OPEN-SOURCE SCRIPT

LSVR - Liquidity Sweep & Volume Reversal

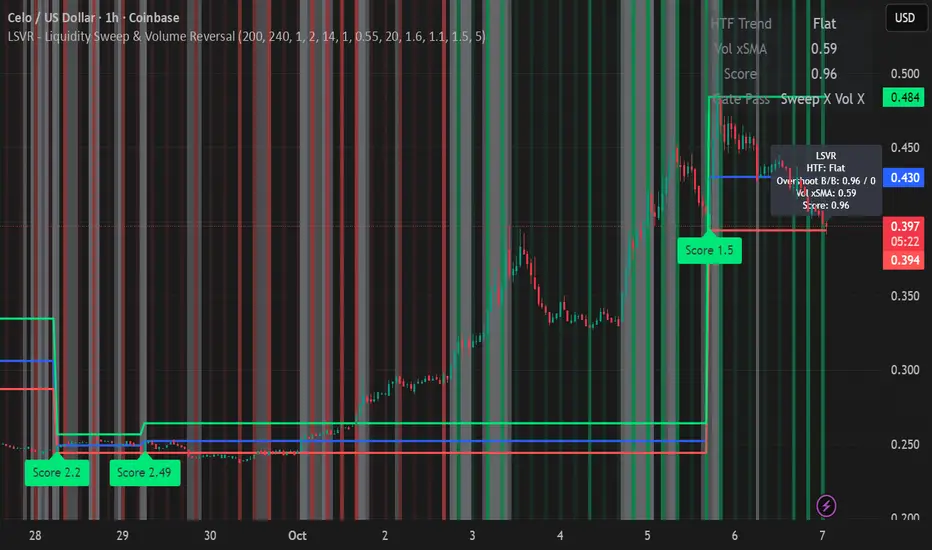

LSVR condenses a pro workflow into one visual overlay: Higher-Timeframe (HTF) Trend → Liquidity Sweep & Reclaim → Volume Confirmation. A signal only prints when all three gates align at bar close, and the chart shows everything you need—trend context, the sweep “trap” candle, and a projected Entry/SL/TP based on your chosen R multiple.

How it works

HTF Trend Filter: Projects a smoothed KAMA/EMA from a higher timeframe to the chart using a safe, lookahead-off request. Long signals are considered only above the HTF line; shorts only below.

Liquidity Sweep & Reclaim: Finds confirmed swing highs/lows, then detects an ATR-scaled overshoot through that swing followed by a reclaim (close back inside a configurable % of the bar range).

Volume Confirmation: Requires either a volume spike over Volume SMA × multiplier or optional OBV divergence. No participation = no signal.

Score: Each setup is scored: trend (0/1) + overshoot strength (0..1.5) + conviction (0/1). Signals fire only when the score ≥ Min Signal Score.

What you see

HTF Ribbon (subtle green/red backdrop) for bias.

Sweep Box on the signal candle (green = long, red = short).

Signal markers (“L” / “S”) with a small score label.

Projected lines that persist until the next signal: Entry (close), Stop (beyond swept swing), Target (R multiple).

Heatmap that intensifies when the score crosses your threshold.

Dashboard (top-right): HTF direction, Volume×SMA, current Score, gate pass status.

Tooltip on the last bar with quick stats.

Quick start

Apply to any liquid symbol and set HTF to ~3–6× your chart timeframe (e.g., 15m chart → 1H–4H).

Trade with the HTF trend: take L signals above the HTF line and S signals below it.

Entry = signal bar close, SL = beyond the swept swing, TP = your Projected Take-Profit (R).

Tighten or loosen selectivity with Min Signal Score, Reclaim %, Overshoot (ATR×), and Cooldown.

Recommended presets

Choppy/crypto 15m: minScore 1.25, reclaimPct 0.60–0.65, overshootATR 1.0–1.2, useOBVDiv=false, cooldown 8.

FX 5m / session trend: minScore 1.0–1.1, reclaimPct 0.50–0.55, overshootATR 0.8–1.0, useOBVDiv=true, cooldown 5.

Indices 1m (RTH): minScore 1.2, reclaimPct 0.55–0.60, useOBVDiv=false, cooldown 10.

Non-repainting by design

HTF values use lookahead_off with realtime offset.

Swings are confirmed pivots (no “forming” pivots).

Signals print at bar close only.

Notes

OBV divergence can add sensitivity on liquid markets; keep it off for stricter filtering.

Use Cooldown to avoid clustered sweeps.

This is an overlay/analysis tool, not financial advice. Test settings in Replay/Paper Trading before using live.

How it works

HTF Trend Filter: Projects a smoothed KAMA/EMA from a higher timeframe to the chart using a safe, lookahead-off request. Long signals are considered only above the HTF line; shorts only below.

Liquidity Sweep & Reclaim: Finds confirmed swing highs/lows, then detects an ATR-scaled overshoot through that swing followed by a reclaim (close back inside a configurable % of the bar range).

Volume Confirmation: Requires either a volume spike over Volume SMA × multiplier or optional OBV divergence. No participation = no signal.

Score: Each setup is scored: trend (0/1) + overshoot strength (0..1.5) + conviction (0/1). Signals fire only when the score ≥ Min Signal Score.

What you see

HTF Ribbon (subtle green/red backdrop) for bias.

Sweep Box on the signal candle (green = long, red = short).

Signal markers (“L” / “S”) with a small score label.

Projected lines that persist until the next signal: Entry (close), Stop (beyond swept swing), Target (R multiple).

Heatmap that intensifies when the score crosses your threshold.

Dashboard (top-right): HTF direction, Volume×SMA, current Score, gate pass status.

Tooltip on the last bar with quick stats.

Quick start

Apply to any liquid symbol and set HTF to ~3–6× your chart timeframe (e.g., 15m chart → 1H–4H).

Trade with the HTF trend: take L signals above the HTF line and S signals below it.

Entry = signal bar close, SL = beyond the swept swing, TP = your Projected Take-Profit (R).

Tighten or loosen selectivity with Min Signal Score, Reclaim %, Overshoot (ATR×), and Cooldown.

Recommended presets

Choppy/crypto 15m: minScore 1.25, reclaimPct 0.60–0.65, overshootATR 1.0–1.2, useOBVDiv=false, cooldown 8.

FX 5m / session trend: minScore 1.0–1.1, reclaimPct 0.50–0.55, overshootATR 0.8–1.0, useOBVDiv=true, cooldown 5.

Indices 1m (RTH): minScore 1.2, reclaimPct 0.55–0.60, useOBVDiv=false, cooldown 10.

Non-repainting by design

HTF values use lookahead_off with realtime offset.

Swings are confirmed pivots (no “forming” pivots).

Signals print at bar close only.

Notes

OBV divergence can add sensitivity on liquid markets; keep it off for stricter filtering.

Use Cooldown to avoid clustered sweeps.

This is an overlay/analysis tool, not financial advice. Test settings in Replay/Paper Trading before using live.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.