**Heading:** Strategic Analysis and Trading Recommendations for NIFTY

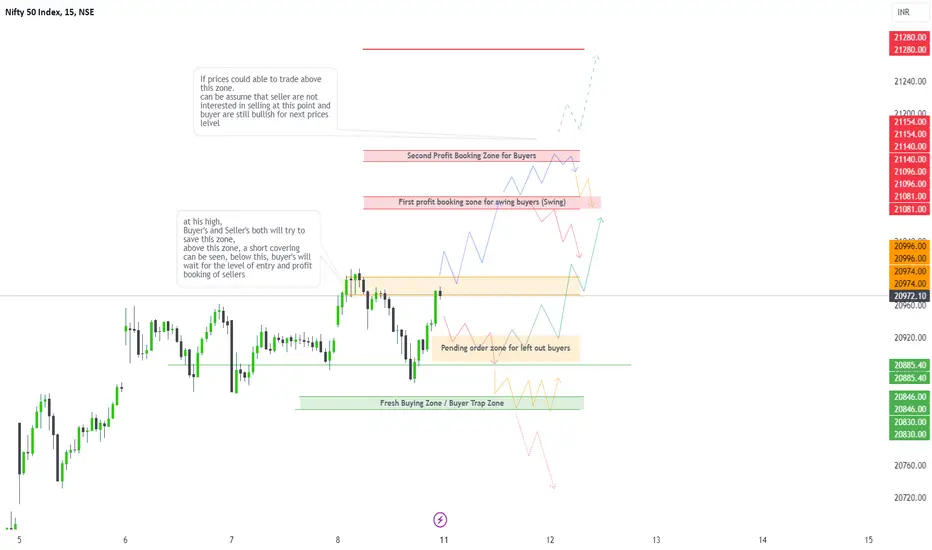

The recent performance of NIFTY indicates a potential bullish trend, with the index closing near an all-time high. However, a closer examination of the short-term timeframe reveals a consolidation phase around this peak. In preparation for Monday's market activity, it is crucial to monitor the price levels closely.

**Key Analysis:**

- *Bullish Scenario:* If prices manage to sustain and trade within the range of 21,000-20,996, an uptick move towards 21,081-21,150 is anticipated, followed by a consolidation phase in the vicinity of 21,150-21,100.

- *Flat to Negative Opening:* In the event of a flat to negative opening, prices may find support in the range of 20,920-20,885. This level could prompt a rebound, presenting an opportunity for initiating buying trades. The recommended stop loss is set at 25-30 points, targeting an upside range of 21,000-21,100.

**Trading Strategies:**

- *Short Positions:* Consider short-side trades only if prices sustain below 20,830. Otherwise, the recommended strategy is to focus on buying on dips at specified levels.

**Recommended Buying Levels:**

1. Sustaining Above: 20,996

2. Retracement Level: 20,920-20,900

3. Buyers Zone Level: 20,846-20,830

**Stop Loss:** Set a maximum of 25-30 points for risk management.

This analysis provides a comprehensive overview of potential market movements, offering strategic insights for traders to navigate the NIFTY index effectively.

The recent performance of NIFTY indicates a potential bullish trend, with the index closing near an all-time high. However, a closer examination of the short-term timeframe reveals a consolidation phase around this peak. In preparation for Monday's market activity, it is crucial to monitor the price levels closely.

**Key Analysis:**

- *Bullish Scenario:* If prices manage to sustain and trade within the range of 21,000-20,996, an uptick move towards 21,081-21,150 is anticipated, followed by a consolidation phase in the vicinity of 21,150-21,100.

- *Flat to Negative Opening:* In the event of a flat to negative opening, prices may find support in the range of 20,920-20,885. This level could prompt a rebound, presenting an opportunity for initiating buying trades. The recommended stop loss is set at 25-30 points, targeting an upside range of 21,000-21,100.

**Trading Strategies:**

- *Short Positions:* Consider short-side trades only if prices sustain below 20,830. Otherwise, the recommended strategy is to focus on buying on dips at specified levels.

**Recommended Buying Levels:**

1. Sustaining Above: 20,996

2. Retracement Level: 20,920-20,900

3. Buyers Zone Level: 20,846-20,830

**Stop Loss:** Set a maximum of 25-30 points for risk management.

This analysis provides a comprehensive overview of potential market movements, offering strategic insights for traders to navigate the NIFTY index effectively.

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.