OPEN-SOURCE SCRIPT

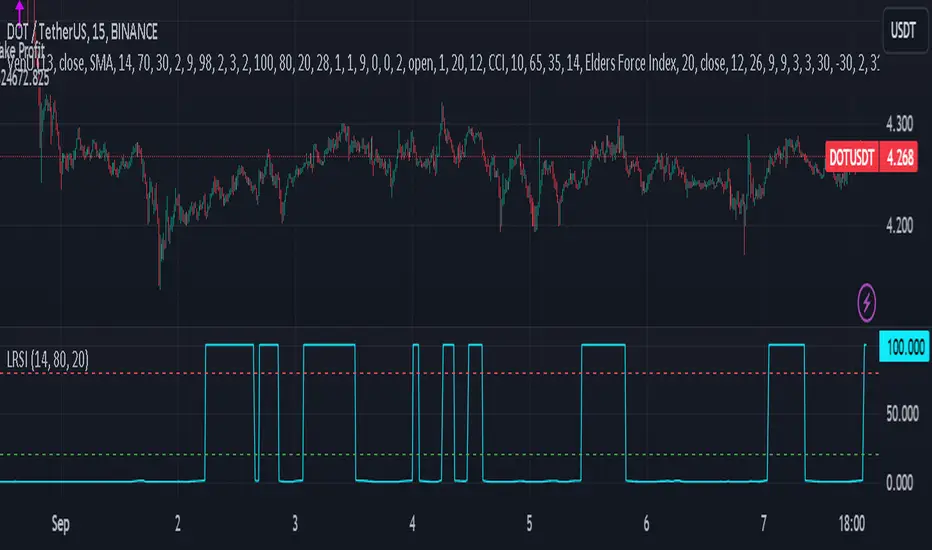

Laguerre RSI - non repainting

It seems that the traditional Laguerre* functions repaint due to the gamma parameter.

That goes even for the editorial pick here.

But one could use calculation period instead of "gamma" parameter. This gives us a non-repainting Laguerre RSI fit for scalping trends.

At first glance, I haven't seen anyone do this with a pine script, but I could be wrong because it's not a big deal.

So here is a variation of Laguerre RSI, without repainting. It's a little bit more insensitive, but this is not of great importance, since only the extreme values are used for confirmation.

( * Laguerre RSI is based on John EHLERS' Laguerre Filter to avoid the noise of RSI.)

And if you implement this indicator into a strategy (like I do) I can give you a trick.

Traditionaly the condition is at follows:

LaRSI = cd == 0 ? 100 : cu / (cu + cd)

(this is the final part of the indicator before the plotting)

LongLaguerre= LaRSI<dnb

ShortLaguerre= LaRSI>upb

It's fine for the short (ot exit long), but for the long is better to make a swich between the CD and CU parameters, as follows:

LaRSI1 = cd == 0 ? 100 : cu / (cu + cd)

LaRSI2 = cu == 0 ? 100 : cu / (cu + cd)

LongLaguerre= LaRSI2<dnb

ShortLaguerre= LaRSI1>upb

That goes even for the editorial pick here.

But one could use calculation period instead of "gamma" parameter. This gives us a non-repainting Laguerre RSI fit for scalping trends.

At first glance, I haven't seen anyone do this with a pine script, but I could be wrong because it's not a big deal.

So here is a variation of Laguerre RSI, without repainting. It's a little bit more insensitive, but this is not of great importance, since only the extreme values are used for confirmation.

( * Laguerre RSI is based on John EHLERS' Laguerre Filter to avoid the noise of RSI.)

And if you implement this indicator into a strategy (like I do) I can give you a trick.

Traditionaly the condition is at follows:

LaRSI = cd == 0 ? 100 : cu / (cu + cd)

(this is the final part of the indicator before the plotting)

LongLaguerre= LaRSI<dnb

ShortLaguerre= LaRSI>upb

It's fine for the short (ot exit long), but for the long is better to make a swich between the CD and CU parameters, as follows:

LaRSI1 = cd == 0 ? 100 : cu / (cu + cd)

LaRSI2 = cu == 0 ? 100 : cu / (cu + cd)

LongLaguerre= LaRSI2<dnb

ShortLaguerre= LaRSI1>upb

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.