OPEN-SOURCE SCRIPT

Brown's Exponential Smoothing Tool (BEST)

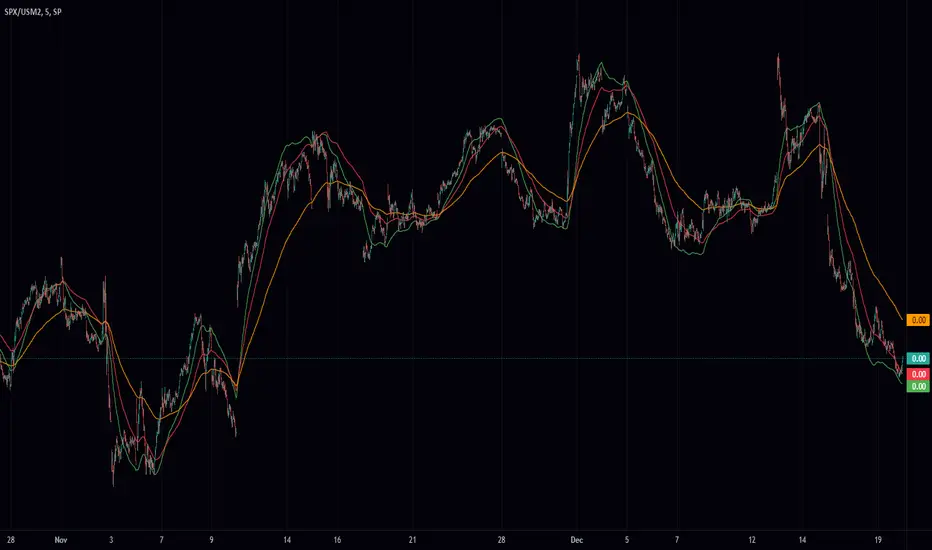

Brown's Exponential Smoothing Tool (BEST) is a script for technical analysis in financial markets. It is designed to smooth out price fluctuations and identify trends in a given time series data.

The script begins by defining the "BEST" indicator, which will be overlaid on top of the chart. The user can then specify the source of the data (e.g. close price) and set the values for the smoothing factor (alpha) and the style of exponential smoothing (BES, DBES, or TBES).

The script then defines three functions for calculating the exponential smoothing: "bes", "tbes", and "dbes". The "bes" function applies a single iteration of exponential smoothing to the input data, using the specified alpha value. The "tbes" function applies three iterations of exponential smoothing, using the triple exponential moving average (TEMA) formula to smooth out the data even further. The "dbes" function applies two iterations of exponential smoothing, using the double exponential moving average (DEMA) formula to smooth out the data.

Finally, the script defines a "ma" function, which returns the exponential smoothing result based on the style selected by the user. The script plots the result of the "ma" function on the chart, using the color orange.

In summary, Brown's Exponential Smoothing Tool is a script for smoothing out financial time series data and identifying trends. It allows the user to choose from three different styles of exponential smoothing, each of which has its own strengths and weaknesses. By applying exponential smoothing to financial data, traders and analysts can better understand the underlying trends and make more informed decisions.

The script begins by defining the "BEST" indicator, which will be overlaid on top of the chart. The user can then specify the source of the data (e.g. close price) and set the values for the smoothing factor (alpha) and the style of exponential smoothing (BES, DBES, or TBES).

The script then defines three functions for calculating the exponential smoothing: "bes", "tbes", and "dbes". The "bes" function applies a single iteration of exponential smoothing to the input data, using the specified alpha value. The "tbes" function applies three iterations of exponential smoothing, using the triple exponential moving average (TEMA) formula to smooth out the data even further. The "dbes" function applies two iterations of exponential smoothing, using the double exponential moving average (DEMA) formula to smooth out the data.

Finally, the script defines a "ma" function, which returns the exponential smoothing result based on the style selected by the user. The script plots the result of the "ma" function on the chart, using the color orange.

In summary, Brown's Exponential Smoothing Tool is a script for smoothing out financial time series data and identifying trends. It allows the user to choose from three different styles of exponential smoothing, each of which has its own strengths and weaknesses. By applying exponential smoothing to financial data, traders and analysts can better understand the underlying trends and make more informed decisions.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.