OPEN-SOURCE SCRIPT

OSC_SpecialK Beta_Pine3

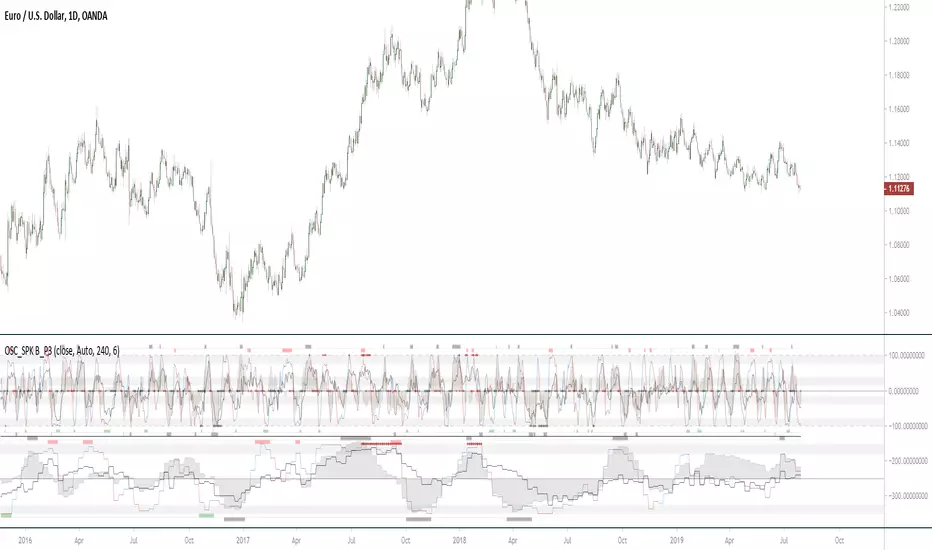

A multiple signals|oscillators indicator based on custom stochrsi, custom BB% , CoG, Standard ChandeMoM,Standard overload RSI.

Work with all symbols. Requiert a correct volume source for SpK_Shadow and Fastsignal. (Some index have bad volume)

Legend :

Black Line : Standard ChandeMoM

Blue/Red Line : 14|9|3 StochRSI with sma called SpK

Black Squares : A fast and reactive signal (often a faster retracement, can be relativly horizontal or continuity trend with acceleration[its strength can be deduced by combining the other signals, notably the SpK_Shadow] ) Really reactive with low interval. (!!Volume dependance!!) called FastSignal.

Red/Green Squares: Need other signal for confirmation. Can be slow to trigger, especially with low interval.(It is important to be in the right trend) Called Signal T1|T2 (!!Volume dependance!!)

Tiny diamond (top/bottom of both section) : Standard RSI saturation

Tiny diamond (middle line of top section) : Center of Gravity signal (standard value I think). Can help to confirm an other signal.

Histogram|area: Work as a difference because it is. Called SpK_Shadow (It's like Peter Pan shadow's ) Can help to see the FastSignal end (when hist arrives near the middle). || In combination with SignalT1/T2 : When shadow is on the middle and you have T1|T2 signals a strong impulsion is possible. (Keep in mind the trend with the LargeTimeFrame[bottom section]) (!!Volume dependance!!)

Bottom Section is a Large TimeFrame of the top section, with a ratio. I use it to see the level of risk on the interval, according to the targets displayed by my overlay indicator. (OVL_Kikoocycle Beta_Pine3 )

By combining signals and oscillators, it is relatively easy to deduce good opportunities or avoid certain pitfalls. (Keep in mind this script was designed to be used with an overlay indicator, particulary my other script called OVL_Kikoocycle Beta_Pine3 (soon published ) )

Sorry if I do not use traders' common vocabulary...And for my dirty english.

Work with all symbols. Requiert a correct volume source for SpK_Shadow and Fastsignal. (Some index have bad volume)

Legend :

Black Line : Standard ChandeMoM

Blue/Red Line : 14|9|3 StochRSI with sma called SpK

Black Squares : A fast and reactive signal (often a faster retracement, can be relativly horizontal or continuity trend with acceleration[its strength can be deduced by combining the other signals, notably the SpK_Shadow] ) Really reactive with low interval. (!!Volume dependance!!) called FastSignal.

Red/Green Squares: Need other signal for confirmation. Can be slow to trigger, especially with low interval.(It is important to be in the right trend) Called Signal T1|T2 (!!Volume dependance!!)

Tiny diamond (top/bottom of both section) : Standard RSI saturation

Tiny diamond (middle line of top section) : Center of Gravity signal (standard value I think). Can help to confirm an other signal.

Histogram|area: Work as a difference because it is. Called SpK_Shadow (It's like Peter Pan shadow's ) Can help to see the FastSignal end (when hist arrives near the middle). || In combination with SignalT1/T2 : When shadow is on the middle and you have T1|T2 signals a strong impulsion is possible. (Keep in mind the trend with the LargeTimeFrame[bottom section]) (!!Volume dependance!!)

Bottom Section is a Large TimeFrame of the top section, with a ratio. I use it to see the level of risk on the interval, according to the targets displayed by my overlay indicator. (OVL_Kikoocycle Beta_Pine3 )

By combining signals and oscillators, it is relatively easy to deduce good opportunities or avoid certain pitfalls. (Keep in mind this script was designed to be used with an overlay indicator, particulary my other script called OVL_Kikoocycle Beta_Pine3 (soon published ) )

Sorry if I do not use traders' common vocabulary...And for my dirty english.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.