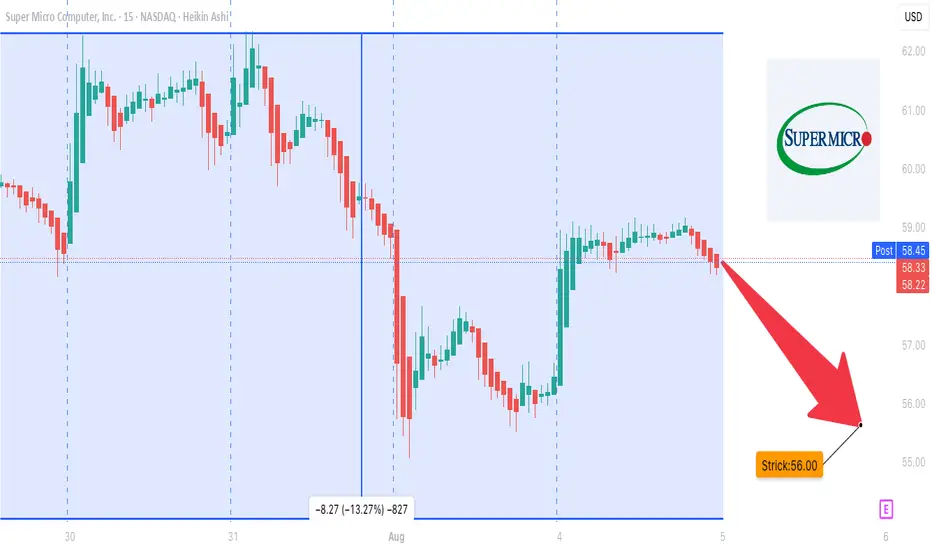

### 🧨 SMCI Earnings Setup: Big Miss Incoming? Put Flow Exploding 🚨

📆 **Earnings Date:** Aug 5, 2025 (After Market Close)

💣 **Sentiment:** **Moderate Bearish** — 72% conviction

💬 **Why?**: Weak margins, cash burn, heavy put activity, and bearish technicals.

---

### 🔍 Quick Breakdown:

📉 **Fundamentals:**

* Profit margin only 5.34%

* Free cash flow: **–\$272M**

* Historical EPS beats? Just 50%

* Analyst consensus is turning **bearish**

🧾 **Options Flow:**

* Heavy \$58 & \$56 **Put Accumulation**

* Cautious positioning into earnings

* Skewed toward **defensive hedging**

📉 **Technicals:**

* Weak RSI (\~48), poor volume

* Price drifting with no conviction

* 🔑 Key Support: \$53.66

* 🔼 Resistance: \$60.00

---

### 💼 Trade Setup: SMCI PUT ⚠️

* 📍 **Strike:** \$56.00

* 📆 **Expiry:** Aug 8, 2025

* 💵 **Entry Price:** \$2.23

* 🎯 **Profit Target:** \$6.69

* 🛑 **Stop Loss:** \$1.11

* 🧠 **Size:** 2% Portfolio

**Expected Move:** 10–15% ⚠️ (based on IV and past reactions)

**Exit Plan:** Take profits within 2 hours post-earnings to avoid IV crush!

---

### 📈 TradingView Tags:

```

#SMCI #PutOptions #EarningsPlay #BearishSetup

#OptionsFlow #TechnicalAnalysis #SwingTrade #HighConviction

#NASDAQ #AIStocks #MarketVolatility #DarkPoolData

```

---

### 💬 Hook for Comments:

> SMCI bulls better hope for a miracle… or this earnings could trigger a 15% flush. Are you hedged? 😬

Free Signals Based on Latest AI models💰: QuantSignals.xyz

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

Free Signals Based on Latest AI models💰: QuantSignals.xyz

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.