OPEN-SOURCE SCRIPT

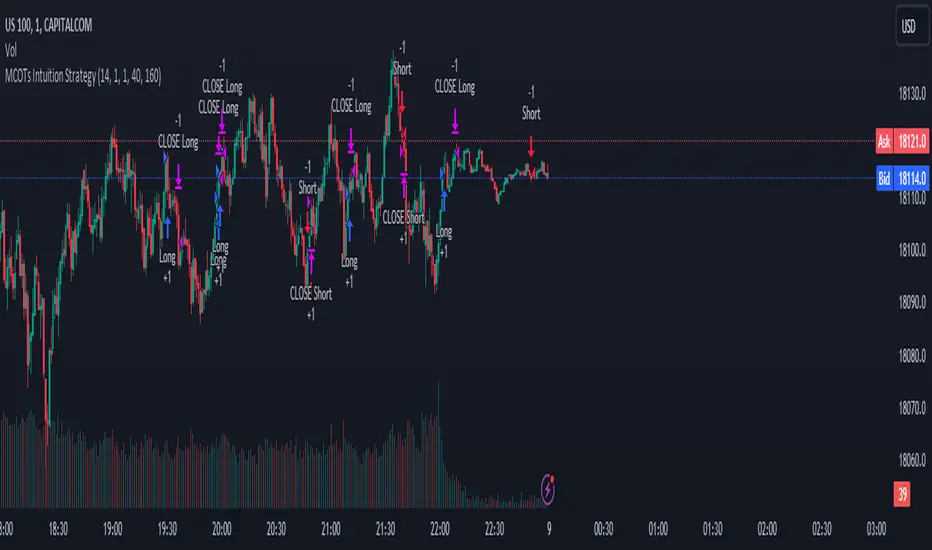

업데이트됨 MCOTs Intuition Strategy

Initial Capital: The strategy starts with an initial capital of $50,000.

Execution: Trades are executed on every price tick to capture all potential movements.

Contract Size: The default position size is one contract per trade.

Timeframe: Although not explicitly mentioned, this strategy is intended for a one-minute timeframe.

RSI Calculation: The Relative Strength Index (RSI) is calculated over a user-defined period (default is 14 periods).

Standard Deviation: The script calculates the standard deviation of the change in RSI values to determine the threshold for entering trades.

Exhaustion Detection: Before entering a long or short position, the script checks for exhaustion in the RSI’s momentum. This is to avoid entering trades during extreme conditions where a reversal is likely.

Entry Conditions: A long position is entered when the current RSI momentum exceeds the standard deviation threshold and is less than the previous momentum multiplied by an exhaustion factor. A short position is entered under the opposite conditions.

Limit Orders for Exit: Instead of traditional stop loss and take profit orders, the strategy uses limit orders to exit positions. This means the strategy sets a desired price level to close the position and waits for the market to reach this price.

Profit Target and Stop Loss: The script allows setting a profit target and stop loss in terms of ticks, which are the smallest measurable increments in price movement for the traded asset.

blah blah whatever

Execution: Trades are executed on every price tick to capture all potential movements.

Contract Size: The default position size is one contract per trade.

Timeframe: Although not explicitly mentioned, this strategy is intended for a one-minute timeframe.

RSI Calculation: The Relative Strength Index (RSI) is calculated over a user-defined period (default is 14 periods).

Standard Deviation: The script calculates the standard deviation of the change in RSI values to determine the threshold for entering trades.

Exhaustion Detection: Before entering a long or short position, the script checks for exhaustion in the RSI’s momentum. This is to avoid entering trades during extreme conditions where a reversal is likely.

Entry Conditions: A long position is entered when the current RSI momentum exceeds the standard deviation threshold and is less than the previous momentum multiplied by an exhaustion factor. A short position is entered under the opposite conditions.

Limit Orders for Exit: Instead of traditional stop loss and take profit orders, the strategy uses limit orders to exit positions. This means the strategy sets a desired price level to close the position and waits for the market to reach this price.

Profit Target and Stop Loss: The script allows setting a profit target and stop loss in terms of ticks, which are the smallest measurable increments in price movement for the traded asset.

blah blah whatever

릴리즈 노트

Initial Capital: The strategy starts with an initial capital of $50,000.Execution: Trades are executed on every price tick to capture all potential movements.

Contract Size: The default position size is one contract per trade.

Timeframe: Although not explicitly mentioned, this strategy is intended for a one-minute timeframe.

RSI Calculation: The Relative Strength Index (RSI) is calculated over a user-defined period (default is 14 periods).

Standard Deviation: The script calculates the standard deviation of the change in RSI values to determine the threshold for entering trades.

Exhaustion Detection: Before entering a long or short position, the script checks for exhaustion in the RSI’s momentum. This is to avoid entering trades during extreme conditions where a reversal is likely.

Entry Conditions: A long position is entered when the current RSI momentum exceeds the standard deviation threshold and is less than the previous momentum multiplied by an exhaustion factor. A short position is entered under the opposite conditions.

Limit Orders for Exit: Instead of traditional stop loss and take profit orders, the strategy uses limit orders to exit positions. This means the strategy sets a desired price level to close the position and waits for the market to reach this price.

Profit Target and Stop Loss: The script allows setting a profit target and stop loss in terms of ticks, which are the smallest measurable increments in price movement for the traded asset.

blah blah whatever

릴리즈 노트

Initial Capital: The strategy starts with an initial capital of $50,000.Execution: Trades are executed on every price tick to capture all potential movements.

Contract Size: The default position size is one contract per trade.

Timeframe: Although not explicitly mentioned, this strategy is intended for a one-minute timeframe.

RSI Calculation: The Relative Strength Index (RSI) is calculated over a user-defined period (default is 14 periods).

Standard Deviation: The script calculates the standard deviation of the change in RSI values to determine the threshold for entering trades.

Exhaustion Detection: Before entering a long or short position, the script checks for exhaustion in the RSI’s momentum. This is to avoid entering trades during extreme conditions where a reversal is likely.

Entry Conditions: A long position is entered when the current RSI momentum exceeds the standard deviation threshold and is less than the previous momentum multiplied by an exhaustion factor. A short position is entered under the opposite conditions.

Limit Orders for Exit: Instead of traditional stop loss and take profit orders, the strategy uses limit orders to exit positions. This means the strategy sets a desired price level to close the position and waits for the market to reach this price.

Profit Target and Stop Loss: The script allows setting a profit target and stop loss in terms of ticks, which are the smallest measurable increments in price movement for the traded asset.

blah blah whatever

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.