OPEN-SOURCE SCRIPT

업데이트됨 Master Correlation Table

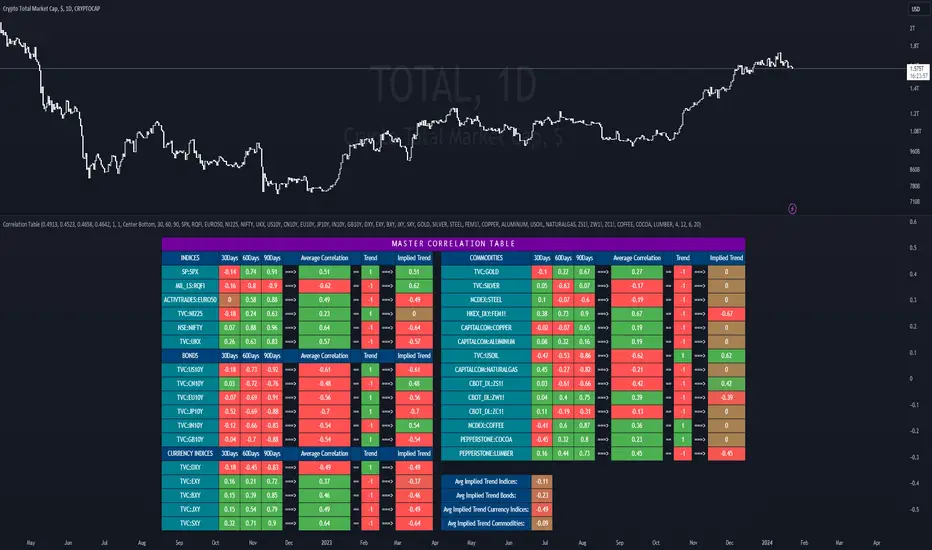

This indicator features macroeconomic correlation from 4 areas: Stock Indices, Bond Yields, Currency Indices and Commodities.

Assets used in this Correlation Table are split into two kinds:

- Large Economies: Stock Indices, Bond Yields and Currency Indices from 3 largest economies in the world (US, China, EU) are always included in the Average Implied Trend calculation.

- Strong/Weak: Assets that don't belong to previous kind and all commodities, these are filtered based on their current correlation strength, if their strength is weaker than the average they are not included in the Average Implied Trend calculation.

Values for correlation strength filter were determined from personal research and are set as default in code, they can be customized or fully removed (set to 0).

This Correlation Table only includes major Commodities and Stock Indices, Bond Yields, Currency Indices from Top 10 countries ranked by GDP that also have impact in the world.

All the tickers used are fully customizable along with the table colors to the user's liking.

Credits to IkkeOmar for the Normalized Kama Oscillator

Credits to Mukuro-Hoshimiya for core codes of this indicator

Assets used in this Correlation Table are split into two kinds:

- Large Economies: Stock Indices, Bond Yields and Currency Indices from 3 largest economies in the world (US, China, EU) are always included in the Average Implied Trend calculation.

- Strong/Weak: Assets that don't belong to previous kind and all commodities, these are filtered based on their current correlation strength, if their strength is weaker than the average they are not included in the Average Implied Trend calculation.

Values for correlation strength filter were determined from personal research and are set as default in code, they can be customized or fully removed (set to 0).

This Correlation Table only includes major Commodities and Stock Indices, Bond Yields, Currency Indices from Top 10 countries ranked by GDP that also have impact in the world.

All the tickers used are fully customizable along with the table colors to the user's liking.

Credits to IkkeOmar for the Normalized Kama Oscillator

Credits to Mukuro-Hoshimiya for core codes of this indicator

릴리즈 노트

Automated the filter process and added option to choose your own filter values.릴리즈 노트

Fixed filter error with commodities오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.