OPEN-SOURCE SCRIPT

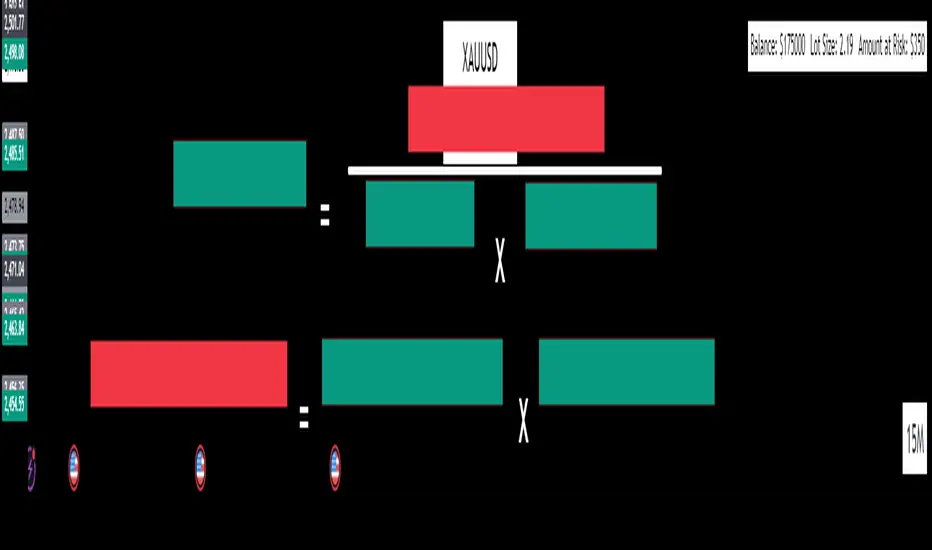

Lot Size Calculator by MenolakRugi

The Lot Size Formula in forex trading is a critical tool that offers several key benefits to traders:

🟢Risk Management: By using the formula, traders can control the amount of capital they risk on each trade. This helps prevent excessive losses by aligning the lot size with a predefined risk tolerance, such as 1% or 2% of the account balance.

🟢Consistent Position Sizing: The formula ensures that position sizes are calculated based on the specific trade setup, including the distance to the stop loss. This consistency helps avoid over-leveraging and reduces the emotional aspect of trading.

🟢Adaptability: The lot size can be adjusted according to different currency pairs and market conditions. This flexibility ensures that traders can apply the formula across various trading instruments and environments.

🟢Improved Profit Potential: By managing risk effectively, traders can protect their capital while maximizing profit opportunities. When losses are controlled, traders are able to stay in the market longer and compound their gains over time.

🟢Precision in Trade Planning: Calculating the lot size allows traders to plan their trades more precisely, aligning their strategies with the amount they are willing to risk. This leads to more disciplined and structured trading, reducing impulsive decisions.

In summary, the lot size formula helps maintain a balanced approach to trading, where both risk and reward are carefully managed to increase the chances of long-term success.

🟢Risk Management: By using the formula, traders can control the amount of capital they risk on each trade. This helps prevent excessive losses by aligning the lot size with a predefined risk tolerance, such as 1% or 2% of the account balance.

🟢Consistent Position Sizing: The formula ensures that position sizes are calculated based on the specific trade setup, including the distance to the stop loss. This consistency helps avoid over-leveraging and reduces the emotional aspect of trading.

🟢Adaptability: The lot size can be adjusted according to different currency pairs and market conditions. This flexibility ensures that traders can apply the formula across various trading instruments and environments.

🟢Improved Profit Potential: By managing risk effectively, traders can protect their capital while maximizing profit opportunities. When losses are controlled, traders are able to stay in the market longer and compound their gains over time.

🟢Precision in Trade Planning: Calculating the lot size allows traders to plan their trades more precisely, aligning their strategies with the amount they are willing to risk. This leads to more disciplined and structured trading, reducing impulsive decisions.

In summary, the lot size formula helps maintain a balanced approach to trading, where both risk and reward are carefully managed to increase the chances of long-term success.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.