OPEN-SOURCE SCRIPT

Bollinger Bands % | QuantEdgeB

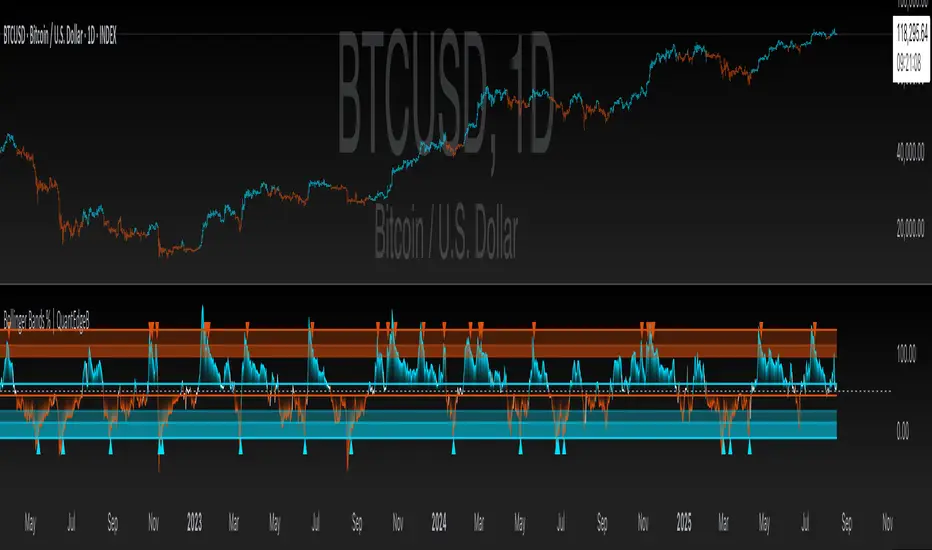

📊 Introducing Bollinger Bands % (BB%) by QuantEdgeB

🛠️ Overview

BB% | QuantEdgeB is a volatility-aware momentum tool that maps price within a Bollinger envelope onto a normalized scale. By letting you choose the base moving average (SMA, EMA, DEMA, TEMA, HMA, ALMA, EHMA, THMA, RMA, WMA, VWMA, T3, LSMA) and even Heikin-Ashi sources, it adapts to your style while keeping readings consistent across symbols and timeframes. Clear thresholds and color-coded visuals make it easy to spot emerging strength, fading moves, and potential mean-reversions.

✨ Key Features

• 🔹 Flexible Baseline

Pick from 12 MA types (plus Heikin-Ashi source option) to tailor responsiveness and smoothness.

• 🔹 Normalized Positioning

Price is expressed as a percentage of the band range, yielding an intuitive 0–100 style read (can exceed in extreme trends).

• 🔹 Actionable Thresholds

Default Long 55 / Short 45 levels provide simple, objective triggers.

• 🔹 Visual Clarity

Color-coded candles, shaded OB/OS zones, and adaptive color themes speed up decision-making.

• 🔹 Ready-to-Alert

Built-in alerts for long/short transitions.

📐 How It Works

1️⃣ Band Construction

A moving average (your choice) defines the midline; volatility (standard deviation) builds upper/lower bands.

2️⃣ Normalization

The indicator measures where price sits between the lower and upper band, scaling that into a bounded oscillator (BB%).

3️⃣ Signal Logic

• ✅ Long when BB% rises above 55 (strength toward the top of the envelope).

• ❌ Short when BB% falls below 45 (weakness toward the bottom).

4️⃣ OB/OS Context

Shaded regions above/below typical ranges highlight exhaustion and potential snap-backs.

⚙️ Custom Settings

• Base MA Type: SMA, EMA, DEMA, TEMA, HMA, ALMA, EHMA, THMA, RMA, WMA, VWMA, T3, LSMA

• Source Mode: Classic price or Heikin-Ashi (close/open/high/hlc3)

• Base Length: default 40

• Band Width: standard deviation-based (2× SD by default)

• Long / Short Thresholds: defaults 55 / 45

• Color Mode: Alpha, MultiEdge, TradingSuite, Premium, Fundamental, Classic, Warm, Cold, Strategy

• Candles & Labels: optional candle coloring and signal markers

👥 Ideal For

✅ Trend Followers — Ride strength as price compresses near the upper band.

✅ Swing/Mean-Reversion Traders — Fade extremes when BB% stretches into OB/OS zones.

✅ Multi-Timeframe Analysts — Compare band position consistently across periods.

✅ System Builders — Use BB% as a normalized feature for strategies and filters.

📌 Conclusion

BB% | QuantEdgeB delivers a clean, normalized read of price versus its volatility envelope—adaptable via rich MA/source options and easy to automate with thresholds and alerts.

