The Nifty 50 ended the week at 24,870.10, gaining +0.97%.

🔹 Key Levels for the Upcoming Week

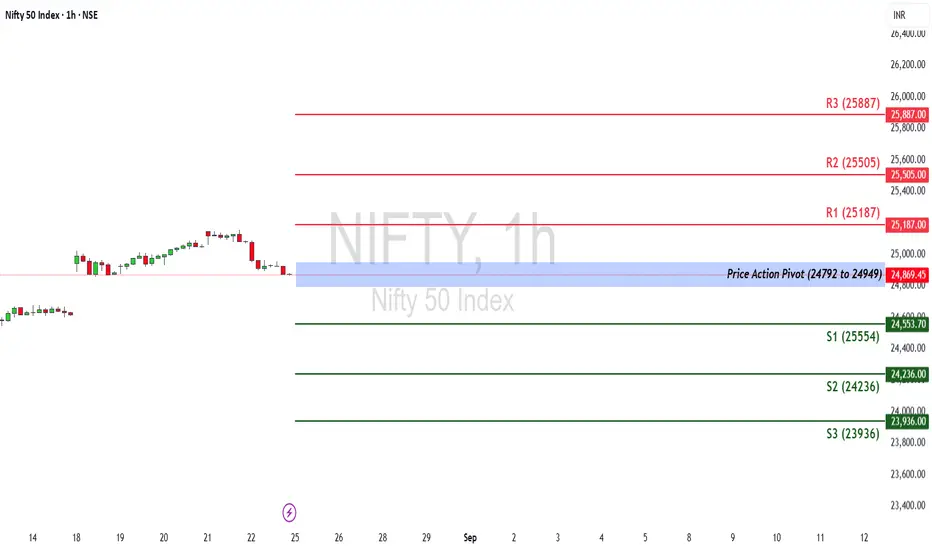

📌 Price Action Pivot Zone:

24,792 to 24,949 – This is the critical zone to watch. A decisive move beyond either side may dictate next week’s trend.

🔻 Support Levels

S1: 24,553

S2: 24,236

S3: 23,936

🔺 Resistance Levels

R1: 25,187

R2: 25,505

R3: 25,887

📊 Candle Observation:

The last weekly candle formed a red body with a long lower shadow, showing that although bears dominated early in the week, strong buying support emerged near the lows. This wick-based recovery signals demand at lower levels, keeping the support zones (24,553–24,236) important for the coming sessions.

📰 Sentiment Check (Last Week):

The Nifty opened the week with a gap-up, supported by global cues and positive sentiment around the Trump–Putin meeting, which was seen as a potential step toward easing geopolitical tensions.

However, mid-week profit booking dragged the index down, before buyers stepped back in from lower supports, leaving a long lower wick on the weekly candle.

This shows underlying resilience, though the market remains sensitive to global political developments.

📈 Market Outlook

✅ Bullish Scenario:

If Nifty sustains above 24,949, buying momentum could build, aiming for R1 (25,187). A strong breakout above this may push prices towards R2 (25,505) and R3 (25,887).

❌ Bearish Scenario:

If the index breaks below 24,792, selling pressure may return. This could drag Nifty towards S1 (24,553), and further down to S2 (24,236) and S3 (23,936).

📌 Sentiment Outlook:

Nifty is showing resilience with support at lower levels, but for a strong bullish confirmation, it needs to sustain above the 24,949 pivot zone. Global cues, especially political events, may continue to influence short-term moves.

Disclaimer: lnkd.in/gJJDnvn2

🔹 Key Levels for the Upcoming Week

📌 Price Action Pivot Zone:

24,792 to 24,949 – This is the critical zone to watch. A decisive move beyond either side may dictate next week’s trend.

🔻 Support Levels

S1: 24,553

S2: 24,236

S3: 23,936

🔺 Resistance Levels

R1: 25,187

R2: 25,505

R3: 25,887

📊 Candle Observation:

The last weekly candle formed a red body with a long lower shadow, showing that although bears dominated early in the week, strong buying support emerged near the lows. This wick-based recovery signals demand at lower levels, keeping the support zones (24,553–24,236) important for the coming sessions.

📰 Sentiment Check (Last Week):

The Nifty opened the week with a gap-up, supported by global cues and positive sentiment around the Trump–Putin meeting, which was seen as a potential step toward easing geopolitical tensions.

However, mid-week profit booking dragged the index down, before buyers stepped back in from lower supports, leaving a long lower wick on the weekly candle.

This shows underlying resilience, though the market remains sensitive to global political developments.

📈 Market Outlook

✅ Bullish Scenario:

If Nifty sustains above 24,949, buying momentum could build, aiming for R1 (25,187). A strong breakout above this may push prices towards R2 (25,505) and R3 (25,887).

❌ Bearish Scenario:

If the index breaks below 24,792, selling pressure may return. This could drag Nifty towards S1 (24,553), and further down to S2 (24,236) and S3 (23,936).

📌 Sentiment Outlook:

Nifty is showing resilience with support at lower levels, but for a strong bullish confirmation, it needs to sustain above the 24,949 pivot zone. Global cues, especially political events, may continue to influence short-term moves.

Disclaimer: lnkd.in/gJJDnvn2

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.