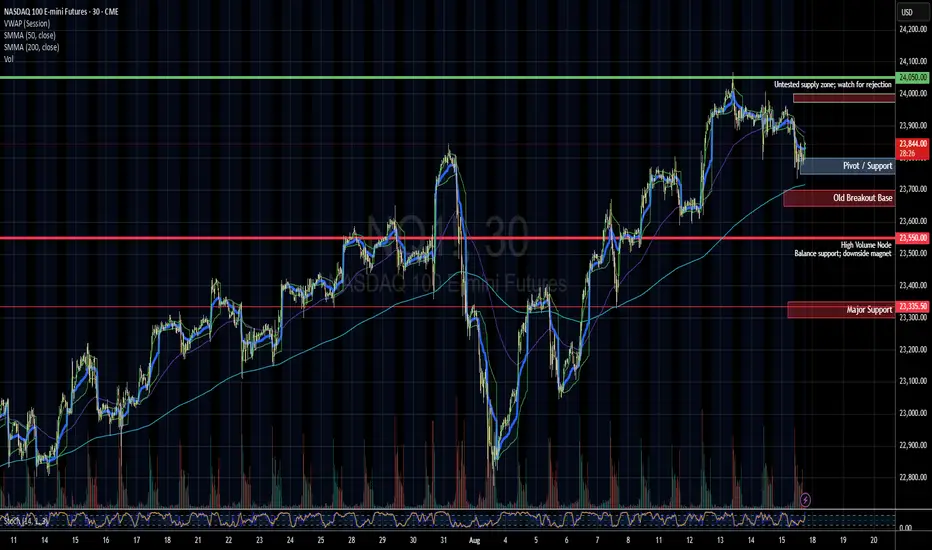

NQ futures are coiling between 23,750–23,950, following last week’s breakout attempt that stalled near 24,000. This week’s catalysts could set the tone for the next directional move.

Key Levels

24,050 → Supply zone (watch for rejection).

23,975–24,000 → Breakout trigger.

23,800–23,825 → Pivot support.

23,750 → Line-in-the-sand for bulls.

23,550 → Downside magnet if 23,750 fails.

Major Catalysts

Mon (Aug 18): NAHB Housing Confidence.

Tue (Aug 19): Housing Starts + Home Depot earnings.

Wed (Aug 20): Lowe’s earnings, FOMC Minutes.

Fri (Aug 22): Powell speaks at Jackson Hole.

Housing data + retail earnings will offer an early read on consumer and housing strength, while Jackson Hole is the wildcard for rates and liquidity.

Trade Scenarios

Bullish → Hold 23,750–23,800, break above 24,000 → target 24,050–24,150.

Bearish → Lose 23,750, sell momentum toward 23,550, possibly 23,300.

Neutral → Chop between 23,750–23,950 until catalysts break balance.

Bias: Stay patient in the balance zone. Housing + retail earnings set the tone early, but Powell’s Jackson Hole speech decides the week.

Key Levels

24,050 → Supply zone (watch for rejection).

23,975–24,000 → Breakout trigger.

23,800–23,825 → Pivot support.

23,750 → Line-in-the-sand for bulls.

23,550 → Downside magnet if 23,750 fails.

Major Catalysts

Mon (Aug 18): NAHB Housing Confidence.

Tue (Aug 19): Housing Starts + Home Depot earnings.

Wed (Aug 20): Lowe’s earnings, FOMC Minutes.

Fri (Aug 22): Powell speaks at Jackson Hole.

Housing data + retail earnings will offer an early read on consumer and housing strength, while Jackson Hole is the wildcard for rates and liquidity.

Trade Scenarios

Bullish → Hold 23,750–23,800, break above 24,000 → target 24,050–24,150.

Bearish → Lose 23,750, sell momentum toward 23,550, possibly 23,300.

Neutral → Chop between 23,750–23,950 until catalysts break balance.

Bias: Stay patient in the balance zone. Housing + retail earnings set the tone early, but Powell’s Jackson Hole speech decides the week.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.