Is Ferrari On the Cusp of a Breakout?

Among those affected is Italian sports car manufacturer Ferrari Inc (ticker: RACE). However, as the earnings release for the first half (H1) of its Fiscal Year (FY) 2025 made on the 31st of July this year, the “dancing horse” of Maranello is clearly not like the others. Trend Analysis

If trends established as of H1 of FY 2025 continue, the company will close out the fiscal year with an 8% growth in revenue over the previous FY.

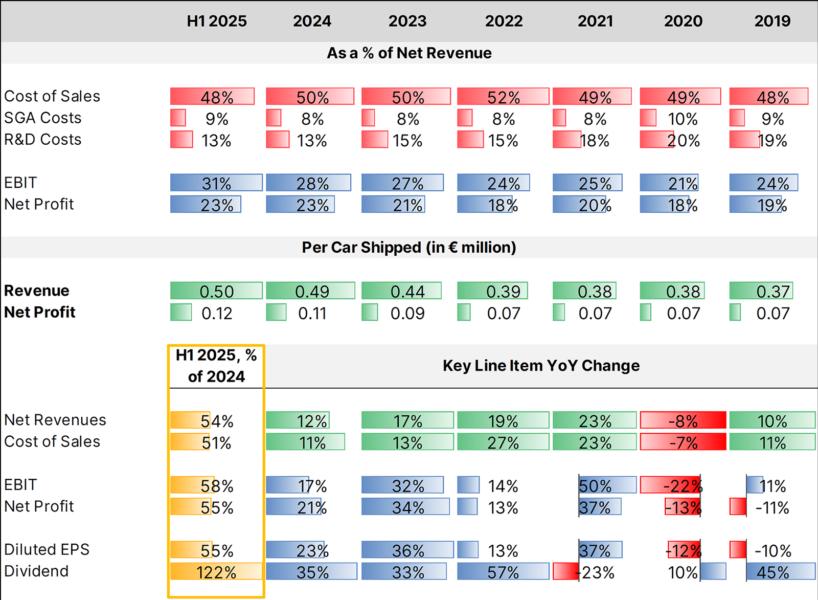

Source: Company Information; Leverage Shares analysis

While not quite as dramatic as in previous FYs – which have witnessed significant revenue growth Year-on-Year (YoY) after an 8% drop in pandemic-era FY 2020 – this comes with a key improvement in two metrics: the revenue accrued per car shipped has seen a 31% increase from around €380,000 in FY 2021 to a little over €500,000 as of H1 2025. Net Profit as calculated on a “per car shipped” basis has been even more dramatic in the same period: a 72% improvement to nearly € 120,000 as of H1 2025.

In late February, Ferrari announced a dividend distribution of €2.896, which is 22% higher than in the previous FY. In recent history, this is the lowest it has been since the drop in FY 2021 in response to the revenue downturn in FY 2020. While this stands out as an outlier, it might have something to do with the company’s plans for the future. Ferrari CEO Benedetto Vigna stated that the company has received excellent initial feedback on the newly launched Ferrari Amalfi, which he called “a coupé that redefines the concept of the contemporary grand tourer”. He also stated that demand for the 296 Speciale family remains overwhelming.

The company is also seemingly well-positioned in the new energy vehicle (NEV) space. In the second quarter (Q2) of FY 2025, products delivered included six internal combustion engine (ICE) models and five hybrid engine models, represented 55% and 45% of total shipments respectively.

Sales from cars and parts constituted 85% of total revenues in H1 2025. The balance is derived from their racing teams, the company-owned Mugello racetrack, the renting of their engines to other F1 teams, royalties, merchandise, financial services (leases, etc.) and so forth. Do U.S. Tariffs Matter Much?

Considering the fact that U.S. tariffs only impact goods shipped to the U.S., the U.S. market share would be a germane point of consideration. In its reported regions, the U.S. is part of the “America”, which includes both continents. Trends don’t show the U.S. in particular being an overwhelming market for the company.

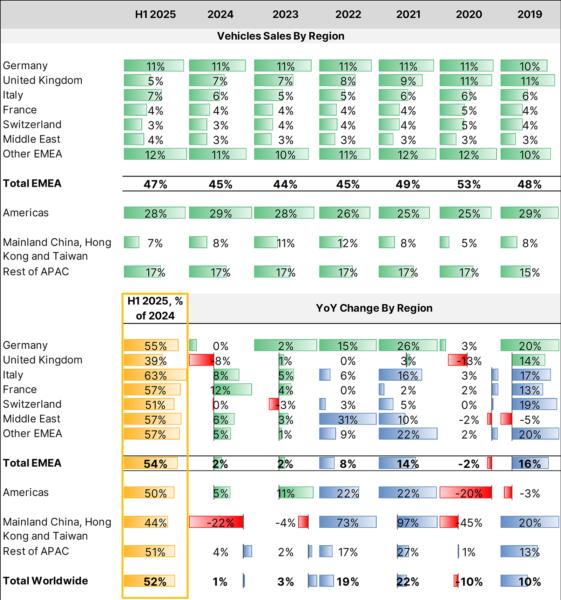

Source: Company Information; Leverage Shares analysis

As of H1 2025, the “Americas” constitute 28% of total volumes shipped, with the U.S. alone constituting 24% of total volume. While the U.S. is up from the 21% share in FY 2021, it is down from the 25% in the previous FY. Increased sales in other sub-regions within the “Americas” has been propping up the overall share to a miniscule decrease of 1% from the previous FY for this region.

Another region of interest that has been of interest in recent times has been “Mainland China, Hong Kong and Taiwan”, wherein the mainland alone registered a massive 89% YoY growth in FY 2022. Between the mainland and the other sub-regions, there has always been a 2% difference: while the mainland alone constituted 10% of volumes shipped in FY 2022, the region accounted for 12% in total. Since then, growth in the mainland has faltered: the next two FYs registered negative growth, with FY 2024 showing a YoY drop of 33%. Even in H1 2025, the “2% rule” has held.

What’s driving global sales are Europe and the Middle East (or the “EMEA” region) and the rest of Asia-Pacific (“Rest of APAC” region) which comprises of Japan, Australia, Singapore, Indonesia, South Korea, Thailand, India and Malaysia. Outside of the United Kingdom – which has been declining in shipment share since 2021 – nearly every other sub-region shows explosive growth. Providing resilient support has been “Rest of APAC”, which is trending to an increase in volume this year relative to the previous FY. Overall net shipments for the current FY are currently trending to be 4% higher over the previous FY – growth higher than that seen in the past two FYs. Something to Consider

In Ferrari, there are some parallels to and distinctions between Apple: cars are produced all over the world and are available at various price points but few marques have the “brand equity” that Ferrari has (much like Apple does in smartphones). It isn’t cheap to maintain any high-performance vehicle – and Ferrari doesn’t buck this trend – but the owning of a Ferrari isn’t perceived quite the same way as owning a vehicle from any other marque. Unlike Apple, however, the brand's “performance” expectations were derived through consistent, visible and strong performance relative to competing brands over the course of decades - thus creating an “image” that is hard to chip away at in the mindset of those that constitute the buyer segments for the company. Therefore, if it were to be more expensive to own a Ferrari, it is entirely possible that owning it makes it that much more valuable. Tariff or no tariff, the company’s products are bound to sell. The stock’s recent performance might even signal to some that it is an interesting time to buy in.