NIO Earnings (QS V3 | 2025-11-24)

Strategy: Buy Calls (Earnings Play)

Confidence: 65% (Medium)

Expiry: 2025-11-28

Strike: $6.00

Entry: ~$0.18

Target 1: $0.36

Stop Loss: $0.09

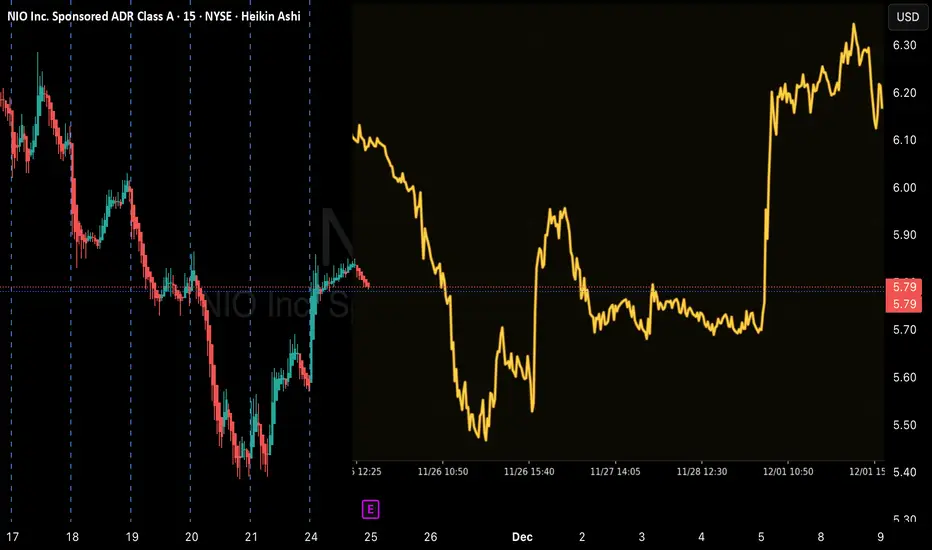

📈 Technical Overview

Price: ~$5.82

Range: $5.25 – $5.87 (tight)

RSI: ~22.4 → Oversold

Volume: 1.1× average → Mild interest

Trend Regime: 95.3% → Strong momentum environment

Support: $5.75 (critical – Katy target)

Resistance: $6.00 / $6.12

IV: ~108% → High earnings volatility

Chart Instructions:

Draw support at $5.75.

Draw resistance line at $6.00–$6.12.

Add RSI indicator (watch for >30 breakout).

Mark option entry zone at $0.18–$0.19.

Plot targets $0.36 and $0.54 (extension).

📰 Sentiment / News Summary

High-impact earnings scheduled

Revenue growth reported at 22,347%

Neutral-to-bullish media tone

Whale activity + call volume shows positioning ahead of earnings

🧪 Flow & Volatility

Put/Call Ratio: 0.37 → Strong call buying

Unusual volume at $6C

Elevated IV ~108% (expect wide moves)

High trend regime → amplified breakouts

⚠️ Risk Notes

Katy AI shows neutral → slightly bearish path

Post-earnings drift can invalidate call setup

High IV = potential IV crush

Stick to 2% position size

Strategy: Buy Calls (Earnings Play)

Confidence: 65% (Medium)

Expiry: 2025-11-28

Strike: $6.00

Entry: ~$0.18

Target 1: $0.36

Stop Loss: $0.09

📈 Technical Overview

Price: ~$5.82

Range: $5.25 – $5.87 (tight)

RSI: ~22.4 → Oversold

Volume: 1.1× average → Mild interest

Trend Regime: 95.3% → Strong momentum environment

Support: $5.75 (critical – Katy target)

Resistance: $6.00 / $6.12

IV: ~108% → High earnings volatility

Chart Instructions:

Draw support at $5.75.

Draw resistance line at $6.00–$6.12.

Add RSI indicator (watch for >30 breakout).

Mark option entry zone at $0.18–$0.19.

Plot targets $0.36 and $0.54 (extension).

📰 Sentiment / News Summary

High-impact earnings scheduled

Revenue growth reported at 22,347%

Neutral-to-bullish media tone

Whale activity + call volume shows positioning ahead of earnings

🧪 Flow & Volatility

Put/Call Ratio: 0.37 → Strong call buying

Unusual volume at $6C

Elevated IV ~108% (expect wide moves)

High trend regime → amplified breakouts

⚠️ Risk Notes

Katy AI shows neutral → slightly bearish path

Post-earnings drift can invalidate call setup

High IV = potential IV crush

Stick to 2% position size

Free Signals Based on Latest AI models💰: QuantSignals.xyz

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

Free Signals Based on Latest AI models💰: QuantSignals.xyz

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.