🔎 Overview

____________________________________________________________

📔 Concept

____________________________________________________________

📌 How to Use

____________________________________________________________

📊 Chart Explanation

____________________________________________________________

👀 Observation

____________________________________________________________

💡 Conclusion

___________________________________________________________

⚠️ Disclaimer

The Bearish Engulfing Pattern is a strong two-candle reversal formation that signals a potential shift from an uptrend to a downtrend.

It occurs when a small bullish (green) candle is immediately followed by a large bearish (red) candle that completely engulfs the prior candle’s body.

This shows a clear shift in market psychology — buyers initially push the price higher, but sellers step in with force and erase those gains, marking the start of bearish momentum.

____________________________________________________________

📔 Concept

A Bearish Engulfing occurs when:

1️⃣ The first candle is a small green candle continuing the uptrend.

2️⃣ The next candle is a large red candle whose body completely engulfs the green candle’s body.

3️⃣ This pattern signals that sellers have regained control after buyer exhaustion.

____________________________________________________________

📌 How to Use

✅ Validation → The candle must close below the open of the red candle to confirm bearish reversal.

❌ Devalidation → If price closes above the close of the red candle before validation, the signal fails.

This structured confirmation helps filter false breakouts and define clear risk levels.

____________________________________________________________

📊 Chart Explanation

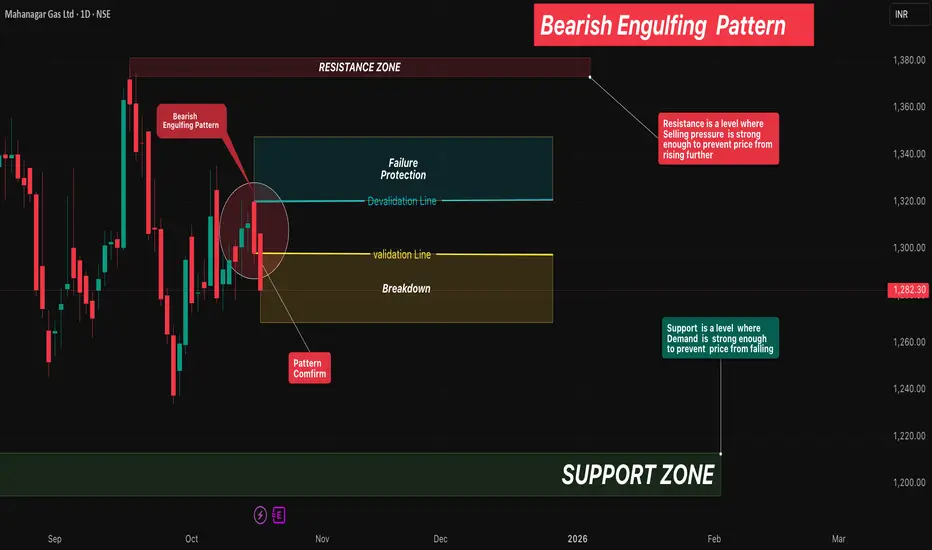

• Symbol →MGL

• Timeframe → 1D

• On 15 Oct 2025, a small green candle formed, continuing the uptrend.

• On 16 Oct 2025, a large red candle engulfed the previous green body — confirming the Bearish Engulfing Pattern.

• On 17 Oct 2025, price broke down further, validating the bearish reversal.

This sequence highlights how quickly market sentiment shifted from bullish to bearish control.

____________________________________________________________

👀 Observation

• The Bearish Engulfing is most reliable near swing highs or resistance zones.

• High volume on the engulfing candle strengthens the reversal signal.

• Combining this pattern with confirmation tools like RSI, Supertrend, or Moving Averages

improves accuracy.

____________________________________________________________

💡 Conclusion

The Bearish Engulfing Pattern marks a clear shift in control from buyers to sellers.

Once validated, it indicates a high-probability reversal setup with defined stop-lose and target zones based on structure or risk-reward multiples.

___________________________________________________________

⚠️ Disclaimer

📘 For educational purposes only.

🙅 Not SEBI registered.

❌ Not a buy/sell recommendation.

🧠 Purely a learning resource.

📊 Not Financial Advice.

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.