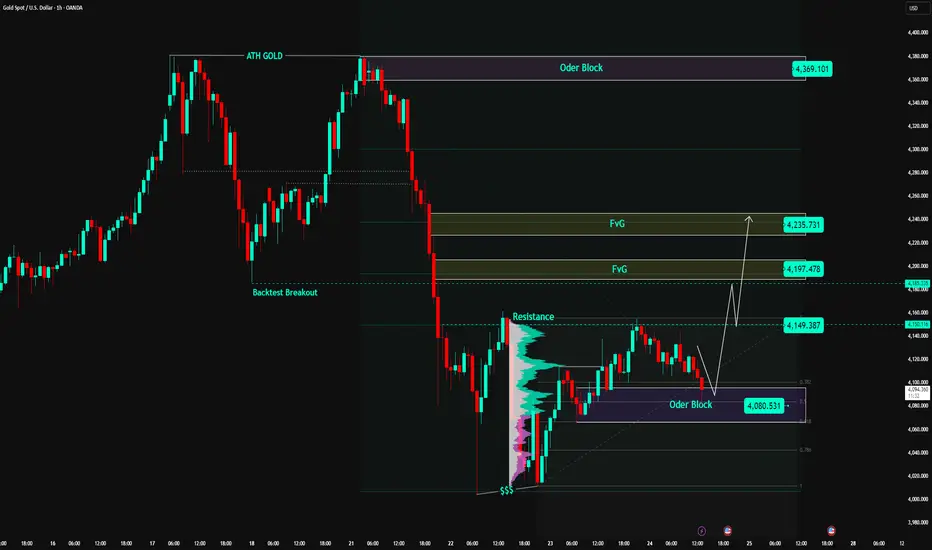

🔍 Market Context

After a sharp decline from the ATH GOLD 4,371 USD peak, gold has completed a liquidity sweep around the 4,010 USD bottom and formed a stable accumulation zone above the Order Block 4,080 USD.

The buyers are gradually regaining control as the price holds firm at the OB and shows signs of short-term supply absorption.

The Resistance 4,149 USD zone is currently a temporary barrier; if successfully breached – gold could trigger a recovery wave towards the Fair Value Gap (FVG) zones at 4,197 and 4,235 USD.

The current price structure leans towards a bullish retracement structure – prioritising buy orders when the price reacts from the active demand zone.

💎 Key Technical Structure

Order Block (OB): 4,080 – 4,085 USD → crucial support zone, confluence with Fibo 0.786, serving as an accumulation base.

Resistance (Breakout Level): 4,149 USD → confirmation zone for upward direction, requires decisive breakout.

FVG1: 4,197 – 4,210 USD → first target, short-term supply test zone.

FVG2: 4,225 – 4,235 USD → confluence resistance zone, potential profit-taking for recovery wave.

ATH GOLD: 4,371 USD → long-term resistance, expanded target if the market maintains strong buying flow.

Overall Structure:

→ Short-term: bullish recovery.

→ Medium-term: re-accumulation after a deep correction phase.

📈 Trading Scenarios

1️⃣ BUY Setup #1 – Retest Order Block 4,080 USD

Entry: 4,080 – 4,085

SL: 4,060

TP1: 4,149

TP2: 4,197

TP3: 4,235

✅ Condition:

Wait for the price to retrace to the OB zone and show clear bullish reversal signals (rejection or bullish engulfing).

➡️ This is a classic “Buy the Dip” setup – aligning with the recovery structure, with high probability due to OB + strong Fibonacci confluence.

2️⃣ BUY Setup #2 – Break & Retest zone 4,149 USD

Entry: 4,149 – 4,155

SL: 4,130

TP1: 4,197

TP2: 4,235

✅ Condition:

Price breaks through the 4,149 resistance zone with good volume and lightly retests, without closing candles below 4,130.

➡️ Trend-following setup, aligning with the flow when the market confirms a short-term resistance break.

3️⃣ SELL Scalp – Reaction at FVG 4,235 USD (short-term)

Entry: 4,230 – 4,235

SL: 4,245

TP: 4,197 → 4,150

✅ Condition:

If gold reacts weakly and there is no follow-up buy at the FVG2 zone → a short-term technical sell can be considered on pullback.

➡️ Short-term sell – only execute if there is no confirmation of continued upward movement.

⚠️ Risk Management

Prioritise BUY according to the main structure (retracement bullish).

Do not FOMO buy within the zone (4,110 – 4,130).

If H1 closes candles below 4,060 → invalidates the bullish scenario, wait for structure reconstruction.

Maintain moderate order size when trading around the FVG zone to avoid noise.

💬 Conclusion

Gold is in the process of re-accumulation and preparing for a technical recovery phase.

As long as the price holds the Order Block 4,080 USD zone, the recovery structure remains valid, and the feasible target is 4,197 → 4,235 USD.

