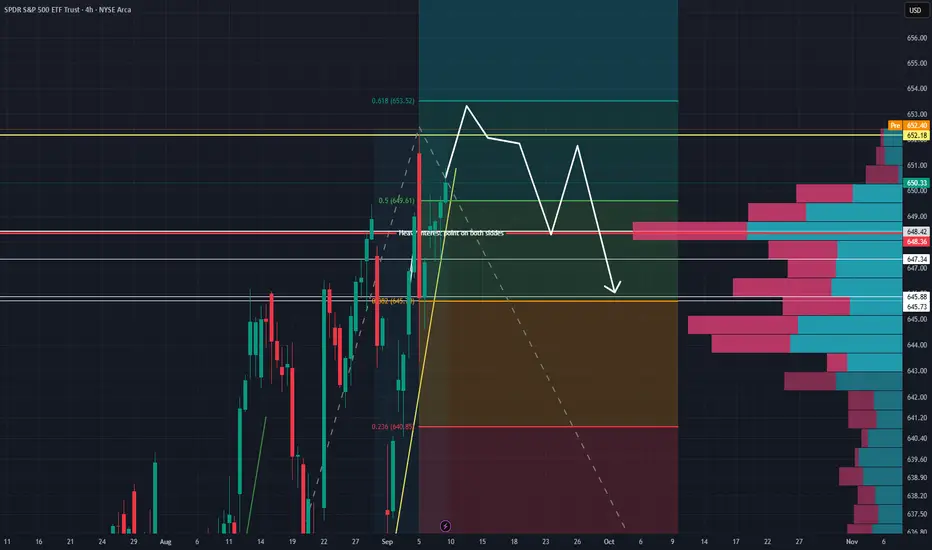

Bear: looking at the adx indicator, we are very low on trend strength on the daily and 4h timeframe of  SPY . There is room for some more upside to possibly test ath around 652. I believe it will go up to test before it has a pullback again but that being said, adx is low, there are many touches of bearish divergence (lower rsi peaks : higher price points), and we have not seen much drastic big candles in a while. Its important to note that rate cuts are ALREADY priced in. We are forward looking ALREADY. I do not think it impossible that we see a pullback around rate decision or sooner. The current immediate 4h and 1h trend is steep (showing possible exhaustion incoming) especially with all the indicators showing momentum consolidating or slowing down - which could be a possible reversal signal. WATCH ath and the immediate reaction in the days coming.

SPY . There is room for some more upside to possibly test ath around 652. I believe it will go up to test before it has a pullback again but that being said, adx is low, there are many touches of bearish divergence (lower rsi peaks : higher price points), and we have not seen much drastic big candles in a while. Its important to note that rate cuts are ALREADY priced in. We are forward looking ALREADY. I do not think it impossible that we see a pullback around rate decision or sooner. The current immediate 4h and 1h trend is steep (showing possible exhaustion incoming) especially with all the indicators showing momentum consolidating or slowing down - which could be a possible reversal signal. WATCH ath and the immediate reaction in the days coming.

Bull: Fib extension gives upward price points at 653.52 and even up at 659.09. I think its more possible to combine bearish with bullish thesis and say we will hit the 653.52 then drop- we might just bounce after the drop (which may not be very big). We are in a unique environment with policy and an administration that favors the biggest players in our market. It's silly to expect any SIGNIFICANT downside unless something fundamental *global or political happens. I see pullbacks but nothing like April.

simply put, we are going up there's no stopping that the market is A-symmetrical. However, there are points where I can predict high probability exhaustion and reversals in the coming days and week. aka pullback incoming. Watch all time highs and the adx once it starts to curve up.

Bull: Fib extension gives upward price points at 653.52 and even up at 659.09. I think its more possible to combine bearish with bullish thesis and say we will hit the 653.52 then drop- we might just bounce after the drop (which may not be very big). We are in a unique environment with policy and an administration that favors the biggest players in our market. It's silly to expect any SIGNIFICANT downside unless something fundamental *global or political happens. I see pullbacks but nothing like April.

simply put, we are going up there's no stopping that the market is A-symmetrical. However, there are points where I can predict high probability exhaustion and reversals in the coming days and week. aka pullback incoming. Watch all time highs and the adx once it starts to curve up.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.