NIFTY TRADING PLAN – 30-Oct-2025

📊 Prepared by LiveTradingBox | Based on 15-min chart structure & key intraday reference zones

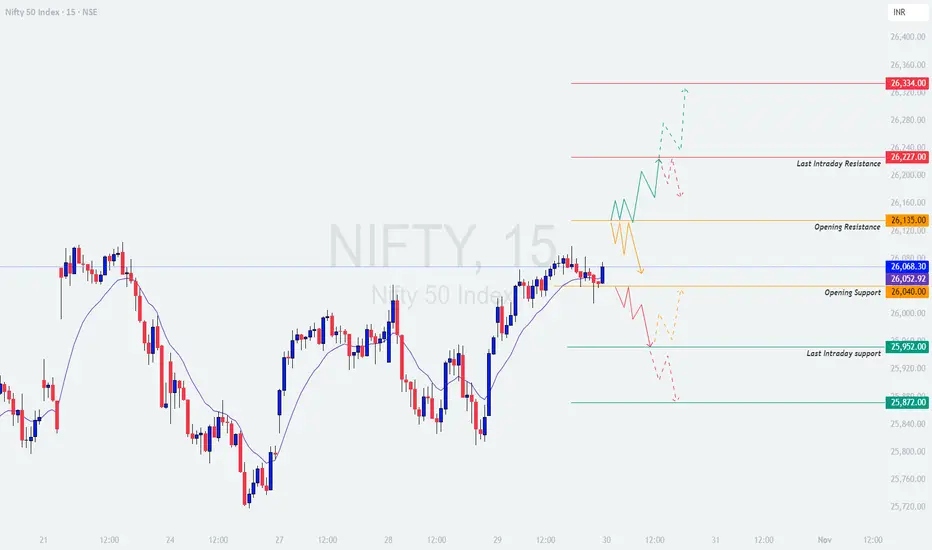

🔍 Key Levels to Watch:

🟥 Last Intraday Resistance: 26,227

🟥 Next Resistance Extension: 26,334

🟧 Opening Resistance: 26,135

🟦 Opening Support: 26,040

🟩 Last Intraday Support: 25,952

🟢 Major Support Zone: 25,872

🟢 1. Gap-Up Opening (Above 26,135 – 100+ points)

If Nifty opens with a Gap-Up above 26,135, it enters the higher resistance zone. The immediate focus will shift to whether it can sustain above this level. Sustained price action above 26,135 may trigger momentum buying toward 26,227 and possibly 26,334 if strength continues.

Plan of Action:

📘 Educational Insight:

A strong gap-up requires confirmation. Many traders jump in early, but waiting for price to hold above the opening resistance helps avoid fake breakouts.

🟦 2. Flat Opening (Around 26,040 ±50 points)

A flat start near 26,040 suggests balanced sentiment between buyers and sellers. Directional clarity will emerge once either the resistance or support levels are broken.

Plan of Action:

📘 Educational Insight:

Flat openings are often “wait-and-watch” setups. Avoid predicting direction; instead, react once key levels confirm strength or weakness.

🔻 3. Gap-Down Opening (Below 25,952 – 100+ points)

If Nifty opens below 25,952, it reflects weak sentiment and profit booking pressure. The index will test demand near 25,872, which serves as the final intraday support zone.

Plan of Action:

📘 Educational Insight:

Gap-down setups usually trigger panic trades. Professionals wait for stabilization before entering, while retail traders often get trapped during early volatility.

🧠 Risk Management Tips for Options Traders:

📈 Summary & Conclusion:

⚠️ Disclaimer:

I am not a SEBI-registered analyst. The above analysis is purely for educational and informational purposes. Traders should do their own analysis or consult a financial advisor before taking any positions.

📊 Prepared by LiveTradingBox | Based on 15-min chart structure & key intraday reference zones

🔍 Key Levels to Watch:

🟥 Last Intraday Resistance: 26,227

🟥 Next Resistance Extension: 26,334

🟧 Opening Resistance: 26,135

🟦 Opening Support: 26,040

🟩 Last Intraday Support: 25,952

🟢 Major Support Zone: 25,872

🟢 1. Gap-Up Opening (Above 26,135 – 100+ points)

If Nifty opens with a Gap-Up above 26,135, it enters the higher resistance zone. The immediate focus will shift to whether it can sustain above this level. Sustained price action above 26,135 may trigger momentum buying toward 26,227 and possibly 26,334 if strength continues.

Plan of Action:

- [] Wait for the first 15-minute candle to close. Avoid chasing the initial spike.

[] If price sustains above 26,135, consider entering long positions targeting 26,227–26,334 zone.

[] Keep a strict stop loss below 26,040 on a closing basis.

[] If rejection occurs near 26,227, book profits partially and trail your stop to cost. - If Nifty fails to sustain above 26,135 and slips below 26,040, avoid longs and prepare for a pullback toward 25,952.

📘 Educational Insight:

A strong gap-up requires confirmation. Many traders jump in early, but waiting for price to hold above the opening resistance helps avoid fake breakouts.

🟦 2. Flat Opening (Around 26,040 ±50 points)

A flat start near 26,040 suggests balanced sentiment between buyers and sellers. Directional clarity will emerge once either the resistance or support levels are broken.

Plan of Action:

- [] Allow the first 30 minutes for market stabilization.

[] A sustained move above 26,135 with volume indicates strength — target 26,227 with a stop loss below 26,040.

[] If Nifty stays range-bound between 26,135–26,040, expect sideways movement — best avoided for options trading.

[] Breakdown below 26,040 will open short opportunities targeting 25,952–25,872 zones. - For option buyers, avoid overtrading in sideways phases to reduce premium decay.

📘 Educational Insight:

Flat openings are often “wait-and-watch” setups. Avoid predicting direction; instead, react once key levels confirm strength or weakness.

🔻 3. Gap-Down Opening (Below 25,952 – 100+ points)

If Nifty opens below 25,952, it reflects weak sentiment and profit booking pressure. The index will test demand near 25,872, which serves as the final intraday support zone.

Plan of Action:

- [] Monitor price reaction near 25,872 — if it holds and rebounds, expect a short-covering rally toward 26,040.

[] If Nifty remains below 25,952 without recovery, maintain a bearish stance with a target of 25,820 (psychological level).

[] Place a stop loss above 26,040 on an hourly close.

[] Avoid bottom fishing; wait for confirmation candles before considering reversals.

📘 Educational Insight:

Gap-down setups usually trigger panic trades. Professionals wait for stabilization before entering, while retail traders often get trapped during early volatility.

🧠 Risk Management Tips for Options Traders:

- [] Always define your risk — use stop-loss orders and don’t hold losing trades beyond your comfort zone.

[] Avoid trading both sides of the market; pick one directional bias.

[] Stick to ATM or slightly ITM options to manage time decay efficiently.

[] Avoid aggressive trades during the first 15–30 minutes after the market opens. - Maintain proper position sizing — never risk more than 2–3% of your trading capital in a single trade.

📈 Summary & Conclusion:

- [] Above 26,135, the bias remains bullish — expect an extension toward 26,227–26,334.

[] Between 26,040–26,135, expect choppy consolidation — best to wait for breakout confirmation.

[] Below 25,952, weakness may extend toward 25,872 or lower if support fails.

[] Stick to a disciplined approach — react to price, don’t predict it.

⚠️ Disclaimer:

I am not a SEBI-registered analyst. The above analysis is purely for educational and informational purposes. Traders should do their own analysis or consult a financial advisor before taking any positions.

거래청산: 타겟 닿음

Both downside levels achieved 면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.