Procter & Gamble: Valuation in a High-Yield Environment

Procter & Gamble continues to be viewed as a stable, reliable stock with global brand strength and consistent earnings. However, its current valuation and yield must now be examined in the context of rising interest rates. With Treasury yields near five percent and corporate bonds offering similar or higher returns than PG's equity dividend, the traditional rationale for owning the stock is being questioned. Investors must evaluate whether the equity premium still makes sense, or if fixed income instruments now offer a better risk-adjusted return.

Financial Performance Overview

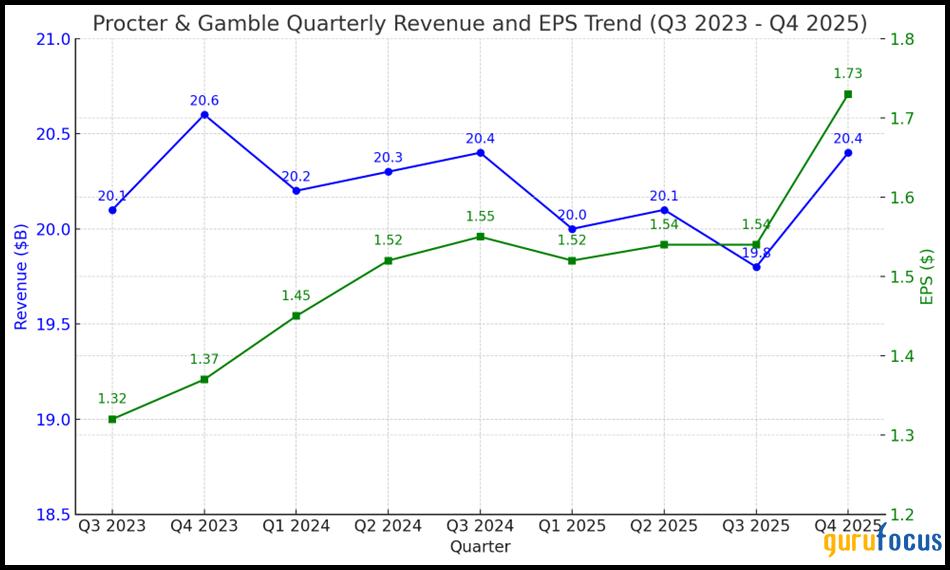

P&G reported its fourth quarter and full fiscal year 2025 earnings on July 29. For the quarter, the company delivered net sales of 20.4 billion dollars, representing a two percent year-over-year increase. Organic sales growth also came in at two percent, supported largely by pricing rather than volume. Gross margin expanded to 51.2 percent, while operating margin held at 23 percent. Core earnings per share for the quarter were 1.73 dollars, and for the full year, they totaled 6.70 dollars. This result landed near the midpoint of previously issued guidance.

Cash generation remains a strong point. Operating cash flow for the year reached 16.8 billion dollars, with free cash flow productivity at 94 percent. The company returned 16 billion dollars to shareholders through dividends and share repurchases. Looking ahead, management expects two to four percent organic sales growth and core earnings per share in the range of 6.80 to 7.00 dollars for fiscal 2026. These figures point to a continuation of modest, stable performance.

Ownership Structure and Insider Activity

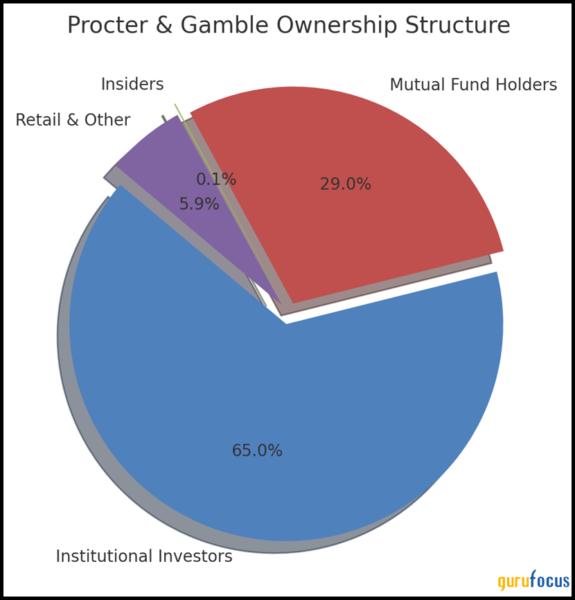

When you look behind P&G's solid base, you don't find a visionary founder or insider cabal, you find the titans of Wall Street. Around 65% of PG shares are held by institutional investors, including Vanguard (9%), BlackRock (7%), and State Street (4%).