If it breaks through 4,235 USD, the market could extend the rally towards the 4,300 – 4,370 USD (ATH GOLD) zone.

👉 Reasonable Strategy:

Buy 4,080 → TP 4,197 / 4,235.

Buy more when 4,149 break confirms upward direction.

Sell short reaction at 4,235 if there is no signal of continued break.

🔥 “Patience at the base — profits come to those who wait for the OB reaction.”

⏰ Timeframe: 1H

📅 Update: 24/10/2025

✍️ Analysis by: Captain Vincent

After a sharp decline from the ATH GOLD 4,371 USD peak, gold has completed a liquidity sweep around the 4,010 USD bottom and formed a stable accumulation zone above the Order Block 4,080 USD.

The buyers are gradually regaining control as the price holds firm at the OB and shows signs of short-term supply absorption.

The Resistance 4,149 USD zone is currently a temporary barrier; if successfully breached – gold could trigger a recovery wave towards the Fair Value Gap (FVG) zones at 4,197 and 4,235 USD.

The current price structure leans towards a bullish retracement structure – prioritising buy orders when the price reacts from the active demand zone.

💎 Key Technical Structure

Order Block (OB): 4,080 – 4,085 USD → crucial support zone, confluence with Fibo 0.786, serving as an accumulation base.

Resistance (Breakout Level): 4,149 USD → confirmation zone for upward direction, requires decisive breakout.

FVG1: 4,197 – 4,210 USD → first target, short-term supply test zone.

FVG2: 4,225 – 4,235 USD → confluence resistance zone, potential profit-taking for recovery wave.

ATH GOLD: 4,371 USD → long-term resistance, expanded target if the market maintains strong buying flow.

Overall Structure:

→ Short-term: bullish recovery.

→ Medium-term: re-accumulation after a deep correction phase.

📈 Trading Scenarios

1️⃣ BUY Setup #1 – Retest Order Block 4,080 USD

Entry: 4,080 – 4,085

SL: 4,060

TP1: 4,149

TP2: 4,197

TP3: 4,235

✅ Condition:

Wait for the price to retrace to the OB zone and show clear bullish reversal signals (rejection or bullish engulfing).

➡️ This is a classic “Buy the Dip” setup – aligning with the recovery structure, with high probability due to OB + strong Fibonacci confluence.

2️⃣ BUY Setup #2 – Break & Retest zone 4,149 USD

Entry: 4,149 – 4,155

SL: 4,130

TP1: 4,197

TP2: 4,235

✅ Condition:

Price breaks through the 4,149 resistance zone with good volume and lightly retests, without closing candles below 4,130.

➡️ Trend-following setup, aligning with the flow when the market confirms a short-term resistance break.

3️⃣ SELL Scalp – Reaction at FVG 4,235 USD (short-term)

Entry: 4,230 – 4,235

SL: 4,245

TP: 4,197 → 4,150

✅ Condition:

If gold reacts weakly and there is no follow-up buy at the FVG2 zone → a short-term technical sell can be considered on pullback.

➡️ Short-term sell – only execute if there is no confirmation of continued upward movement.

⚠️ Risk Management

Prioritise BUY according to the main structure (retracement bullish).

Do not FOMO buy within the zone (4,110 – 4,130).

If H1 closes candles below 4,060 → invalidates the bullish scenario, wait for structure reconstruction.

Maintain moderate order size when trading around the FVG zone to avoid noise.

💬 Conclusion

Gold is in the process of re-accumulation and preparing for a technical recovery phase.

As long as the price holds the Order Block 4,080 USD zone, the recovery structure remains valid, and the feasible target is 4,197 → 4,235 USD.

If it breaks through 4,235 USD, the market could extend the rally towards the 4,300 – 4,370 USD (ATH GOLD) zone.

👉 Reasonable Strategy:

Buy 4,080 → TP 4,197 / 4,235.

Buy more when 4,149 break confirms upward direction.

Sell short reaction at 4,235 if there is no signal of continued break.

🔥 “Patience at the base — profits come to those who wait for the OB reaction.”

⏰ Timeframe: 1H

📅 Update: 24/10/2025

✍️ Analysis by: Captain Vincent

Join Real - Time Trade Post: t.me/+vPyQJ6Ohb-RkMjNl

🔥 3 - 4 DAILY TRADE

🔥 15 - 20 SCALPING SIGNALS

🔥 Real - Time Proceed Orders

🔥 3 - 4 DAILY TRADE

🔥 15 - 20 SCALPING SIGNALS

🔥 Real - Time Proceed Orders

관련 발행물

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.

Join Real - Time Trade Post: t.me/+vPyQJ6Ohb-RkMjNl

🔥 3 - 4 DAILY TRADE

🔥 15 - 20 SCALPING SIGNALS

🔥 Real - Time Proceed Orders

🔥 3 - 4 DAILY TRADE

🔥 15 - 20 SCALPING SIGNALS

🔥 Real - Time Proceed Orders

관련 발행물

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.