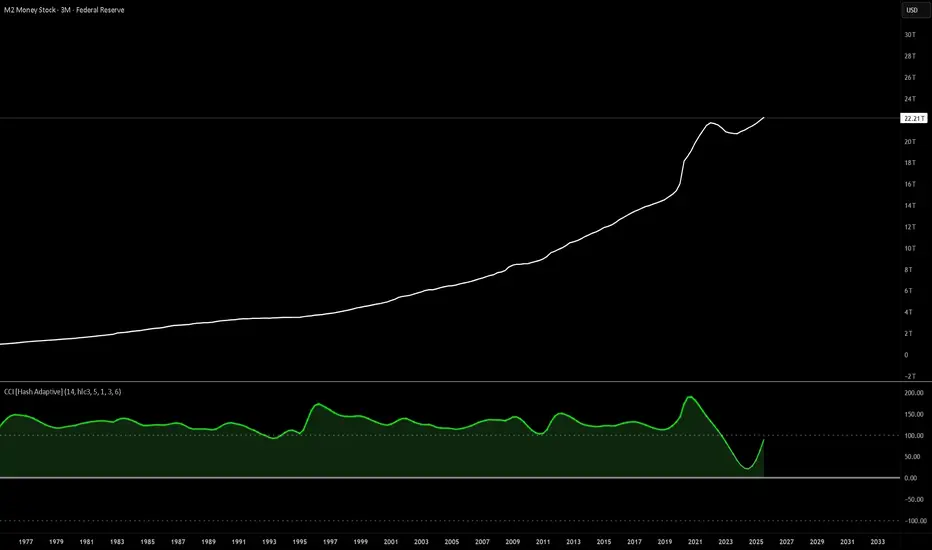

M2 is the bluntest liquidity proxy we’ve got. That white line only really goes one way—and when it accelerates, risk assets don’t argue, they re-rate.

Check the CCI under the chart: triple-digit prints that are frankly absurd for a macro series. That’s the liquidity impulse screaming. When CCI rolls positive and stays there, you tend to get multiple expansion; when it rolled negative in ’22–’23, you got de-rating and chop.

Why it matters (mechanics in one breath):

more dollars chasing the same assets → higher nominal prices, lower real yields → fatter DCFs, easier credit → buybacks/issuance → persistent bid. It’s not about narratives; it’s about liquidity.

Check the CCI under the chart: triple-digit prints that are frankly absurd for a macro series. That’s the liquidity impulse screaming. When CCI rolls positive and stays there, you tend to get multiple expansion; when it rolled negative in ’22–’23, you got de-rating and chop.

Why it matters (mechanics in one breath):

more dollars chasing the same assets → higher nominal prices, lower real yields → fatter DCFs, easier credit → buybacks/issuance → persistent bid. It’s not about narratives; it’s about liquidity.

Quant research firm developing proprietary indicators, trading automation, and risk frameworks for digital & macro markets. Free indicator channel (telegram) t.me/hashcapitalresearchchannel I hashadaptive.com

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

Quant research firm developing proprietary indicators, trading automation, and risk frameworks for digital & macro markets. Free indicator channel (telegram) t.me/hashcapitalresearchchannel I hashadaptive.com

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.