Not much to comment here. Market is Uber bullish, there's no fear at all... at least in US equities.

Very strange, that 3-4 weeks before Brexit vote, FX priced in quite remarkable risk premium through short term options implied volatility, while the stock markets (in general) completely ignore any risks, at least for now.

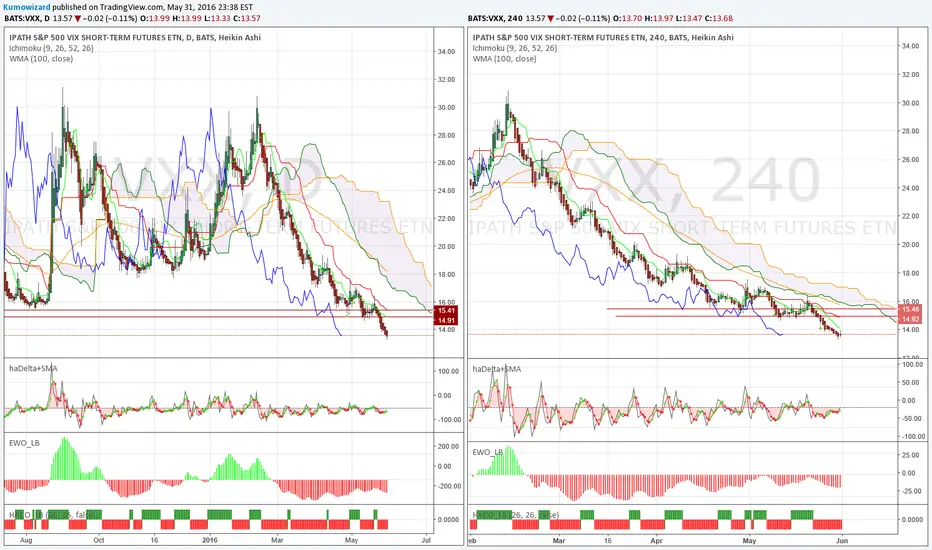

Which market is pricing correctly? FX or Equities? Or maybe FX is overpricing risks, while Equity markets clearly undervalue it? I don't have the clear answer, but I can answer your question when to buy VXX (SP500 short term volatility).

1. You can try small bottom fishing with tiny longs, IF you see some form of Heikin-Ashi reversal on daily

2. You have to buy larger size, IF price breaks through the key bearish support zone, which is now the 14,90-15,40 range.

Regarding SP500 and VXX, I actually see more bearish risk factors:

- Brexit

- China

- OPEC meeting with disappointment and WTI selloff

- FED hawkish tone -> rates ticking higher -> USD stronger -> more liquidity tightening

- Decreasing trend in Corporate earnings + profit warnings

- US election

In my childhood I was told "It is better to fear (too early), than to get (suddenly) scared!"

Keep your eyes open!

Very strange, that 3-4 weeks before Brexit vote, FX priced in quite remarkable risk premium through short term options implied volatility, while the stock markets (in general) completely ignore any risks, at least for now.

Which market is pricing correctly? FX or Equities? Or maybe FX is overpricing risks, while Equity markets clearly undervalue it? I don't have the clear answer, but I can answer your question when to buy VXX (SP500 short term volatility).

1. You can try small bottom fishing with tiny longs, IF you see some form of Heikin-Ashi reversal on daily

2. You have to buy larger size, IF price breaks through the key bearish support zone, which is now the 14,90-15,40 range.

Regarding SP500 and VXX, I actually see more bearish risk factors:

- Brexit

- China

- OPEC meeting with disappointment and WTI selloff

- FED hawkish tone -> rates ticking higher -> USD stronger -> more liquidity tightening

- Decreasing trend in Corporate earnings + profit warnings

- US election

In my childhood I was told "It is better to fear (too early), than to get (suddenly) scared!"

Keep your eyes open!

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.