OPEN-SOURCE SCRIPT

OBV Z-Scores

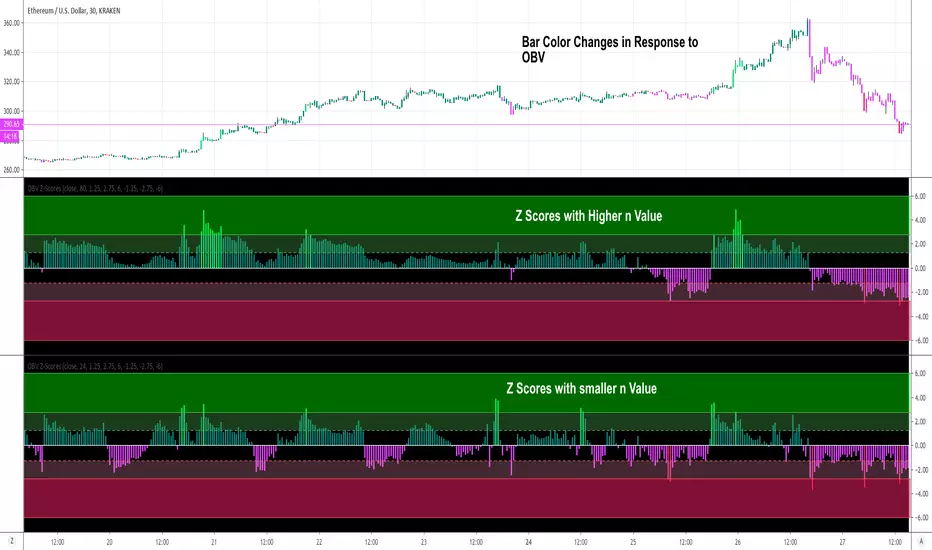

This study calculates the On-Balance Volume (OBV) and displays it in terms of its Z-Score.

OBV is a great momentum indicator . As the name suggests, OBV predicts changes in price based on the security's volume flow.

Formula:

if (Current Price > Previous Price)

then Current OBV = Previous OBV + Current Volume

if (Current Price < Previous Price)

then Current OBV = Previous OBV - Current Volume

if (Current Price == Previous Price)

then Current OBV = Previous OBV

As the formula shows, the OBV goes a step beyond just looking at the pure volume of a security. Instead, it factors in relative price action from period to period to reflect investor sentiment. As a result, we often look to the OBV to spot bullish or bearish trends while they are in the early stages of development or simply predict impending uptrends or downtrends.

To make the OBV easier to visualize, we converted the value to a Z-Score. The Z-Score is a simple statistical measurement and represents the current OBV value's distance from the mean OBV value in terms of # of standard deviations.

Users can adjust the values for the 2 upper bounds for Z Scores and 2 lower bounds. Additionally, the n value for z score calculation can be adjusted in the input menu. A higher n value means the z score will be based on a longer lookback period. A lower value will result in more sensitive readings.

Overall, I think this is an interesting way to represent OBV values and will be a valuable leading indicator.

~Happy Trading~

OBV is a great momentum indicator . As the name suggests, OBV predicts changes in price based on the security's volume flow.

Formula:

if (Current Price > Previous Price)

then Current OBV = Previous OBV + Current Volume

if (Current Price < Previous Price)

then Current OBV = Previous OBV - Current Volume

if (Current Price == Previous Price)

then Current OBV = Previous OBV

As the formula shows, the OBV goes a step beyond just looking at the pure volume of a security. Instead, it factors in relative price action from period to period to reflect investor sentiment. As a result, we often look to the OBV to spot bullish or bearish trends while they are in the early stages of development or simply predict impending uptrends or downtrends.

To make the OBV easier to visualize, we converted the value to a Z-Score. The Z-Score is a simple statistical measurement and represents the current OBV value's distance from the mean OBV value in terms of # of standard deviations.

Users can adjust the values for the 2 upper bounds for Z Scores and 2 lower bounds. Additionally, the n value for z score calculation can be adjusted in the input menu. A higher n value means the z score will be based on a longer lookback period. A lower value will result in more sensitive readings.

Overall, I think this is an interesting way to represent OBV values and will be a valuable leading indicator.

~Happy Trading~

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

-Profit Programmers

profitprogrammer.com

profitprogrammer.com

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

-Profit Programmers

profitprogrammer.com

profitprogrammer.com

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.