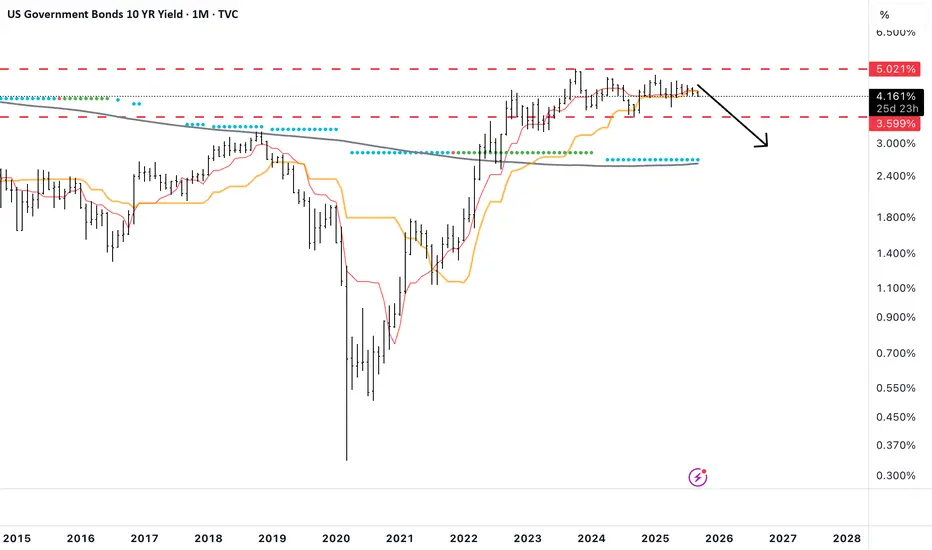

Everyone keeps talking about how rates cuts are going to push long term yields higher because that is what happened last September, etc, etc.

IMO the bond market is realizing that the US Economy is already in a very weak state and it will adjust accordingly.

It's highly doubtful that rates will "crash" but the 10 year could hit 2.5-2.7% (near the 200 SMA) and it would still be in an overall long term bullish structure.

IMO the bond market is realizing that the US Economy is already in a very weak state and it will adjust accordingly.

It's highly doubtful that rates will "crash" but the 10 year could hit 2.5-2.7% (near the 200 SMA) and it would still be in an overall long term bullish structure.

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.