OPEN-SOURCE SCRIPT

업데이트됨 Machine Learning Support and Resistance [AlgoAlpha]

🚀 Elevate Your Trading with Machine Learning Dynamic Support and Resistance!

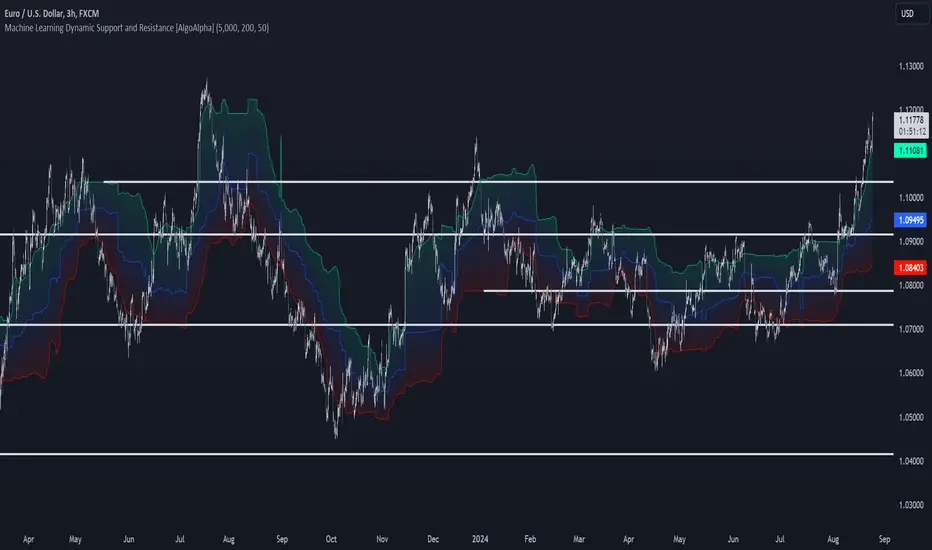

The Machine Learning Dynamic Support and Resistance by AlgoAlpha leverages advanced machine learning techniques to identify dynamic support and resistance levels on your chart. This tool is designed to help traders spot key price levels where the market might reverse or stall, enhancing your trading strategy with precise, data-driven insights.

Key Features:

Quick Guide to Using the Machine Learning Dynamic Support and Resistance Indicator

Maximize your trading with this powerful indicator by following these streamlined steps! 🚀✨

How It Works

This indicator employs a K-means clustering algorithm to dynamically identify key price levels based on the historical price data within a specified lookback window. It starts by initializing three centroids based on the highest, lowest, and an average between the highest and lowest price over the lookback period. The algorithm then iterates through the price data to cluster the prices around these centroids, dynamically adjusting them until they stabilize, representing potential support and resistance levels. These levels are further confirmed based on a separate confirmation length parameter to identify "fixed" levels, which are then drawn as horizontal lines on the chart. The script continuously updates these levels as new data comes in, while also removing older levels to keep the chart clean and relevant, offering traders a clear and adaptive view of market structure.

The Machine Learning Dynamic Support and Resistance by AlgoAlpha leverages advanced machine learning techniques to identify dynamic support and resistance levels on your chart. This tool is designed to help traders spot key price levels where the market might reverse or stall, enhancing your trading strategy with precise, data-driven insights.

Key Features:

- 🎯 Dynamic Levels: Continuously adjusts support and resistance levels based on real-time price data using a K-means clustering algorithm.

- 🧠 Machine Learning: Utilizes clustering methods to optimize the identification of significant price zones.

- ⏳ Configurable Lookback Periods: Customize the training length and confirmation length for better adaptability to different market conditions.

- 🎨 Visual Clarity: Clearly distinguish bullish and bearish zones with customizable color schemes.

- 📉 Trailing and Fixed Levels: Option to display both trailing and fixed support/resistance levels for comprehensive analysis.

- 🚮 Auto-Cleaning: Automatically removes outdated levels after a specified number of bars to keep your chart clean and relevant.

Quick Guide to Using the Machine Learning Dynamic Support and Resistance Indicator

Maximize your trading with this powerful indicator by following these streamlined steps! 🚀✨

- 🛠 Add the Indicator: Add the indicator to favorites by pressing the star icon. Customize settings like clustering training length, confirmation length, and whether to show trailing or fixed levels to fit your trading style.

- 📊 Market Analysis: Monitor the dynamic levels to identify potential reversal points. Use these levels to inform entry and exit points, or to set stop losses.

How It Works

This indicator employs a K-means clustering algorithm to dynamically identify key price levels based on the historical price data within a specified lookback window. It starts by initializing three centroids based on the highest, lowest, and an average between the highest and lowest price over the lookback period. The algorithm then iterates through the price data to cluster the prices around these centroids, dynamically adjusting them until they stabilize, representing potential support and resistance levels. These levels are further confirmed based on a separate confirmation length parameter to identify "fixed" levels, which are then drawn as horizontal lines on the chart. The script continuously updates these levels as new data comes in, while also removing older levels to keep the chart clean and relevant, offering traders a clear and adaptive view of market structure.

릴리즈 노트

Edited the short title릴리즈 노트

Added feature to color fixed levels based on whether price is above or below them오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

🚨Get premium for 50% OFF (ends Jan 31st): algoalpha.io

🛜Get FREE signals: discord.gg/xCmqTVRexz

💡Tutorials: youtube.com/@AlgoAlpha

🛜Get FREE signals: discord.gg/xCmqTVRexz

💡Tutorials: youtube.com/@AlgoAlpha

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

🚨Get premium for 50% OFF (ends Jan 31st): algoalpha.io

🛜Get FREE signals: discord.gg/xCmqTVRexz

💡Tutorials: youtube.com/@AlgoAlpha

🛜Get FREE signals: discord.gg/xCmqTVRexz

💡Tutorials: youtube.com/@AlgoAlpha

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.