These firms aren't looking for speculative plays. They want predictability, steady cash flows, and defensive portfolio anchors.

In the meantime, insider ownership is almost zero (less then 0.1 percent), and recent purchases consist of basic sales associated with compensation rather than strategic purchases. This is to say that, the stock is priced according to insiders as well. The bottom line: PG is not an investment that allows you to make big profits, but rather a decent anchor to anyone who desires predictability and not a surprise ride.

Relative Valuation Versus Peers

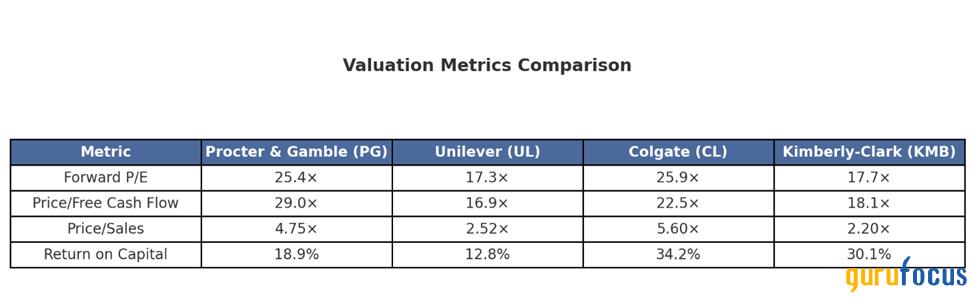

When comparing valuation metrics across peer companies in the consumer staples sector, Procter & Gamble stands out for its premium pricing. The stock currently trades at 25.4 times forward earnings, compared to 17.3 times for Unilever, 25.9 times for Colgate-Palmolive, and 17.7 times for Kimberly-Clark. On a price-to-free-cash-flow basis, PG trades at 29.0 times, compared to 16.9 times for Unilever and 18.1 times for Kimberly-Clark. Price-to-sales is also elevated at 4.75, compared to 2.52 for Unilever and 2.20 for Kimberly-Clark.

PG's return on capital stands at 18.9 percent, while Colgate and Kimberly-Clark both post higher returns above 30 percent. Much of the valuation reflects brand power and defensive appeal rather than superior operating performance

