avoid trading in very narrow price ranges.

-Wait for the close of the signaled candle for the pattern to be valid.

-I recommend using tight stop losses below the low (or above the high) of the pattern, and targeting reward-to-risk ratios that do not exceed 1:1 in most cases.

The signals with green and red arrows are in favor of the trend and above the EMA 20, so you should pay close attention to them. The signals marked with green and red circles also show great opportunities, but they should be studied with greater caution.

Warnings:

-Avoid entries on false highs when there is strong buying pressure (evident in bullish candles with high momentum).

-Avoid entries on false lows when there is strong selling pressure (evident in bearish candles with high momentum).

-Avoid entries on false lows when there is clear resistance and the price is overbought.

-Avoid entries on false highs when there is nearby support and the price is oversold.

-Avoid trading in very narrow price ranges.

-Wait for the close of the signaled candle for the pattern to be valid.

-I recommend using tight stop losses below the low (or above the high) of the pattern, and targeting reward-to-risk ratios that do not exceed 1:1 in most cases.

보호된 스크립트입니다

이 스크립트는 비공개 소스로 게시됩니다. 하지만 제한 없이 자유롭게 사용할 수 있습니다 — 여기에서 자세히 알아보기.

📖Revista El Especulador:

drive.google.com/file/d/1Fs8l9xSpZIy5haCb5l0HWzgeAanOifs_/view?usp=drivesdk

👉t.me/ElEspeculador96 (Telegram)

drive.google.com/file/d/1Fs8l9xSpZIy5haCb5l0HWzgeAanOifs_/view?usp=drivesdk

👉t.me/ElEspeculador96 (Telegram)

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.

보호된 스크립트입니다

이 스크립트는 비공개 소스로 게시됩니다. 하지만 제한 없이 자유롭게 사용할 수 있습니다 — 여기에서 자세히 알아보기.

📖Revista El Especulador:

drive.google.com/file/d/1Fs8l9xSpZIy5haCb5l0HWzgeAanOifs_/view?usp=drivesdk

👉t.me/ElEspeculador96 (Telegram)

drive.google.com/file/d/1Fs8l9xSpZIy5haCb5l0HWzgeAanOifs_/view?usp=drivesdk

👉t.me/ElEspeculador96 (Telegram)

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.