- Dow Jones Index reversed from key support level 45000.00

- Likely to rise to resistance level 45765.00

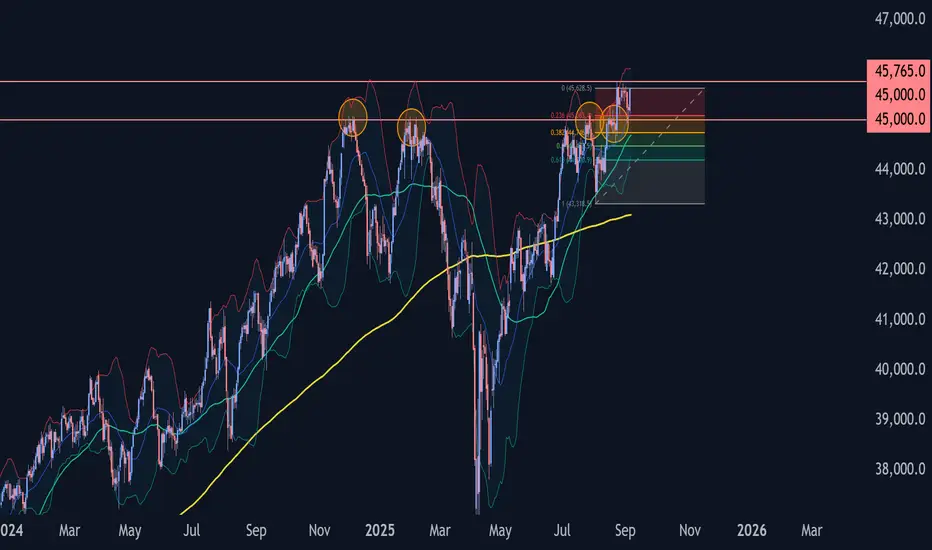

Dow Jones Index recently reversed from the support area between the key support level 45000.00 (former strong resistance, which has been reversing the price from the end of 2024), 20-day moving average and the 38.2% Fibonacci correction of the upward impulse from August.

The upward reversal from this support area stopped the previous short-term correction ii.

Given the strong daily uptrend, Dow Jones Index can be expected to rise to the next resistance level 45765.00 (which reversed the Index in August).

- Likely to rise to resistance level 45765.00

Dow Jones Index recently reversed from the support area between the key support level 45000.00 (former strong resistance, which has been reversing the price from the end of 2024), 20-day moving average and the 38.2% Fibonacci correction of the upward impulse from August.

The upward reversal from this support area stopped the previous short-term correction ii.

Given the strong daily uptrend, Dow Jones Index can be expected to rise to the next resistance level 45765.00 (which reversed the Index in August).

Alexander Kuptsikevich,

Chief Market Analyst at FxPro

----------

Follow our Telegram channel t.me/fxpro dedicated to providing insightful market analysis and expertise.

Reach out to media.comments@fxpro.com for PR and media inquiries

Chief Market Analyst at FxPro

----------

Follow our Telegram channel t.me/fxpro dedicated to providing insightful market analysis and expertise.

Reach out to media.comments@fxpro.com for PR and media inquiries

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.

Alexander Kuptsikevich,

Chief Market Analyst at FxPro

----------

Follow our Telegram channel t.me/fxpro dedicated to providing insightful market analysis and expertise.

Reach out to media.comments@fxpro.com for PR and media inquiries

Chief Market Analyst at FxPro

----------

Follow our Telegram channel t.me/fxpro dedicated to providing insightful market analysis and expertise.

Reach out to media.comments@fxpro.com for PR and media inquiries

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.