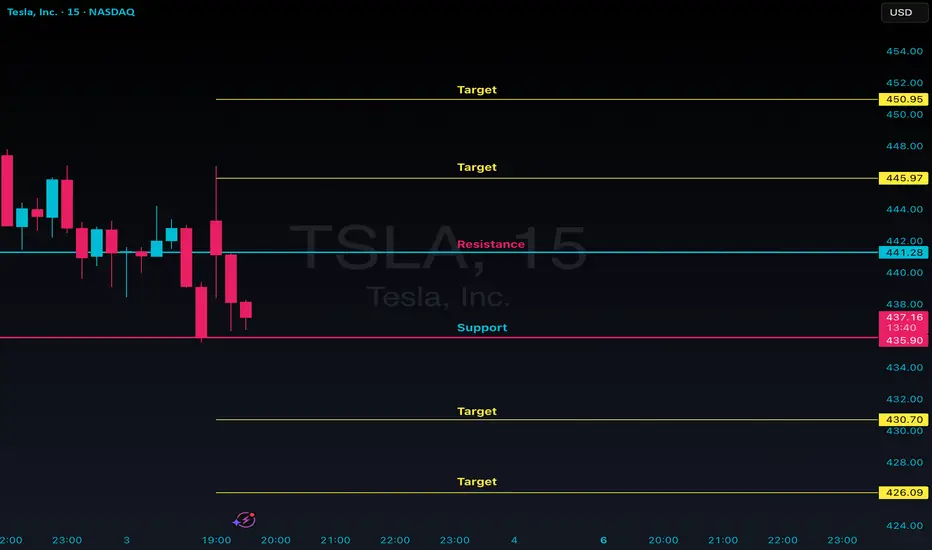

🔴 Resistance: 441

🚀 Upside Targets: 445 – 450

🟢 Support: 435

🚀 Downside Targets: 430 – 426

⚠️ Risk Management is Key — Always Trade with Proper Risk-Reward Strategy ⚠️

🔥 These Levels Work Best on 5 to 15-Minute Timeframes 🔥

❤️ Market Wisdom to Remember: ❤️

⭐ Trade what you see, not what you assume

⭐ Follow the trend — it's your only true friend

⭐ The chart tells the real story — trust it

⭐ Emotions & assumptions have no place in trading

⭐ Capital protection comes first — always

At Globus Capitas, our mission is to empower individuals globally with the knowledge and skills needed to navigate financial markets confidently and work towards achieving their financial goals. 💪

Please Note: Levels shared are for DayTrading only.

🚫 Disclaimer: The information provided is purely educational. No buy/sell recommendations. Always do your own research, assess your risk tolerance, and consult a financial advisor before making any investment decisions. We are not responsible for any profit or loss.

💡 Your support matters! Like, comment, and follow to stay updated and motivated.

Cheers & Trade Smart! 🚀

🚀 Upside Targets: 445 – 450

🟢 Support: 435

🚀 Downside Targets: 430 – 426

⚠️ Risk Management is Key — Always Trade with Proper Risk-Reward Strategy ⚠️

🔥 These Levels Work Best on 5 to 15-Minute Timeframes 🔥

❤️ Market Wisdom to Remember: ❤️

⭐ Trade what you see, not what you assume

⭐ Follow the trend — it's your only true friend

⭐ The chart tells the real story — trust it

⭐ Emotions & assumptions have no place in trading

⭐ Capital protection comes first — always

At Globus Capitas, our mission is to empower individuals globally with the knowledge and skills needed to navigate financial markets confidently and work towards achieving their financial goals. 💪

Please Note: Levels shared are for DayTrading only.

🚫 Disclaimer: The information provided is purely educational. No buy/sell recommendations. Always do your own research, assess your risk tolerance, and consult a financial advisor before making any investment decisions. We are not responsible for any profit or loss.

💡 Your support matters! Like, comment, and follow to stay updated and motivated.

Cheers & Trade Smart! 🚀

노트

Why Tesla Is Down1. High valuation, rising discount rates

Tesla is a growth stock with much of its valuation tied to future optionality (autonomy, AI, energy). When real yields rise (or rate cut expectations get questioned), growth names like Tesla often get hit harder due to discounting pressure.

2. Expired U.S. EV incentives / fiscal headwinds

Tesla itself delivered record numbers in Q3, partly fueled by a rush to benefit from the EV tax credit before it expired. But once the incentive is gone, the incremental demand drop or uncertainty can spook investors.

3. Mixed fundamentals & regional weakness

While U.S. deliveries rose, Tesla’s performance in Europe remains weak, and costs, margin pressure, or competitive dynamics may be seen as risks.

4. Profit-taking / overextended run

Tesla has had strong runs recently. Some of today’s weakness may simply reflect profit-taking, especially in a volatile environment, or blowoff top fears.

5. Narrative shift / investor rotation

Investors may be shifting focus from pure EV hype to other secular themes (AI, semiconductor, energy infrastructure). Tesla could be losing relative momentum in that rotation.

20+ years in global markets — from the London Stock Exchange to the New York Stock Exchange — mastering Europe’s pulse and Wall Street’s edge.

관련 발행물

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.

20+ years in global markets — from the London Stock Exchange to the New York Stock Exchange — mastering Europe’s pulse and Wall Street’s edge.

관련 발행물

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.