Here's the explanation.

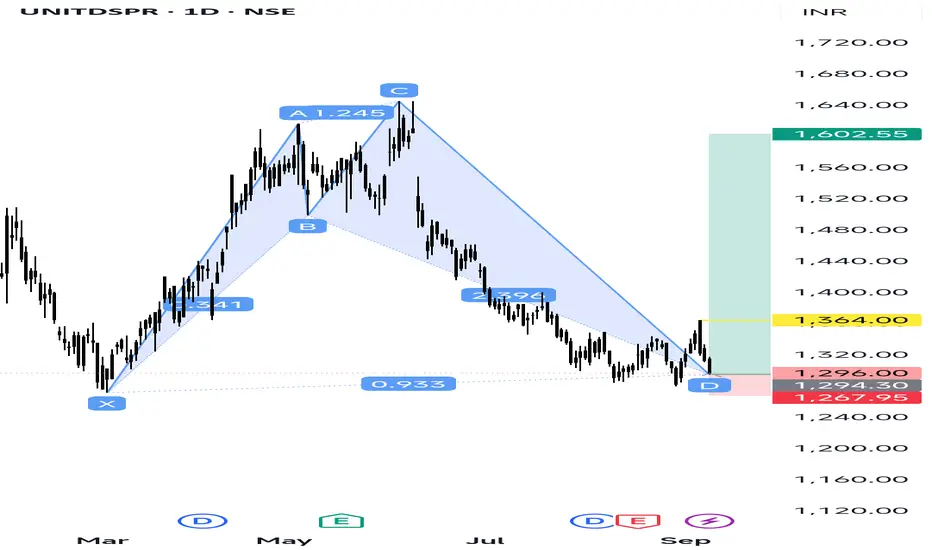

X to A: Initial strong rally.

A to B: Price retraced to ~0.886 of XA (fits Shark criteria).

B to C: A strong bullish move – extended to above 1.13 of AB.

C to D: A deep retracement, falling back close to 0.886–1.13 zone of XA → forming the Potential Reversal Zone (PRZ).

Now, the price is sitting around D (1296), which is the completion zone.

---

🔹 Trading Plan (General)

1. Entry:

Around Point D (1290–1300 zone) if reversal signs (bullish candles, RSI divergence, volume support) are visible.

2. Targets:

T1 → 1364 (first resistance / yellow line on chart)

T2 → 1500–1520

T3 → 1602 (green zone marked)

3. Stop Loss:

Below 1267 (red zone marked). If price closes below, pattern fails.

X to A: Initial strong rally.

A to B: Price retraced to ~0.886 of XA (fits Shark criteria).

B to C: A strong bullish move – extended to above 1.13 of AB.

C to D: A deep retracement, falling back close to 0.886–1.13 zone of XA → forming the Potential Reversal Zone (PRZ).

Now, the price is sitting around D (1296), which is the completion zone.

---

🔹 Trading Plan (General)

1. Entry:

Around Point D (1290–1300 zone) if reversal signs (bullish candles, RSI divergence, volume support) are visible.

2. Targets:

T1 → 1364 (first resistance / yellow line on chart)

T2 → 1500–1520

T3 → 1602 (green zone marked)

3. Stop Loss:

Below 1267 (red zone marked). If price closes below, pattern fails.

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.