OPEN-SOURCE SCRIPT

DCI

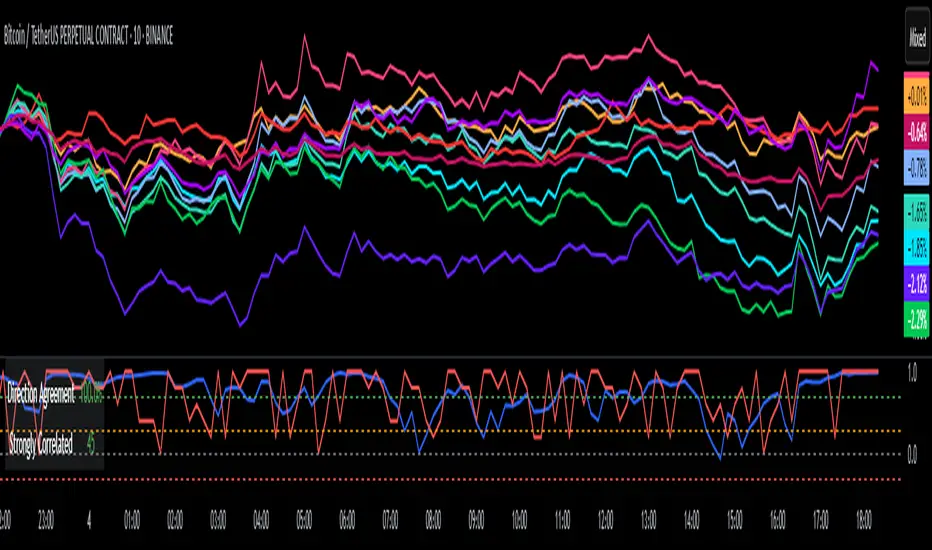

### 📌 **DCI – Direction Correlation Index**

#### 🔹 **What It Is**

The **Direction Correlation Index (DCI)** is a tool for measuring how closely a group of up to 10 symbols move together in both *trend correlation* and *short-term direction*. It helps identify whether a group of assets is acting in unison or moving independently.

---

#### ⚙️ **How It Works**

DCI outputs three key metrics:

1. **Average Correlation**

* Measures the average of all pairwise correlations between the selected symbols.

* Prices are first standardized using a z-score (based on simple moving average and standard deviation over a user-defined lookback period).

* Correlation is calculated using Pearson’s method for all 45 symbol pairs.

* Result ranges from:

* `+1.00` = strong positive correlation

* `0.00` = no correlation

* `-1.00` = strong inverse correlation

2. **Direction Agreement %**

* Checks whether each symbol is moving up or down compared to its previous bar.

* Calculates the percentage of symbols moving in the same direction.

* For example: if 7 of 10 symbols are moving up and 3 are moving down, the direction agreement is 70%.

3. **Strong Correlation Count**

* Counts how many of the 45 symbol pairs have an absolute correlation above `0.7`.

* Helps highlight how many pairs are currently highly correlated.

---

#### 📈 **How to Use It**

1. **Select Symbols**

* In the **Settings**, you can input up to 10 custom symbols. These can be stocks, indices, forex pairs, crypto, or any tradable asset.

2. **Adjust the Lookback Period**

* Defines how many bars back are used to calculate z-scores and correlations.

* Default is `12`. Use shorter periods for faster response; longer periods for smoother, slower data.

3. **Interpret the Table (Plotted on Chart)**

* **Avg Corr**: Tells you how much the group is co-moving. High correlation often reflects unified market behavior.

* **Dir Agr %**: Shows directional sync. High values mean most instruments are trending the same way in the current bar.

* **> 0.7**: The number of pairs currently strongly correlated (|corr| > 0.7).

---

#### 🧠 **Practical Usage Tips**

* Use DCI to monitor **sector alignment**, **portfolio behavior**, or **market group momentum**.

* Confirm trend strength by checking if high correlation aligns with a strong direction agreement.

* Low correlation + mixed direction can signal **choppy or indecisive markets**.

* High correlation + strong direction = **trend confirmation** across your selected instruments.

- Made with DeepSeek

#### 🔹 **What It Is**

The **Direction Correlation Index (DCI)** is a tool for measuring how closely a group of up to 10 symbols move together in both *trend correlation* and *short-term direction*. It helps identify whether a group of assets is acting in unison or moving independently.

---

#### ⚙️ **How It Works**

DCI outputs three key metrics:

1. **Average Correlation**

* Measures the average of all pairwise correlations between the selected symbols.

* Prices are first standardized using a z-score (based on simple moving average and standard deviation over a user-defined lookback period).

* Correlation is calculated using Pearson’s method for all 45 symbol pairs.

* Result ranges from:

* `+1.00` = strong positive correlation

* `0.00` = no correlation

* `-1.00` = strong inverse correlation

2. **Direction Agreement %**

* Checks whether each symbol is moving up or down compared to its previous bar.

* Calculates the percentage of symbols moving in the same direction.

* For example: if 7 of 10 symbols are moving up and 3 are moving down, the direction agreement is 70%.

3. **Strong Correlation Count**

* Counts how many of the 45 symbol pairs have an absolute correlation above `0.7`.

* Helps highlight how many pairs are currently highly correlated.

---

#### 📈 **How to Use It**

1. **Select Symbols**

* In the **Settings**, you can input up to 10 custom symbols. These can be stocks, indices, forex pairs, crypto, or any tradable asset.

2. **Adjust the Lookback Period**

* Defines how many bars back are used to calculate z-scores and correlations.

* Default is `12`. Use shorter periods for faster response; longer periods for smoother, slower data.

3. **Interpret the Table (Plotted on Chart)**

* **Avg Corr**: Tells you how much the group is co-moving. High correlation often reflects unified market behavior.

* **Dir Agr %**: Shows directional sync. High values mean most instruments are trending the same way in the current bar.

* **> 0.7**: The number of pairs currently strongly correlated (|corr| > 0.7).

---

#### 🧠 **Practical Usage Tips**

* Use DCI to monitor **sector alignment**, **portfolio behavior**, or **market group momentum**.

* Confirm trend strength by checking if high correlation aligns with a strong direction agreement.

* Low correlation + mixed direction can signal **choppy or indecisive markets**.

* High correlation + strong direction = **trend confirmation** across your selected instruments.

- Made with DeepSeek

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.