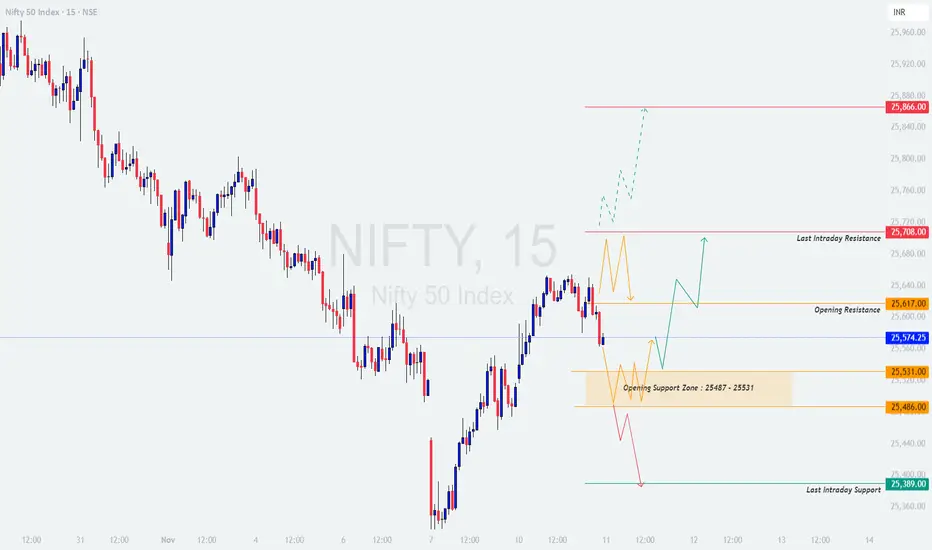

📊 NIFTY TRADING PLAN — 11 NOV 2025

(Timeframe Reference: 15-Min Chart)

Chart Summary:

Nifty is currently trading near 25,574, positioned just below the Opening Resistance (25,617) and slightly above the Opening Support Zone (25,487 – 25,531). The index continues to consolidate in a tight range after a short-term rebound, suggesting that a breakout is imminent.

The structure indicates that the market is at a decision point — a sustained move above 25,617 may invite further upside momentum, while slipping below 25,487 could expose the lower support near 25,389.

Volatility may increase as traders position ahead of the weekend and key economic data.

Key Levels to Watch:

🟢 Supports: 25,531 / 25,487 / 25,389

🟥 Resistances: 25,617 / 25,708 / 25,866

⚖️ Bias Zone: 25,487 – 25,617 (Opening Range)

🟢 Scenario 1: GAP-UP Opening (100+ Points)

If Nifty opens above 25,670 – 25,700, it will be opening close to the Last Intraday Resistance (25,708). Bulls will need to sustain above this zone to extend momentum toward 25,866.

💡 Educational Note:

Gap-up openings can often be deceptive — they excite traders into premature entries without confirming strength. True momentum is validated only when the market holds above resistance zones with rising volume and strong candle closes. Always let the first few candles define control between bulls and bears.

🟧 Scenario 2: FLAT Opening (Within 25,487 – 25,617)

A flat opening around the current range will likely lead to a period of early consolidation and directionless moves. The first half-hour will be crucial to identify whether the breakout happens upward or downward.

🧠 Educational Tip:

Flat openings require traders to be patient and disciplined. Most of the false moves occur within the first 30 minutes when traders try to predict direction instead of reacting to it. The best opportunities come once a breakout confirms and retests with volume-backed follow-through.

🔴 Scenario 3: GAP-DOWN Opening (100+ Points)

If Nifty opens below 25,470 or near 25,430 – 25,400, it will test the Opening Support Zone (25,487 – 25,531) and potentially move toward Last Intraday Support (25,389).

📘 Educational Insight:

Gap-downs are driven by overnight panic, and traders often overreact during the first few minutes. Smart money usually waits for sellers to exhaust before entering for reversals. Watching the candle structure and volume at key supports gives clues to whether it’s a continuation or reversal day.

💼 RISK MANAGEMENT TIPS FOR OPTIONS TRADERS:

📈 SUMMARY:

📚 CONCLUSION:

Nifty is currently at a tight consolidation zone, preparing for a decisive breakout. A move above 25,617 could attract bullish continuation toward 25,708 – 25,866, while slipping below 25,487 might tilt control toward bears with potential tests of 25,389 or lower.

Tomorrow’s session will reward patient traders who wait for breakout confirmation and avoid early traps.

Stay objective, respect the levels, and let price action lead the way.

📊 The best trades come not from prediction but from preparation and disciplined execution.

⚠️ DISCLAIMER:

I am not a SEBI-registered analyst. The views and analysis shared above are solely for educational purposes. Please do your own research or consult a certified financial advisor before making any trading or investment decisions.

(Timeframe Reference: 15-Min Chart)

Chart Summary:

Nifty is currently trading near 25,574, positioned just below the Opening Resistance (25,617) and slightly above the Opening Support Zone (25,487 – 25,531). The index continues to consolidate in a tight range after a short-term rebound, suggesting that a breakout is imminent.

