OPEN-SOURCE SCRIPT

업데이트됨 HIGH and LOW Optimized Trend Tracker HOTT LOTT

Anıl Özekşi's latest development on his precious OTT - Optimized Trend Tracker:

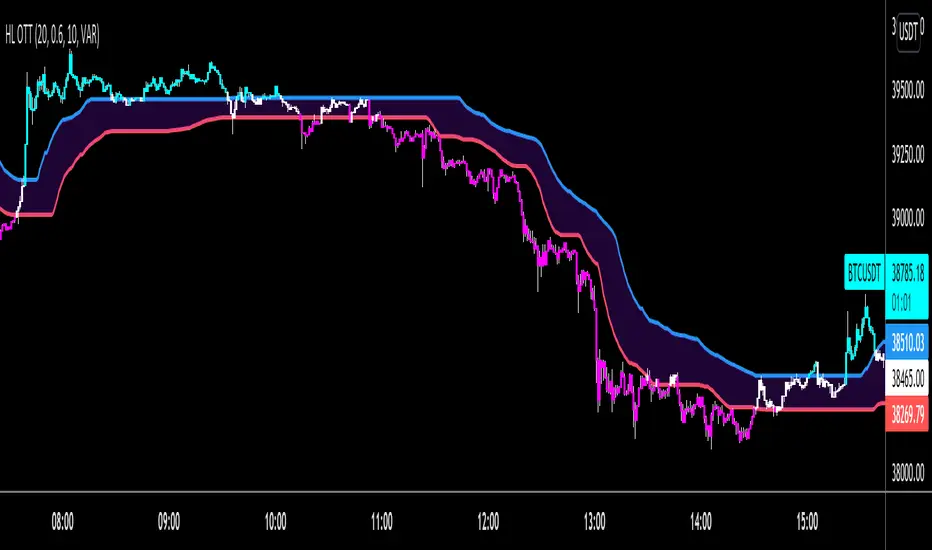

In this version, there are two lines of OTT which are derived from HIGHEST price values (HOTT) and LOVEST price values (LOTT) which were originally sourced to CLOSE values on default OTT.

Another significant difference is there is no Support Line (Moving Average) in this version.

The area between HOTT and LOTT is FLAT ZONE which developer advises to do nothing.

Bars will be highlighted to Turquoise when candles close over HOTT, means an UPTREND SIGNAL

and to Fuchia when candles begin closing under LOTT line to indicate a DOWNTREND SIGNAL.

FLAT ZONE is highlighted also to have the maximum concentration on sideways market conditions.

There are three quantitative parameters in this indicator:

The first parameter in the OTT indicator set by the two parameters is the period/length.

OTT lines will be much sensitive to trend movements if it is smaller.

And vice versa, will be less sensitive when it is longer.

As the period increases it will become less sensitive to little trends and price actions.

In this way, your choice of period, will be closely related to which of the sort of trends you are interested in.

The OTT percent parameter in OTT is an optimization coefficient. Just like in the period

small values are better at capturing short term fluctuations, while large values

will be more suitable for long-term trends.

The final adjustable quantitative parameter is HIGHEST and LOWEST length which is the source of calculations.

Anıl Özekşi generally works on 1 minute charts so I personally advise traders to optimize parameters to have more accurate signals. Just concentrate on FLAT price zones and indicator will do the rest in trends.

Built in Moving Average type defaultly set as VAR but users can choose from 10 different Moving Average types like:

SMA : Simple Moving Average

EMA : Exponential Moving Average

DEMA : Double Exponential Moving Average

WMA : Weighted Moving Average

TMA : Triangular Moving Average

VAR : Variable Index Dynamic Moving Average a.k.a. VIDYA

WWMA : Welles Wilder's Moving Average

ZLEMA : Zero Lag Exponential Moving Average

TSF : True Strength Force

HULL : Hull Moving Average

In this version, there are two lines of OTT which are derived from HIGHEST price values (HOTT) and LOVEST price values (LOTT) which were originally sourced to CLOSE values on default OTT.

Another significant difference is there is no Support Line (Moving Average) in this version.

The area between HOTT and LOTT is FLAT ZONE which developer advises to do nothing.

Bars will be highlighted to Turquoise when candles close over HOTT, means an UPTREND SIGNAL

and to Fuchia when candles begin closing under LOTT line to indicate a DOWNTREND SIGNAL.

FLAT ZONE is highlighted also to have the maximum concentration on sideways market conditions.

There are three quantitative parameters in this indicator:

The first parameter in the OTT indicator set by the two parameters is the period/length.

OTT lines will be much sensitive to trend movements if it is smaller.

And vice versa, will be less sensitive when it is longer.

As the period increases it will become less sensitive to little trends and price actions.

In this way, your choice of period, will be closely related to which of the sort of trends you are interested in.

The OTT percent parameter in OTT is an optimization coefficient. Just like in the period

small values are better at capturing short term fluctuations, while large values

will be more suitable for long-term trends.

The final adjustable quantitative parameter is HIGHEST and LOWEST length which is the source of calculations.

Anıl Özekşi generally works on 1 minute charts so I personally advise traders to optimize parameters to have more accurate signals. Just concentrate on FLAT price zones and indicator will do the rest in trends.

Built in Moving Average type defaultly set as VAR but users can choose from 10 different Moving Average types like:

SMA : Simple Moving Average

EMA : Exponential Moving Average

DEMA : Double Exponential Moving Average

WMA : Weighted Moving Average

TMA : Triangular Moving Average

VAR : Variable Index Dynamic Moving Average a.k.a. VIDYA

WWMA : Welles Wilder's Moving Average

ZLEMA : Zero Lag Exponential Moving Average

TSF : True Strength Force

HULL : Hull Moving Average

릴리즈 노트

version updated to v5오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

Telegram t.me/AlgoRhytm

YouTube (Turkish): youtube.com/c/kivancozbilgic

YouTube (English): youtube.com/c/AlgoWorld

YouTube (Turkish): youtube.com/c/kivancozbilgic

YouTube (English): youtube.com/c/AlgoWorld

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

Telegram t.me/AlgoRhytm

YouTube (Turkish): youtube.com/c/kivancozbilgic

YouTube (English): youtube.com/c/AlgoWorld

YouTube (Turkish): youtube.com/c/kivancozbilgic

YouTube (English): youtube.com/c/AlgoWorld

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.