Income Yield Compared to Fixed Income Alternatives

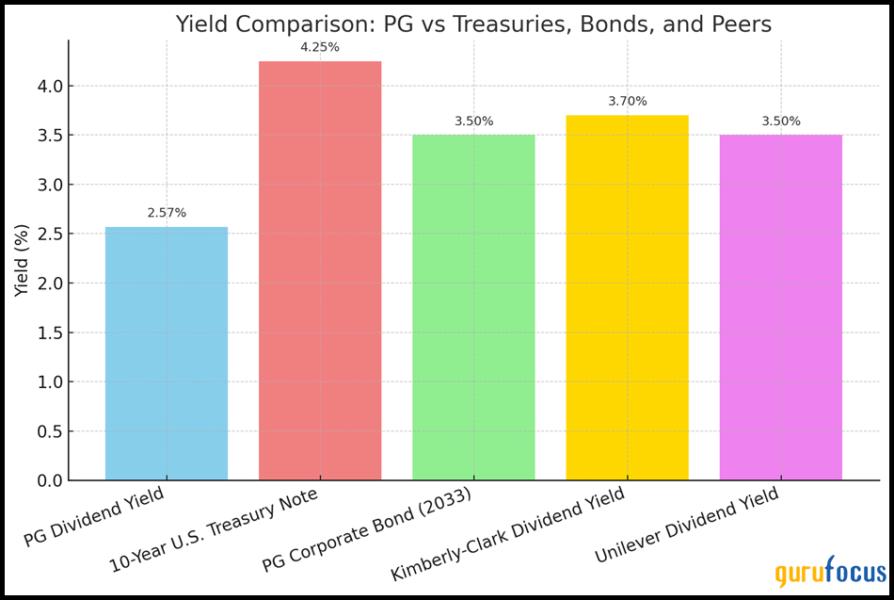

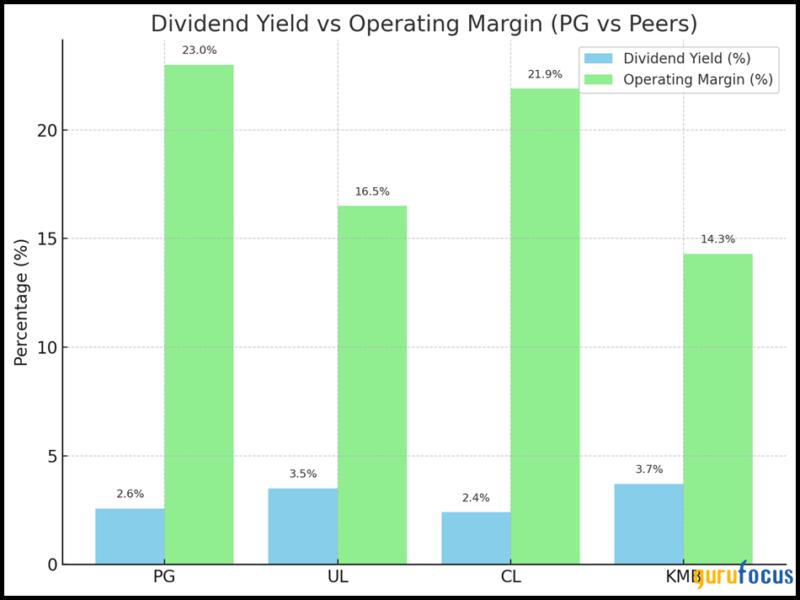

The dividend yield on PG shares is currently 2.57 percent. This is lower than the yield on a 10-year Treasury, which hovers around 4.25 percent. Even Procter & Gamble's own corporate bonds maturing in 2033 offer yields near 3.5 percent. Meanwhile, peers such as Kimberly-Clark and Unilever provide dividend yields in the range of 3.5 to 3.7 percent.

This comparison forces investors to ask a simple question. This raises a tough question: why hold PG shares with their lower yield when Treasuries and corporate bonds offer equal or better income with less risk? The answer likely lies in investor preference for total return potential, but that case weakens when growth remains modest and valuation is stretched.

Brand Equity and Competitive Position

Procter & Gamble continues to own some of the world's most recognizable brands across cleaning, hygiene, and baby care. Names such as Tide, Pampers, Gillette, and Dawn maintain strong consumer loyalty. This brand strength has enabled the company to raise prices while maintaining margins. However, there are signs that consumer pushback is beginning, particularly in emerging markets and among younger demographics.

The rise of private label products and sustainability-driven competitors poses a slow but steady threat to PG's dominance. The company has responded with digital expansion and investment in eco-friendly packaging, but defending its moat is requiring more capital and strategic adaptation than in the past.

Capital Allocation and Growth Outlook

Procter & Gamble has remained consistent in its capital allocation strategy. A significant portion of free cash flow is returned to shareholders, and acquisitions have been minimal. Management's focus is on organic growth, operational efficiency, and margin expansion. While this approach supports financial stability, it offers limited upside surprise potential.

The company's growth outlook remains constrained. Mid-single-digit earnings growth and low-single-digit revenue growth are expected over the next fiscal year. These projections fall short of justifying the current equity premium unless investors are willing to pay a high price purely for predictability.

Risk Factors and Valuation Sensitivity

Several key risks warrant attention. First, margin pressures may increase as input costs rise and pricing power weakens. Second, currency fluctuations could negatively impact reported earnings, given PG's global footprint. Third, volume declines in response to pricing could become more pronounced, particularly if economic conditions deteriorate or inflation fatigue persists among consumers.

Perhaps the largest risk, however, is valuation compression. If interest rates remain elevated, investors may continue to migrate toward fixed income options. This could place downward pressure on high-multiple, low-yield equities like Procter & Gamble. The stock is priced for consistency, but not for disruption or underperformance.

Conclusion

Procter & Gamble remains a high-quality company with world-class brands, dependable cash flow, and disciplined management. Its ability to maintain profitability through economic cycles is well established. However, in today's market, that level of stability is no longer scarce. Investors can now access similar or better yields from government bonds, PG's own corporate debt, or other consumer staples stocks trading at lower multiples and higher yields.

While PG may continue to perform well on a fundamental basis, its equity valuation appears rich relative to both peers and fixed income alternatives. Investors seeking income and capital preservation may find better value elsewhere. Procter & Gamble still delivers what it always has, consistency and brand strength, but at current prices, that consistency comes at a premium many may no longer be willing to pay.