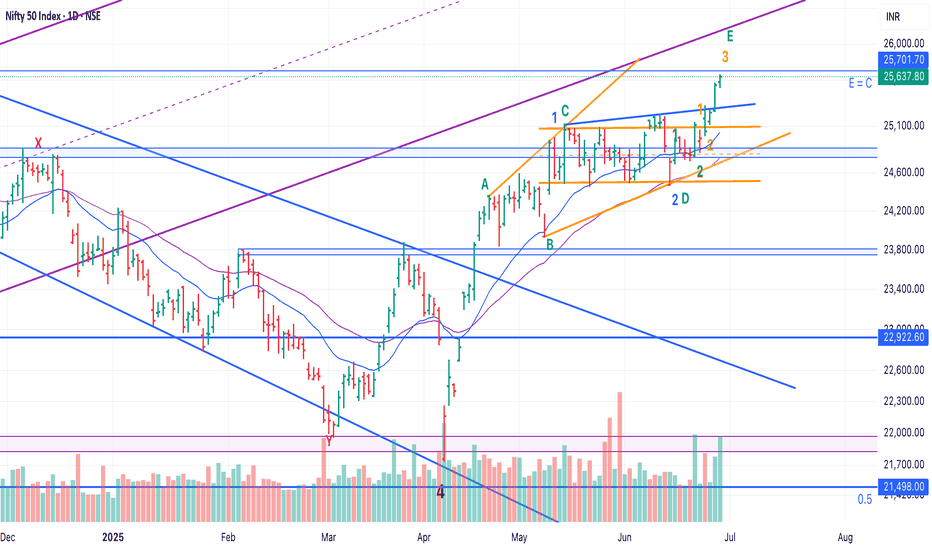

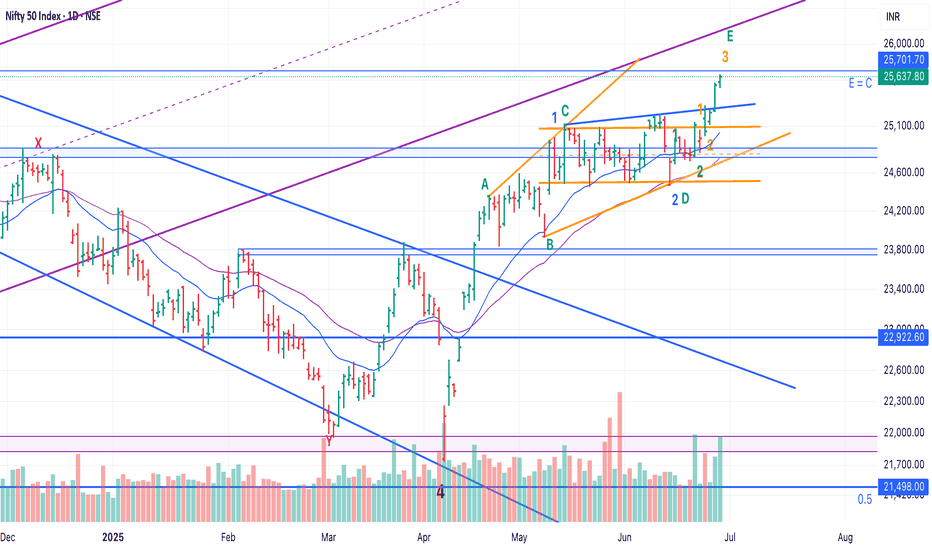

In our last post we discussed that in short term 25700 is the target and if we cross that, then Leading diagonal gets invalidated and hence we look for much higher levels.

Last post:

Thankfully, we didn't get out in shakeouts and rode the entire move till +25600

Now, unfortunately we did not cross 25700 and hence the chance of Wave 1 or something else ending at 25670 became stronger.

As of now, we are at a place where there is a lot of confusion. I see a 5th up pending in wider indices, but Nifty seems done.

So, is there a possibility that other indices go up, while Nifty just does a pullback as part of the correction and not make a new swing high?

A few charts for reference:

Nifty Smallcap:

Nifty 500:

That's about the counts : From other technicals perspective the move looks very similar to Sep 2022 - March 2023 period. But where in that period are we?

PA (point A)Oct 2022 - where one more high till Dec 2022 is left?

or

PB - Feb 2023 - where we just get a pullback and drift lower?

(I have marked green arrows on RSI charts to show the reference)

So, what do we do in such case?

Ditch nifty, play stocks. Lot of stocks looking good - starting 5th up (Just browse through and you'll find many making similar structure as SmallCap index)

(Hint - Defence, Realty, Autos, Metals, Pharma)

All the best!

I will share updates, if I get more clarity on Nifty - till then enjoy the stocks and trade light - remember we are playing seemingly the last leg. :)

Last post:

Thankfully, we didn't get out in shakeouts and rode the entire move till +25600

Now, unfortunately we did not cross 25700 and hence the chance of Wave 1 or something else ending at 25670 became stronger.

As of now, we are at a place where there is a lot of confusion. I see a 5th up pending in wider indices, but Nifty seems done.

So, is there a possibility that other indices go up, while Nifty just does a pullback as part of the correction and not make a new swing high?

A few charts for reference:

Nifty Smallcap:

Nifty 500:

That's about the counts : From other technicals perspective the move looks very similar to Sep 2022 - March 2023 period. But where in that period are we?

PA (point A)Oct 2022 - where one more high till Dec 2022 is left?

or

PB - Feb 2023 - where we just get a pullback and drift lower?

(I have marked green arrows on RSI charts to show the reference)

So, what do we do in such case?

Ditch nifty, play stocks. Lot of stocks looking good - starting 5th up (Just browse through and you'll find many making similar structure as SmallCap index)

(Hint - Defence, Realty, Autos, Metals, Pharma)

All the best!

I will share updates, if I get more clarity on Nifty - till then enjoy the stocks and trade light - remember we are playing seemingly the last leg. :)

관련 발행물

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

관련 발행물

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.