📈 Daily Support & Resistance Levels

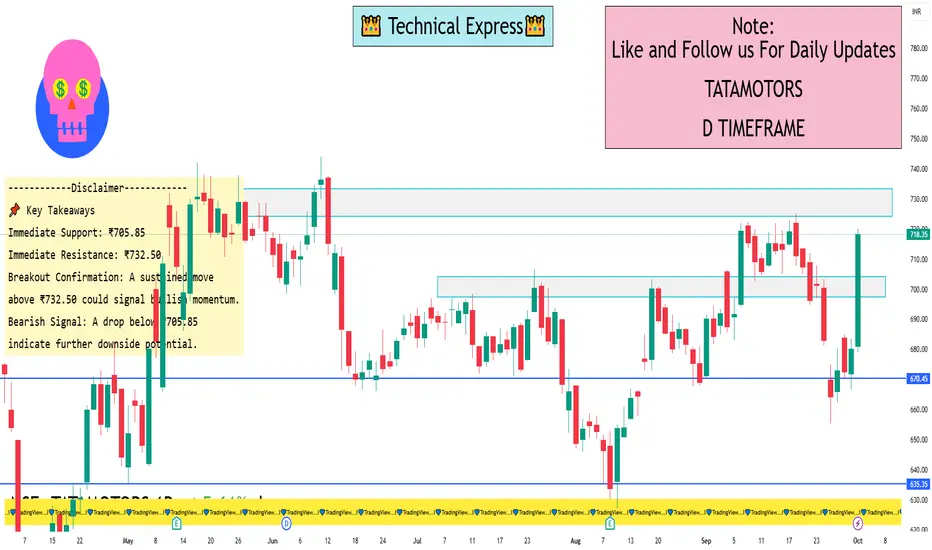

Immediate Support: ₹705.85

Immediate Resistance: ₹732.50

Pivot Point: ₹705.85

These levels are derived from the Classic Pivot Point analysis, indicating that the stock is trading near its pivot point, suggesting a neutral bias with potential for breakout or pullback depending on market momentum.

🔁 Fibonacci Retracement Levels

Key Support Levels:

23.6%: ₹694.85

38.2%: ₹664.45

50%: ₹639.88

61.8%: ₹615.30

Key Resistance Levels:

23.6%: ₹767.50

38.2%: ₹797.90

50%: ₹822.47

61.8%: ₹847.05

These Fibonacci levels provide potential support and resistance zones, useful for identifying entry and exit points.

📉 Technical Indicators

Relative Strength Index (RSI): Approximately 42.6, indicating early bullish momentum.

Moving Averages: The stock is trading below its 5-day and 13-day moving averages, suggesting a bearish trend.

🧭 Trend Analysis

The stock is currently trading near its pivot point, indicating a neutral bias. A breakout above ₹732.50 could signal bullish momentum, while a drop below ₹705.85 may indicate further downside potential.

📌 Key Takeaways

Immediate Support: ₹705.85

Immediate Resistance: ₹732.50

Breakout Confirmation: A sustained move above ₹732.50 could signal bullish momentum.

Bearish Signal: A drop below ₹705.85 may indicate further downside potential.

Immediate Support: ₹705.85

Immediate Resistance: ₹732.50

Pivot Point: ₹705.85

These levels are derived from the Classic Pivot Point analysis, indicating that the stock is trading near its pivot point, suggesting a neutral bias with potential for breakout or pullback depending on market momentum.

🔁 Fibonacci Retracement Levels

Key Support Levels:

23.6%: ₹694.85

38.2%: ₹664.45

50%: ₹639.88

61.8%: ₹615.30

Key Resistance Levels:

23.6%: ₹767.50

38.2%: ₹797.90

50%: ₹822.47

61.8%: ₹847.05

These Fibonacci levels provide potential support and resistance zones, useful for identifying entry and exit points.

📉 Technical Indicators

Relative Strength Index (RSI): Approximately 42.6, indicating early bullish momentum.

Moving Averages: The stock is trading below its 5-day and 13-day moving averages, suggesting a bearish trend.

🧭 Trend Analysis

The stock is currently trading near its pivot point, indicating a neutral bias. A breakout above ₹732.50 could signal bullish momentum, while a drop below ₹705.85 may indicate further downside potential.

📌 Key Takeaways

Immediate Support: ₹705.85

Immediate Resistance: ₹732.50

Breakout Confirmation: A sustained move above ₹732.50 could signal bullish momentum.

Bearish Signal: A drop below ₹705.85 may indicate further downside potential.

I built a Buy & Sell Signal Indicator with 85% accuracy.

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

관련 발행물

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

I built a Buy & Sell Signal Indicator with 85% accuracy.

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

관련 발행물

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.