Description:

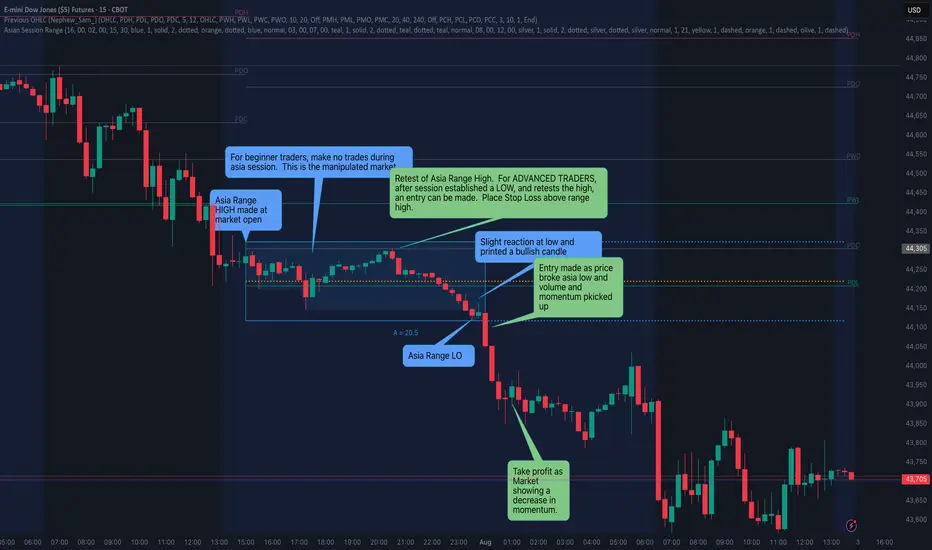

This chart illustrates a textbook Asia Session Range breakout, highlighting both the manipulative trap and the ideal entry based on the SquawkTradeFX strategy.

🔹 Asia Session Range (Grey Box):

This tight consolidation forms overnight during the Asia session.

Price oscillates within a narrow high/low range, creating the trap zone.

This is the “wick zone” of the eventual daily candle.

🔹 The Trap — Liquidity Sweep:

Notice how price first fakes a breakout to the upside, breaking above the Asia High.

This is a liquidity grab, targeting early breakout buyers and triggering their stop-losses.

🔹 The Confirmation & Entry:

After the upside trap, price quickly reverses, sweeping back down.

Momentum increases and volume picks up as price breaks below the Asia Low.

This break signals a true shift in directional intent and offers a high-probability entry as the daily body forms.

🟢 Entry Zone:

Entry is taken on the bearish breakout of the Asia Low after the sweep.

Ideally confirmed with strong bearish candle structure and volume from the London or NY session.

📌 Why This Matters:

This setup exemplifies the SquawkTradeFX principle:

“Let the traps spring first — then strike with confirmation.”

This chart illustrates a textbook Asia Session Range breakout, highlighting both the manipulative trap and the ideal entry based on the SquawkTradeFX strategy.

🔹 Asia Session Range (Grey Box):

This tight consolidation forms overnight during the Asia session.

Price oscillates within a narrow high/low range, creating the trap zone.

This is the “wick zone” of the eventual daily candle.

🔹 The Trap — Liquidity Sweep:

Notice how price first fakes a breakout to the upside, breaking above the Asia High.

This is a liquidity grab, targeting early breakout buyers and triggering their stop-losses.

🔹 The Confirmation & Entry:

After the upside trap, price quickly reverses, sweeping back down.

Momentum increases and volume picks up as price breaks below the Asia Low.

This break signals a true shift in directional intent and offers a high-probability entry as the daily body forms.

🟢 Entry Zone:

Entry is taken on the bearish breakout of the Asia Low after the sweep.

Ideally confirmed with strong bearish candle structure and volume from the London or NY session.

📌 Why This Matters:

This setup exemplifies the SquawkTradeFX principle:

“Let the traps spring first — then strike with confirmation.”

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.