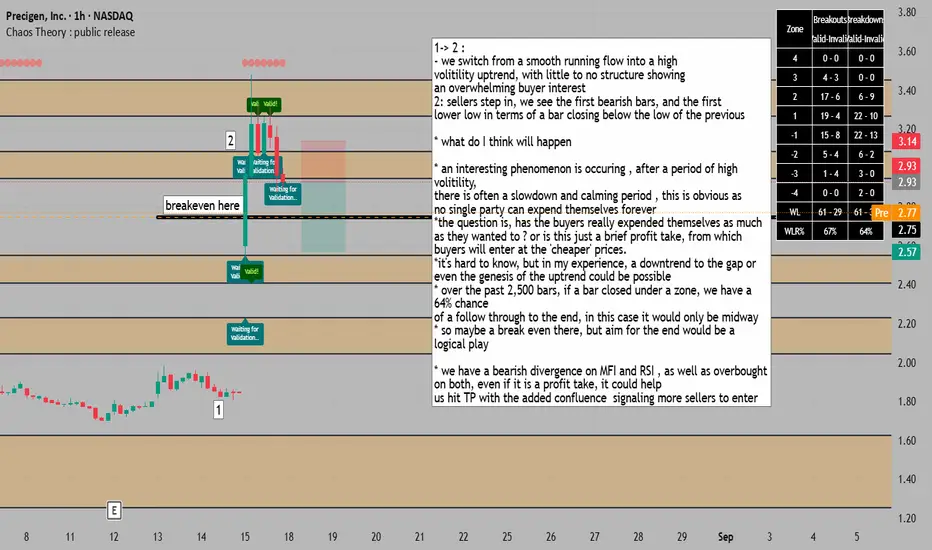

1-> 2 :

- we switch from a smooth running flow into a high

volitility uptrend, with little to no structure showing

an overwhelming buyer interest

2: sellers step in, we see the first bearish bars, and the first

lower low in terms of a bar closing below the low of the previous

* what do I think will happen

* an interesting phenomenon is occuring , after a period of high volitility,

there is often a slowdown and calming period , this is obvious as

no single party can expend themselves forever

*the question is, has the buyers really expended themselves as much

as they wanted to ? or is this just a brief profit take, from which

buyers will enter at the 'cheaper' prices.

*it's hard to know, but in my experience, a downtrend to the gap or

even the genesis of the uptrend could be possible

* over the past 2,500 bars, if a bar closed under a zone, we have a 64% chance

of a follow through to the end, in this case it would only be midway

* so maybe a break even there, but aim for the end would be a logical play

* we have a bearish divergence on MFI and RSI , as well as overbought on both, even if it is a profit take, it could help

us hit TP with the added confluence signaling more sellers to enter

- we switch from a smooth running flow into a high

volitility uptrend, with little to no structure showing

an overwhelming buyer interest

2: sellers step in, we see the first bearish bars, and the first

lower low in terms of a bar closing below the low of the previous

* what do I think will happen

* an interesting phenomenon is occuring , after a period of high volitility,

there is often a slowdown and calming period , this is obvious as

no single party can expend themselves forever

*the question is, has the buyers really expended themselves as much

as they wanted to ? or is this just a brief profit take, from which

buyers will enter at the 'cheaper' prices.

*it's hard to know, but in my experience, a downtrend to the gap or

even the genesis of the uptrend could be possible

* over the past 2,500 bars, if a bar closed under a zone, we have a 64% chance

of a follow through to the end, in this case it would only be midway

* so maybe a break even there, but aim for the end would be a logical play

* we have a bearish divergence on MFI and RSI , as well as overbought on both, even if it is a profit take, it could help

us hit TP with the added confluence signaling more sellers to enter

for trading mentorship and community, message me on telegram : jacesabr_real

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.

for trading mentorship and community, message me on telegram : jacesabr_real

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.