NIFTY Analysis Update

Recent Price Action

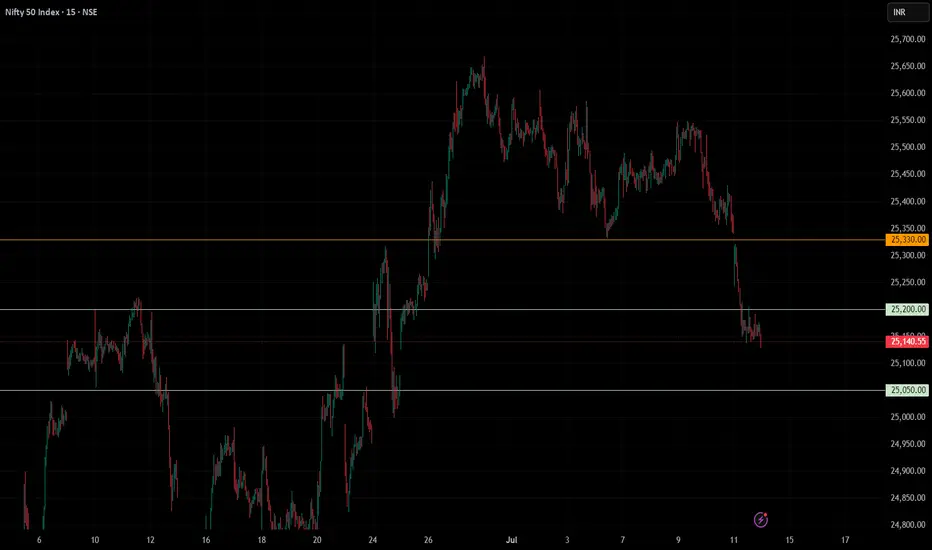

- The **25330** level acted as a significant support zone, as discussed previously.

- The market opened with a gap down below 25330, confirming bearish pressure.

- The next anticipated support at **25200** was also breached, and the session closed below this level.

- With these supports broken, the **25050–25000** range is now identified as the next key support zone.

Technical Indicators

- The **Relative Strength Index (RSI)** is showing extreme oversold conditions across smaller timeframes.

- Such oversold readings typically suggest the potential for a technical bounce or reversal, as selling momentum may be exhausted.

Outlook for Monday

- Given the oversold RSI, there is a heightened probability of a **reversal or bounce** on Monday.

- A rebound towards the **25500-25700** zone is possible, which could serve as a near-term resistance or top before the next directional move.

- If the market manages to close in green, it would confirm the short-term reversal thesis.

Key Levels to Watch

25330: Previous major support (broken)

25200: Next support (broken)

25050–25000: Current support zone

25500-25700: Potential bounce/reversal target

Summary

- **Immediate trend:** Bearish pressure persists after key supports were broken.

- **Short-term outlook:** Oversold conditions suggest a potential bounce; watch for a move toward 25700.

- **Risk:** Failure to hold 25000 could trigger further downside.

Monitor price action closely around the support and resistance zones, and watch for confirmation of reversal signals on Monday.

Recent Price Action

- The **25330** level acted as a significant support zone, as discussed previously.

- The market opened with a gap down below 25330, confirming bearish pressure.

- The next anticipated support at **25200** was also breached, and the session closed below this level.

- With these supports broken, the **25050–25000** range is now identified as the next key support zone.

Technical Indicators

- The **Relative Strength Index (RSI)** is showing extreme oversold conditions across smaller timeframes.

- Such oversold readings typically suggest the potential for a technical bounce or reversal, as selling momentum may be exhausted.

Outlook for Monday

- Given the oversold RSI, there is a heightened probability of a **reversal or bounce** on Monday.

- A rebound towards the **25500-25700** zone is possible, which could serve as a near-term resistance or top before the next directional move.

- If the market manages to close in green, it would confirm the short-term reversal thesis.

Key Levels to Watch

25330: Previous major support (broken)

25200: Next support (broken)

25050–25000: Current support zone

25500-25700: Potential bounce/reversal target

Summary

- **Immediate trend:** Bearish pressure persists after key supports were broken.

- **Short-term outlook:** Oversold conditions suggest a potential bounce; watch for a move toward 25700.

- **Risk:** Failure to hold 25000 could trigger further downside.

Monitor price action closely around the support and resistance zones, and watch for confirmation of reversal signals on Monday.

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.