🔹 Key Takeaways:

1️⃣ Normalized view of price inside the volatility bands

2️⃣ Flexible baseline (12+ MA choices) and Heikin-Ashi support

3️⃣ Straightforward 55/45 triggers with clear visual context

📌 Disclaimer: Past performance is not indicative of future results. No strategy guarantees success.

📌 Strategic Advice: Always backtest, tune parameters, and align with your risk profile before live trading.

🛠️ Overview

BB% | QuantEdgeB is a volatility-aware momentum tool that maps price within a Bollinger envelope onto a normalized scale. By letting you choose the base moving average (SMA, EMA, DEMA, TEMA, HMA, ALMA, EHMA, THMA, RMA, WMA, VWMA, T3, LSMA) and even Heikin-Ashi sources, it adapts to your style while keeping readings consistent across symbols and timeframes. Clear thresholds and color-coded visuals make it easy to spot emerging strength, fading moves, and potential mean-reversions.

✨ Key Features

• 🔹 Flexible Baseline

Pick from 12 MA types (plus Heikin-Ashi source option) to tailor responsiveness and smoothness.

• 🔹 Normalized Positioning

Price is expressed as a percentage of the band range, yielding an intuitive 0–100 style read (can exceed in extreme trends).

• 🔹 Actionable Thresholds

Default Long 55 / Short 45 levels provide simple, objective triggers.

• 🔹 Visual Clarity

Color-coded candles, shaded OB/OS zones, and adaptive color themes speed up decision-making.

• 🔹 Ready-to-Alert

Built-in alerts for long/short transitions.

📐 How It Works

1️⃣ Band Construction

A moving average (your choice) defines the midline; volatility (standard deviation) builds upper/lower bands.

2️⃣ Normalization

The indicator measures where price sits between the lower and upper band, scaling that into a bounded oscillator (BB%).

3️⃣ Signal Logic

• ✅ Long when BB% rises above 55 (strength toward the top of the envelope).

• ❌ Short when BB% falls below 45 (weakness toward the bottom).

4️⃣ OB/OS Context

Shaded regions above/below typical ranges highlight exhaustion and potential snap-backs.

⚙️ Custom Settings

• Base MA Type: SMA, EMA, DEMA, TEMA, HMA, ALMA, EHMA, THMA, RMA, WMA, VWMA, T3, LSMA

• Source Mode: Classic price or Heikin-Ashi (close/open/high/hlc3)

• Base Length: default 40

• Band Width: standard deviation-based (2× SD by default)

• Long / Short Thresholds: defaults 55 / 45

• Color Mode: Alpha, MultiEdge, TradingSuite, Premium, Fundamental, Classic, Warm, Cold, Strategy

• Candles & Labels: optional candle coloring and signal markers

👥 Ideal For

✅ Trend Followers — Ride strength as price compresses near the upper band.

✅ Swing/Mean-Reversion Traders — Fade extremes when BB% stretches into OB/OS zones.

✅ Multi-Timeframe Analysts — Compare band position consistently across periods.

✅ System Builders — Use BB% as a normalized feature for strategies and filters.

📌 Conclusion

BB% | QuantEdgeB delivers a clean, normalized read of price versus its volatility envelope—adaptable via rich MA/source options and easy to automate with thresholds and alerts.

🔹 Key Takeaways:

1️⃣ Normalized view of price inside the volatility bands

2️⃣ Flexible baseline (12+ MA choices) and Heikin-Ashi support

3️⃣ Straightforward 55/45 triggers with clear visual context

📌 Disclaimer: Past performance is not indicative of future results. No strategy guarantees success.

📌 Strategic Advice: Always backtest, tune parameters, and align with your risk profile before live trading.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

🔹 Get access to our premium tools:

whop.com/basetrustcapital 💎

🔹 Unlock our free toolbox:

tradinglibrary.carrd.co/ 🛠️

Disclaimer: All resources and indicators provided are for educational purposes only

whop.com/basetrustcapital 💎

🔹 Unlock our free toolbox:

tradinglibrary.carrd.co/ 🛠️

Disclaimer: All resources and indicators provided are for educational purposes only

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

🔹 Get access to our premium tools:

whop.com/basetrustcapital 💎

🔹 Unlock our free toolbox:

tradinglibrary.carrd.co/ 🛠️

Disclaimer: All resources and indicators provided are for educational purposes only

whop.com/basetrustcapital 💎

🔹 Unlock our free toolbox:

tradinglibrary.carrd.co/ 🛠️

Disclaimer: All resources and indicators provided are for educational purposes only

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.