Wave Analysis — Bullish Alternative Scenario📈 (Long-Term)

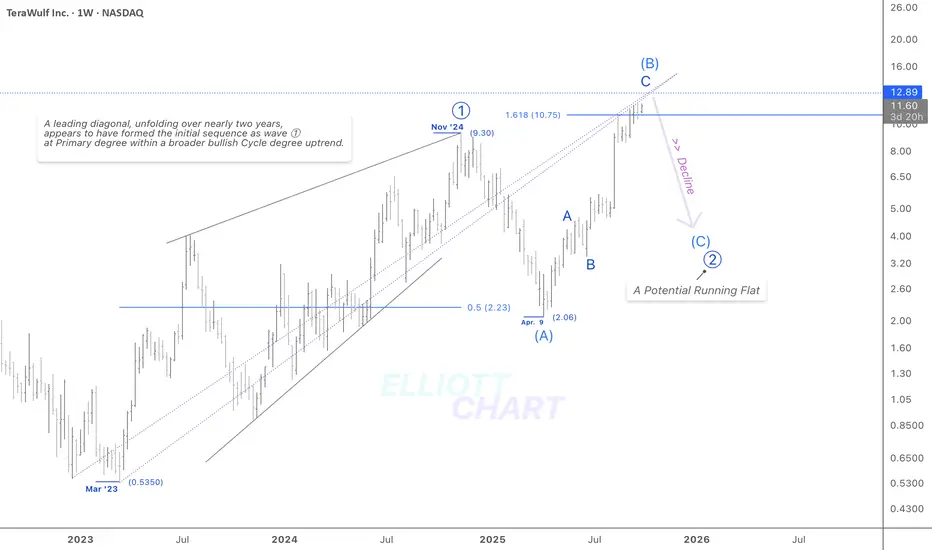

As a potentially bullish alternative, Primary Wave ⓵ may have formed as a Leading Diagonal at the root of a broader upward trend likely in Cycle degree and has been correcting through its Primary Wave ⓶ since November.

The second leg of this correction — Intermediate Wave (B), a countertrend rally — appears to be in its final stages, edging below the key equivalence lines of Diagonal Wave ⓵ — 📑part of my personal technical approach.

Once Wave (B) completes, a final decline in Int. Wave (C) is expected, likely completing the (A)-(B)-(C) corrective sequence as a Running Flat — thereby finalizing Primary Wave ⓶.

#StocksToWatch #MarketAnalysis #TechnicalAnalysis #ElliottWave #WaveAnalysis #TrendAnalysis #FibLevels #FinTwit #TradingView

#Investing #WULF #DataCenters #BitcoinMining #CryptoMining #AIStocks #HPC #AI #BTC #Bitcoin #BTCUSD WULF

WULF  BTC

BTC  AI

AI  BTCUSD

BTCUSD  BITCOIN

BITCOIN

As a potentially bullish alternative, Primary Wave ⓵ may have formed as a Leading Diagonal at the root of a broader upward trend likely in Cycle degree and has been correcting through its Primary Wave ⓶ since November.

The second leg of this correction — Intermediate Wave (B), a countertrend rally — appears to be in its final stages, edging below the key equivalence lines of Diagonal Wave ⓵ — 📑part of my personal technical approach.

Once Wave (B) completes, a final decline in Int. Wave (C) is expected, likely completing the (A)-(B)-(C) corrective sequence as a Running Flat — thereby finalizing Primary Wave ⓶.

#StocksToWatch #MarketAnalysis #TechnicalAnalysis #ElliottWave #WaveAnalysis #TrendAnalysis #FibLevels #FinTwit #TradingView

#Investing #WULF #DataCenters #BitcoinMining #CryptoMining #AIStocks #HPC #AI #BTC #Bitcoin #BTCUSD

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.