롱

Soybeans vs USD: Breakout Robbery in Progress – Join the Escape!

🚨💰🌱 Soybeans vs. US Dollar Commodities CFD Heist Plan (Swing/Day) 🕶️⚡

👋 Dear Ladies & Gentlemen… and my fellow Thief OG’s 🐱👤💵,

Tonight’s grand heist is in the Soybeans Vault 🌱💰 vs. the Mighty Dollar 💵.

We move Bullish 📈 – the loot is ripe, and the guards are weak!

🎯 The Master Heist Plan

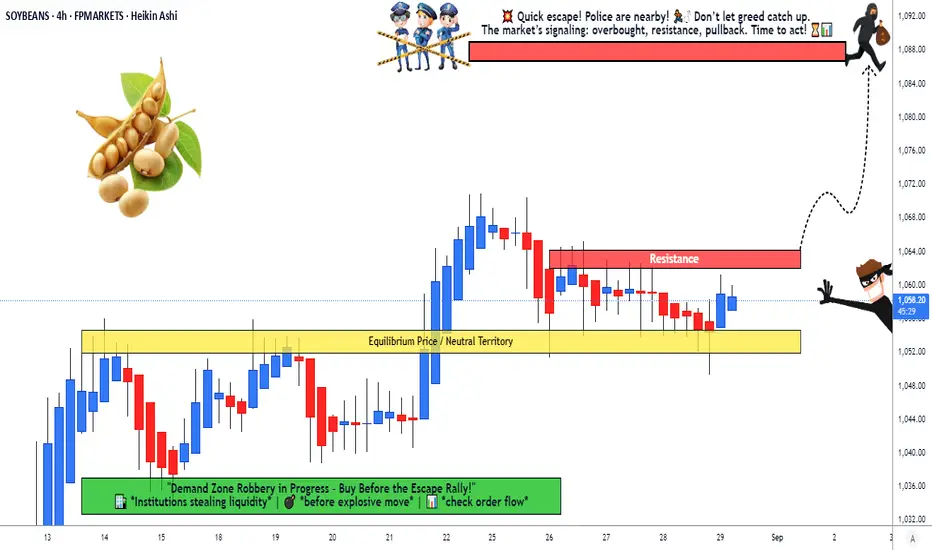

Entry (Breakout Trigger): ⚡ 1065.00

👉 Once the vault door cracks open at 1065, we sneak in with Thief Layer Entries 🕶️🔪:

1063.00

1060.00

1055.00

1052.00

(Keep layering your entries, thief-style… the deeper the pullback, the fatter the loot 💎💸).

Stop Loss (Thief Escape Plan): 🏃♂️💨

📍 The secret tunnel is at 1040.00.

But hey thieves, adjust your SL 🔑 based on your strategy & risk appetite.

Target (Police Barricade 🚔):

👉 1088.00 – That’s where the cops set up the roadblock, so escape with the bag before they catch you 🏆💰✈️.

🕶️ Thief Trading Wisdom

Multiple buy limit layered orders = professional thief entry strategy.

Always confirm the breakout before layering in.

Police (market makers) will try to trap you – stay one step ahead 🐱👤⚡.

🔥 Boost our Robbery Plan if you’re part of the crew 💣💵!

The more likes & views, the bigger the gang grows 🚀.

#ThiefTrading 🕶️ #SoybeansHeist 🌱💰 #CommodityLoot 💸 #SwingTradePlan ⚡ #DayTradeRobbery 🐱👤 #USDvsSoybeans 💵 #BreakoutStrategy 📈 #LayerEntry 🔑 #TradingViewHeist 🚔 #MarketLootPlan

👋 Dear Ladies & Gentlemen… and my fellow Thief OG’s 🐱👤💵,

Tonight’s grand heist is in the Soybeans Vault 🌱💰 vs. the Mighty Dollar 💵.

We move Bullish 📈 – the loot is ripe, and the guards are weak!

🎯 The Master Heist Plan

Entry (Breakout Trigger): ⚡ 1065.00

👉 Once the vault door cracks open at 1065, we sneak in with Thief Layer Entries 🕶️🔪:

1063.00

1060.00

1055.00

1052.00

(Keep layering your entries, thief-style… the deeper the pullback, the fatter the loot 💎💸).

Stop Loss (Thief Escape Plan): 🏃♂️💨

📍 The secret tunnel is at 1040.00.

But hey thieves, adjust your SL 🔑 based on your strategy & risk appetite.

Target (Police Barricade 🚔):

👉 1088.00 – That’s where the cops set up the roadblock, so escape with the bag before they catch you 🏆💰✈️.

🕶️ Thief Trading Wisdom

Multiple buy limit layered orders = professional thief entry strategy.

Always confirm the breakout before layering in.

Police (market makers) will try to trap you – stay one step ahead 🐱👤⚡.

🔥 Boost our Robbery Plan if you’re part of the crew 💣💵!

The more likes & views, the bigger the gang grows 🚀.

#ThiefTrading 🕶️ #SoybeansHeist 🌱💰 #CommodityLoot 💸 #SwingTradePlan ⚡ #DayTradeRobbery 🐱👤 #USDvsSoybeans 💵 #BreakoutStrategy 📈 #LayerEntry 🔑 #TradingViewHeist 🚔 #MarketLootPlan

노트

🎯 Real-Time Soybeans Data (02 Sept 2025)Current Price: $1,026.01 per bushel (USD) [🔻0.86% daily]

Monthly Performance: +5.88%

Yearly Performance: +2.96%

52-Week Range: $955.00 - $1,105.25

📊 Investor Sentiment Outlook

Retail Traders

Sentiment: Neutral to Cautiously Bearish

Key Drivers:

Focus on technical breakdowns and seasonal weakness.

Awaiting China demand signals and USDA updates.

Institutional Traders

Sentiment: Balanced (Waiting for Catalysts)

Managed money funds are neutral after exiting short positions in August.

Monitoring US harvest progress and Brazil’s upcoming harvest.

😨😊 Fear & Greed Index

Current Reading: 64/100 (Greed) [📈 Stock market momentum-driven]

Implication: Optimism in broader markets, but commodities like soybeans may face volatility due to macro risks.

🌍📉 Fundamental & Macro Score Points

Supply Factors

US Harvest: Bumper crop expected, limiting price gains.

Global Stocks: Record-high ending stocks (122.5M tons), led by Brazil’s production boost.

US Acreage: Reduced to 80.9M acres (down 2.5M from June estimate).

Demand Factors

China Import Uncertainty: No recent US purchases; relying on Brazil/Argentina.

Biofuel Policy: EPA biofuel exemptions may reduce soy-based fuel demand.

Export Sales: Down 50% YoY.

Macro Risks

US-China Trade Talks: Potential tariff reductions could boost sentiment.

Global Trade Tensions: Cooling tensions may support agricultural exports.

🐂🐻 Overall Market Outlook Score

Bullish (Long) Case:

Tightening US ending stocks (290M bushels, lowest in 3 years).

Potential trade deal catalyst if China resumes buying.

Bearish (Short) Case:

Ample global supply + Brazil’s record crop (175M tons).

Weak export demand and seasonal pressure.

✅ Net Outlook: Neutral to Slightly Bearish (Short-term caution until demand improves).

📌 Key Takeaways

Prices are pressured by oversupply but supported by low US stocks.

China’s demand is the make-or-break factor.

Watch for USDA reports and trade talk developments.

Institutional money is on sidelines—waiting for clarity.

액티브 트레이드

거래청산: 타겟 닿음

💰 Money-Making Analysis

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

관련 발행물

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.

💰 Money-Making Analysis

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

관련 발행물

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.