OPEN-SOURCE SCRIPT

업데이트됨 Screener: Alpha & Beta

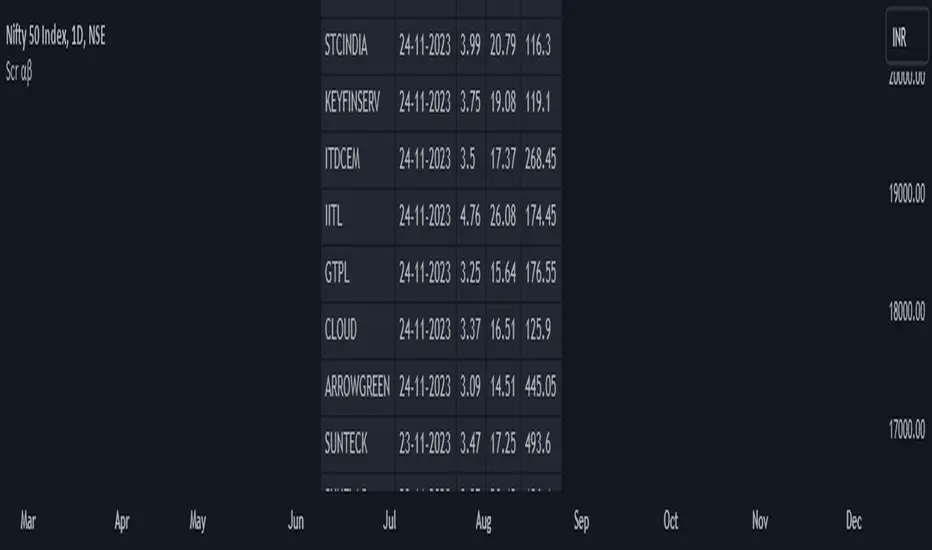

This is a Live Screener for my previous Alpha & Beta indicator, which filters stocks lively based on the given values.

Use 5min timeframe for Live Intraday.

The default stocks in the screener is selected based on high beta value from F&O listed stocks. It may include other stocks also.

User can input stocks of your choice either through the menu or through the Pine editor.

The maximum number of stocks inputs is only 40. The indicator includes only 20 stocks by default.

More number of stocks can be added but it makes the screener slower to load.

Open the indicator in a sperate tab or window to avoided the loading lag.

It is recommended to choose only 10 to 20 stocks based on the weightage from each sectors.

Beta values are dynamic. It changes from day to day based on the trend and sector.

Update the sock list weekly or twice a week or monthly.

Use investing.com screener(preferably) or TradingView screener for shortlisting beta stocks.

Remember that majority of indicators fails in a sideways market, also every indicator is not 100% accurate.

Use 5min timeframe for Live Intraday.

The default stocks in the screener is selected based on high beta value from F&O listed stocks. It may include other stocks also.

User can input stocks of your choice either through the menu or through the Pine editor.

The maximum number of stocks inputs is only 40. The indicator includes only 20 stocks by default.

More number of stocks can be added but it makes the screener slower to load.

Open the indicator in a sperate tab or window to avoided the loading lag.

It is recommended to choose only 10 to 20 stocks based on the weightage from each sectors.

Beta values are dynamic. It changes from day to day based on the trend and sector.

Update the sock list weekly or twice a week or monthly.

Use investing.com screener(preferably) or TradingView screener for shortlisting beta stocks.

Remember that majority of indicators fails in a sideways market, also every indicator is not 100% accurate.

릴리즈 노트

Removed Long or Short titles. It might be misleading in volatile markets.릴리즈 노트

Updated position.릴리즈 노트

Updated on: 26 Nov 2023Enhanced Analysis Features:

- The formula has been updated.

- Evaluate all stocks against the benchmark index using alpha and beta metrics.

- Can screen up to 38 symbols due to TradingView's request limit of 40.

- Organized and readable code for better user understanding.

- Easily analyze additional symbols by replacing indicators in the Paste Symbol box.

- Offers flexibility and customization options for users.

How to Use:

- Step 1 - Choose the desired period in settings.

- Step 2 - Match the chart timeframe with the selected period for accurate results (e.g., 'Medium Term - 52 W (1Y)' corresponds to 'W' for Weekly).

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.