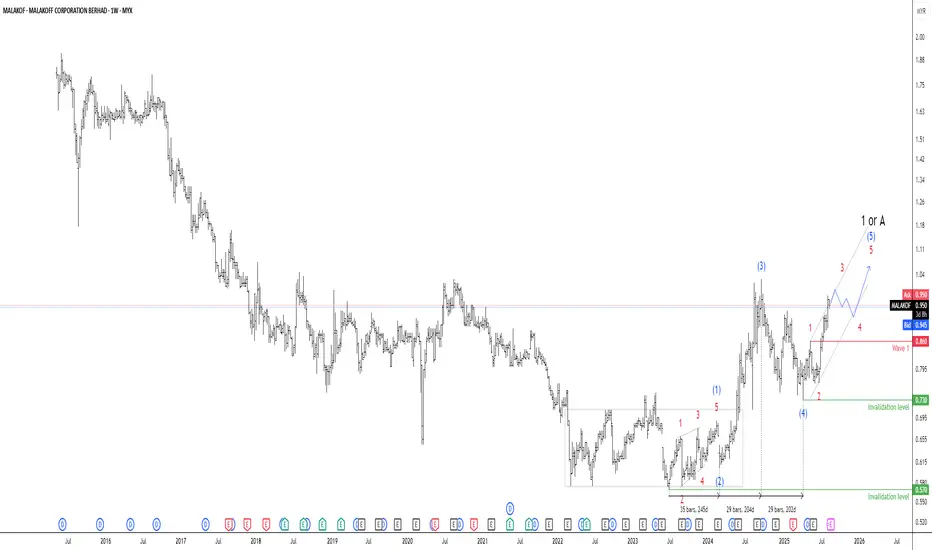

📈 Wave Structure Overview

• The chart shows a completed corrective phase, likely Wave A or 1, followed by a clear impulsive sequence: (1), (2), (3), (4), (5).

• Within that impulse, sub-waves 1–5 are well-defined, suggesting a strong Wave (3) extension — typically the most powerful leg in an Elliott sequence.

• The current price action around MYR 0.945 appears to be in the final stages of Wave (5), or possibly transitioning into a larger Wave 3 or C, depending on your primary count.

🛡️ Invalidation Zone

• RM 0.860 marks the Wave 1 level, which Wave 4 must not breach under standard Elliott Wave rules.

• A drop below RM 0.860 would invalidate the current impulsive count, suggesting that Wave (5) is either truncated or the structure is corrective rather than impulsive.

• This level serves as a critical risk management threshold for traders tracking the bullish scenario.

🔍 Interpretation

• The wave count suggests bullish continuation, especially if price holds above RM 0.860.

• The chart shows a completed corrective phase, likely Wave A or 1, followed by a clear impulsive sequence: (1), (2), (3), (4), (5).

• Within that impulse, sub-waves 1–5 are well-defined, suggesting a strong Wave (3) extension — typically the most powerful leg in an Elliott sequence.

• The current price action around MYR 0.945 appears to be in the final stages of Wave (5), or possibly transitioning into a larger Wave 3 or C, depending on your primary count.

🛡️ Invalidation Zone

• RM 0.860 marks the Wave 1 level, which Wave 4 must not breach under standard Elliott Wave rules.

• A drop below RM 0.860 would invalidate the current impulsive count, suggesting that Wave (5) is either truncated or the structure is corrective rather than impulsive.

• This level serves as a critical risk management threshold for traders tracking the bullish scenario.

🔍 Interpretation

• The wave count suggests bullish continuation, especially if price holds above RM 0.860.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.