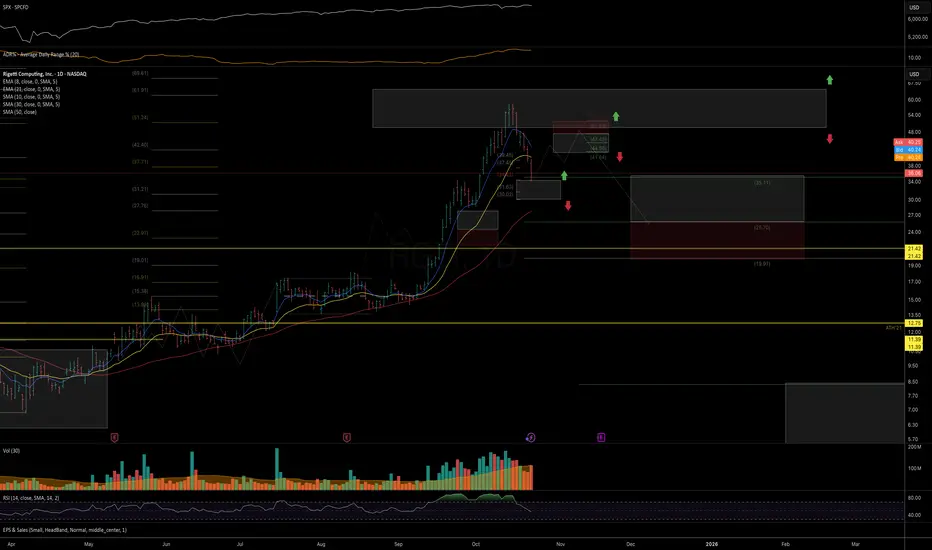

Price reacted as expected from the key resistance outlined in the October update.

The main hypothesis remains that price has likely topped and is now completing its first wave of decline.

Any upcoming recovery attempt will be considered a bounce and potential lower high formation before further downside later this year.

Chart:

In the broader context, the critical zone to monitor is the 35–25 support area.

If price manages to stage an impulsive 5-wave recovery from this zone, the probability for another upside leg toward the next macro resistance at 85–115 will remain valid.

However, if the recovery from this area unfolds as a corrective 3-wave structure, then a breakdown below the Dec’24 top and continuation into the macro support zone will become the higher-probability scenario.

Chart (weekly):

Previous Updates

• On macro resistance and potential topping (Oct 13)

Chart:

View Idea

• On support and pullback potential (Sep 24)

Chart:

View Idea

• On macro structure (Sep 18)

Chart:

View Idea

The main hypothesis remains that price has likely topped and is now completing its first wave of decline.

Any upcoming recovery attempt will be considered a bounce and potential lower high formation before further downside later this year.

Chart:

In the broader context, the critical zone to monitor is the 35–25 support area.

If price manages to stage an impulsive 5-wave recovery from this zone, the probability for another upside leg toward the next macro resistance at 85–115 will remain valid.

However, if the recovery from this area unfolds as a corrective 3-wave structure, then a breakdown below the Dec’24 top and continuation into the macro support zone will become the higher-probability scenario.

Chart (weekly):

Previous Updates

• On macro resistance and potential topping (Oct 13)

Chart:

View Idea

• On support and pullback potential (Sep 24)

Chart:

View Idea

• On macro structure (Sep 18)

Chart:

View Idea

액티브 트레이드

Quantum sector in general, and Alternatively, there’s a possibility of one more short-term upside attempt into the 47–52 zone. However, given the current macro structure, I still lean toward a mid-term downside scenario.

Chart:

📊 Daily FREE Market Insights | Crypto + US Stocks

⚡ Technical analysis, setups & commentary

🌍 t.me/MarketArtistryENG | 🇷🇺 t.me/marketartistry

Join and let's grow together! 🚀

⚡ Technical analysis, setups & commentary

🌍 t.me/MarketArtistryENG | 🇷🇺 t.me/marketartistry

Join and let's grow together! 🚀

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.

📊 Daily FREE Market Insights | Crypto + US Stocks

⚡ Technical analysis, setups & commentary

🌍 t.me/MarketArtistryENG | 🇷🇺 t.me/marketartistry

Join and let's grow together! 🚀

⚡ Technical analysis, setups & commentary

🌍 t.me/MarketArtistryENG | 🇷🇺 t.me/marketartistry

Join and let's grow together! 🚀

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.