The structure indicates that the market is at a decision point — a sustained move above 25,617 may invite further upside momentum, while slipping below 25,487 could expose the lower support near 25,389.

Volatility may increase as traders position ahead of the weekend and key economic data.

Key Levels to Watch:

🟢 Supports: 25,531 / 25,487 / 25,389

🟥 Resistances: 25,617 / 25,708 / 25,866

⚖️ Bias Zone: 25,487 – 25,617 (Opening Range)

🟢 Scenario 1: GAP-UP Opening (100+ Points)

If Nifty opens above 25,670 – 25,700, it will be opening close to the Last Intraday Resistance (25,708). Bulls will need to sustain above this zone to extend momentum toward 25,866.

- []If price sustains above 25,708 with strong bullish candles and rising volume, a move toward 25,820 – 25,866 is likely.

[]However, if Nifty opens higher but fails to hold above 25,708, it may trigger profit booking back toward 25,617 – 25,574.

[]Traders should avoid emotional long entries at the open — instead, wait for a retest of 25,617 to confirm support before going long.

[]Use trailing stops once the price moves 30–40 points in your favor to secure profits in case of sharp reversals.

💡 Educational Note:

Gap-up openings can often be deceptive — they excite traders into premature entries without confirming strength. True momentum is validated only when the market holds above resistance zones with rising volume and strong candle closes. Always let the first few candles define control between bulls and bears.

🟧 Scenario 2: FLAT Opening (Within 25,487 – 25,617)

A flat opening around the current range will likely lead to a period of early consolidation and directionless moves. The first half-hour will be crucial to identify whether the breakout happens upward or downward.

- []If price sustains above 25,617 with volume expansion, expect an upside continuation toward 25,708 – 25,866.

[]If price breaks below 25,487, weakness may extend toward 25,389.

[]Avoid trading within this range — it’s a “no-clear-edge” zone that traps both sides. Wait for the breakout retest confirmation before entering.

[]Scalpers can focus on rejection wicks or engulfing patterns near extremes for quick intraday setups.

🧠 Educational Tip:

Flat openings require traders to be patient and disciplined. Most of the false moves occur within the first 30 minutes when traders try to predict direction instead of reacting to it. The best opportunities come once a breakout confirms and retests with volume-backed follow-through.

🔴 Scenario 3: GAP-DOWN Opening (100+ Points)

If Nifty opens below 25,470 or near 25,430 – 25,400, it will test the Opening Support Zone (25,487 – 25,531) and potentially move toward Last Intraday Support (25,389).

- []If a reversal candle (hammer, bullish engulfing) appears near 25,389, buyers may attempt a short-covering move toward 25,531 – 25,574.

[]However, a sustained break below 25,389 with strong red candles and volume can extend weakness toward 25,320 – 25,280.

[]Avoid shorting immediately on a deep gap-down — instead, wait for a pullback toward resistance zones like 25,487 – 25,531 for better risk-reward.

[]Volume analysis near the support zone will help confirm whether selling pressure is continuing or exhausting.

📘 Educational Insight:

Gap-downs are driven by overnight panic, and traders often overreact during the first few minutes. Smart money usually waits for sellers to exhaust before entering for reversals. Watching the candle structure and volume at key supports gives clues to whether it’s a continuation or reversal day.

💼 RISK MANAGEMENT TIPS FOR OPTIONS TRADERS:

- []Avoid buying options during the first 15 minutes after market open — early IV spikes inflate premiums and reduce your edge.

[]Always define your risk before entering; limit your exposure to 1–2% of total capital per trade.

[]Prefer ITM options for directional conviction, as they are less affected by time decay.

[]If using OTM options, exit quickly after 20–30 points in your favor — don’t let greed turn into decay.

[]Trail stop-losses as soon as your position gains momentum, and never remove stop-losses hoping for a bounce.

[]Remember: Consistency in managing risk is what keeps traders in the game, not catching every move.

📈 SUMMARY:

- []🟧 Opening Range Zone: 25,487 – 25,617[]🟥 Resistance Levels: 25,708 / 25,866[]🟩 Support Levels: 25,531 / 25,487 / 25,389[]⚖️ Bias: Neutral-to-Bullish above 25,617 | Weakness below 25,487

📚 CONCLUSION:

Nifty is currently at a tight consolidation zone, preparing for a decisive breakout. A move above 25,617 could attract bullish continuation toward 25,708 – 25,866, while slipping below 25,487 might tilt control toward bears with potential tests of 25,389 or lower.

Tomorrow’s session will reward patient traders who wait for breakout confirmation and avoid early traps.

Stay objective, respect the levels, and let price action lead the way.

📊 The best trades come not from prediction but from preparation and disciplined execution.

⚠️ DISCLAIMER:

I am not a SEBI-registered analyst. The views and analysis shared above are solely for educational purposes. Please do your own research or consult a certified financial advisor before making any trading or investment decisions.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.