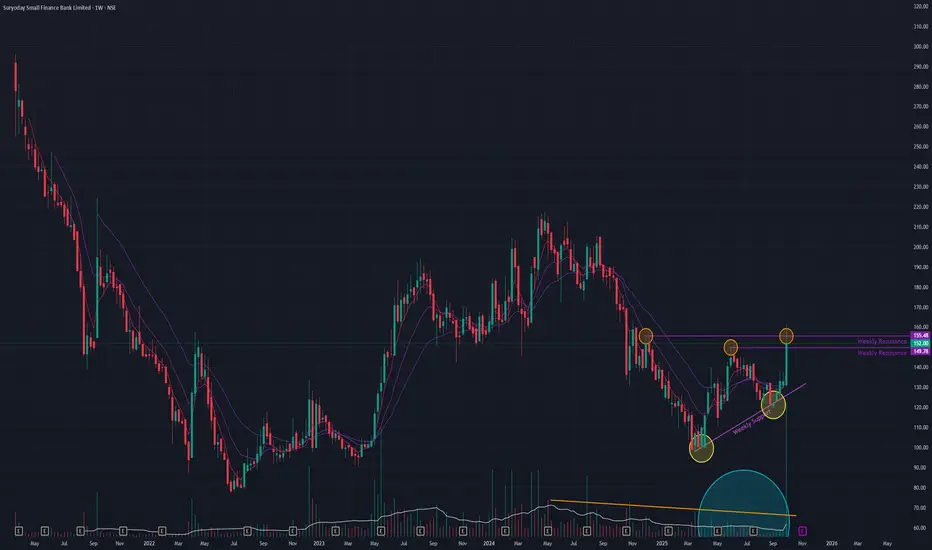

Suryoday Small Finance Bank is showing signs of a potential trend reversal, marked by the recent formation of Higher Lows. Last week, the stock made a significant move, surging +14.38% on massive volume. During this session, it broke through two minor resistances but ultimately closed below a critical long-term resistance level.

This price action indicates a powerful attempt by buyers that was met with significant selling pressure at a key technical barrier.

Conflicting Technical Signals

The current technical landscape presents a mixed picture, highlighting the uncertainty at this juncture:

Bullish Signs 👍:

- Weekly Momentum: On the weekly timeframe, both the short-term Exponential Moving Averages (EMAs) and the Relative Strength Index (RSI) are in a bullish crossover state.

Bearish Signs 📉:

- Declining Volume: The overall trading volume has been drying up, which typically signals a lack of conviction from buyers, despite last week's volume spike.

Outlook: A Decisive Week Ahead

The stock is at a critical inflection point. The powerful surge last week shows bullish intent, but the failure to close above resistance and the low overall volume are causes for caution. The price action in the upcoming week will be crucial in determining whether the stock has the strength to finally break through resistance or if it will be rejected again.

This price action indicates a powerful attempt by buyers that was met with significant selling pressure at a key technical barrier.

Conflicting Technical Signals

The current technical landscape presents a mixed picture, highlighting the uncertainty at this juncture:

Bullish Signs 👍:

- Weekly Momentum: On the weekly timeframe, both the short-term Exponential Moving Averages (EMAs) and the Relative Strength Index (RSI) are in a bullish crossover state.

Bearish Signs 📉:

- Declining Volume: The overall trading volume has been drying up, which typically signals a lack of conviction from buyers, despite last week's volume spike.

Outlook: A Decisive Week Ahead

The stock is at a critical inflection point. The powerful surge last week shows bullish intent, but the failure to close above resistance and the low overall volume are causes for caution. The price action in the upcoming week will be crucial in determining whether the stock has the strength to finally break through resistance or if it will be rejected again.

Disclaimer: This analysis is my personal view & for educational purposes only. They shall not be construed as trade or investment advice. Before making any financial decision, it is imperative that you consult with a qualified financial professional.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

Disclaimer: This analysis is my personal view & for educational purposes only. They shall not be construed as trade or investment advice. Before making any financial decision, it is imperative that you consult with a qualified financial professional.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.